Red Flags Missed by Auditors

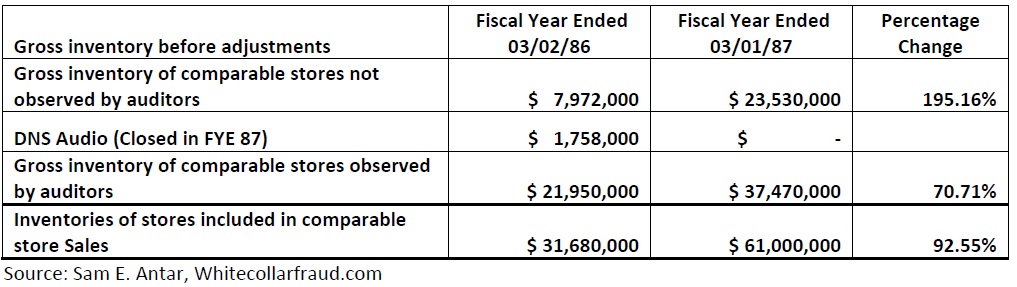

Comparable store sales for the fiscal year ended 03/01/87 decreased 1.5% from the prior year. However, inventories in comparable stores increased 92.55%. Inventory in stores observed by auditors increased 70.71%, while inventory in comparable stores not observed by auditors increased 195.16%. Overall, Crazy Eddie inflated its consolidated inventories (comparable stores, new stores open during 1987, and warehouse inventories) by approximately $22.5 to $28 million in 1987.

Red Flags Missed by Auditors and Investors

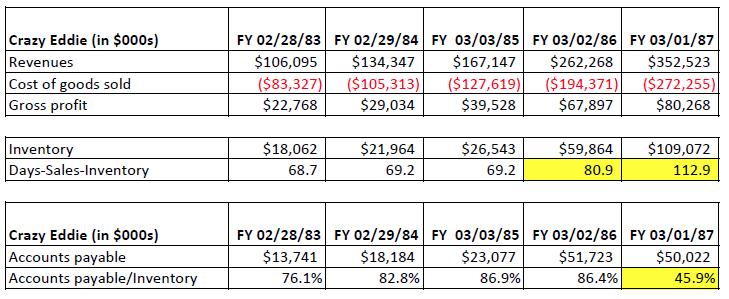

The increases in inflated inventory amounts from 1985 to 1987 made it appear like Crazy Eddie was taking longer periods of time to turnover its inventory. The understatements of accounts payable mainly due to booking fictitious purchase discounts and trade allowances in 1987 decreased the account payable-to-inventory ratio.

Notes:

Days-sales-inventory (DSI) = (Average inventory/cost of goods sold during period) X Number of days in period.

Average inventory = (Beginning Inventory balance + ending inventory balance)/2

A consistently rising DSI is a red flag for possible overstatement of inventory amounts.

Red Flag Spotted, but Widely Ignored

Thorton L. Oglove was the only analyst who correctly noted and went public with concerns about Crazy Eddie’s troubling growth in inventory in relation to sales. According to Crain’s New York Business, “he noticed that for the fiscal half ended Aug. 31, Crazy Eddie’s sales had risen 41%, while inventories had mushroomed 147%. Previously, sales and inventories had generally moved in unison.” However, his concerns were widely ignored by investors.

Why it’s important to read and compare the footnotes in financial reports

In 1987, Crazy Eddie changed one word in its footnotes to overstate income by $20 million.

Annual Report Fiscal year 1986:

Purchase discounts and trade allowances are recognized when received.

Up until 1986, discounts and trade allowances were not recognized as income until a credit memo acknowledgment was actually received from a vendor, even if the discount was already earned.

Annual Report Fiscal year 1987:

Purchase discounts and trade allowances are recognized when earned.

Starting in 1987, Crazy Eddie immediately recognized discounts and trade allowances as income when earned. We did not have to wait for a credit memo acknowledgment to arrive from a vendor before recognizing a purchase discount or trade allowance. Instead, we could recognize them as income as soon as we claimed that they were earned by us or owed to us. The change in accounting policy enabled Crazy Eddie to recognize discounts and trade allowances faster and also inflate income by creating $20 million in fictitious discounts and trade allowances due from vendors.

More details of the techniques involved in Crazy Eddie’s accounting fraud can be found on the Crazy Eddie Fraud page.

See Appendix C – Frequently Asked Questions

Written by, Sam Antar

© Copyright by Sam Antar. All rights reserved.