Setting the Stage: A Tale of Fiscal Smoke and Mirrors

Welcome to New York City’s fiscal funhouse, where transparency vanishes, and accountability takes an indefinite vacation. We’re exposing creative accounting practices of Comptroller Brad Lander and Public Advocate Jumaane Williams, whose offices have elevated questionable bookkeeping to high art.

Prepare for murky expense reports where “N/A Privacy/Security” explains everything, credit card statements pose as riddles, and public funds perform Houdini-worthy disappearing acts. From “blank” entries to suspiciously round figures, we’ll reveal the labyrinthine practices transforming city finances into an epic magic show.

The Dynamic Duo: Transit Champions, Speed Demons, and Masters of Hypocrisy

Our once-harmonious duo now competes in accumulating puzzling expenses and school zone speeding tickets. Despite advocating for public transit and congestion pricing and praising NYC’s network of 476 subway stations and 325 bus routes, their actions tell a different story. These self-proclaimed transit evangelists prefer taxpayer-funded limos with NYPD escorts to the public transportation they champion.

Lander, the fiscal watchdog, has racked up 10 school zone speeding tickets in a decade, while Williams, the people’s advocate, outpaces him with 28 since 2013. In a twist of irony, Williams advocates for police defunding while residing on a military base. Meanwhile, their lenient crime policies correlate with a 31.8% increase in violent crime. It seems our dynamic duo’s talent for contradictions rivals their speed in school zones.

Brad Lander: Making Money Disappear

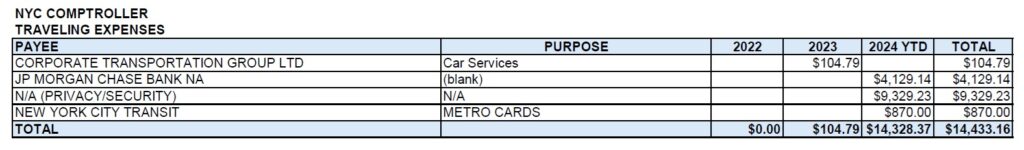

The Traveling Expenses Magic Show

Let’s start with Brad Lander, the city’s chief financial watchdog, who appears to have mistaken the city’s coffers for a bottomless magic hat. His office has conjured up a whopping $14,433.16 in “Traveling Expenses” since January 2022. But here’s where it gets interesting: $9,329.23 of that sum vanished into the mysterious realm of “N/A Privacy/Security.” One can’t help but wonder if they’re guarding the secret recipe for New York’s famous pizza sauce.

Meanwhile, $4,129.14 went to JP Morgan Chase for “travel” with the purpose listed as “(blank).” Ah, the old credit card sleight of hand! It’s a classic move in the magician’s handbook of expense concealment. Five-star hotels? Gourmet meals? Private jet rentals? The possibilities are as endless as New York’s gridlock.

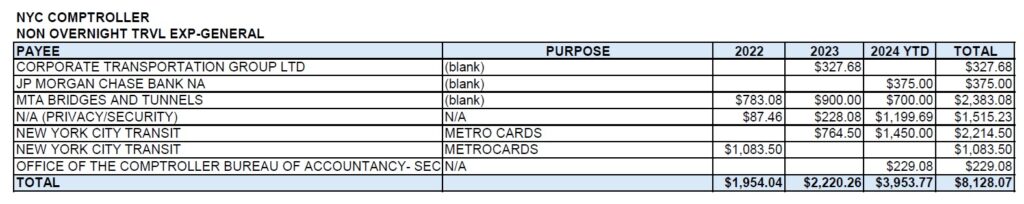

The Non-Overnight Travel Acrobatics

Lander’s office managed to rack up $8,128.07 in “Non-Overnight Travel Expense – General” from 2022 to 2024 (with 2024 figures being year-to-date). The star of this fiscal acrobatic show? MTA Bridges and Tunnels, scoring $2,383.08 over three years for the illuminating purpose of “(blank).” And that’s not all! The ever-mysterious “N/A (PRIVACY/SECURITY)” makes another appearance, gobbling up $1,515.23. Because nothing says “fiscal responsibility” quite like untraceable expenses, right?

But let’s not forget our friends at JP Morgan Chase, who pop up again with $375.00 for – you guessed it – “(blank).” Another brilliant use of the credit card concealment technique. Is it for tolls? Parking? A year’s supply of New York’s finest bagels? The world may never know.

The “Non-Overnight Travel Expense – Special” category is where things get really interesting. We’ve got $590.06 for more “N/A (PRIVACY/SECURITY)” expenses (because regular privacy just isn’t private enough), and $281 to JP Morgan Chase for “(blank).” It seems Lander’s office has a particular fondness for credit card companies and their ability to keep things vague. And let’s not forget the $45 to U.S. Bank National Association in 2022, also for “(blank).” Perhaps it was a deposit for a new abacus for the Comptroller’s office?

Stay tuned for our next act, where we’ll dive into the even more thrilling world of overnight travel! Who knew watching the watchdog could be so entertaining?

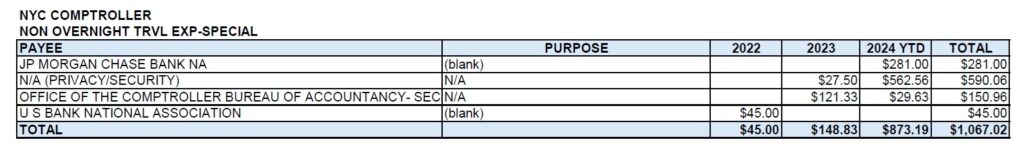

The Overnight Travel Extravaganza

When the sun sets on the Big Apple, the real fiscal acrobatics begin. Brad Lander’s office, in a stunning display of financial gymnastics, has managed to rack up a whopping $248,061.01 for overnight travel since January 2022. It’s enough to make even the most seasoned New York tourist blush.

The star of this nocturnal show? A mysterious $74,479.76 attributed to “N/A Privacy/Security” under “Overnight Travel Expense – General.” One can’t help but wonder: Are we funding the next James Bond movie, or is this just an elaborate way to hide a penchant for luxury pillow mints? The lack of transparency here isn’t just concerning; it’s a black hole of accountability that would make NASA scientists scratch their heads.

Not to be outdone, JP Morgan Chase swoops in with a dazzling $16,072.19 for the illuminating purpose of “(blank).” Ah, the old credit card sleight of hand! Are we talking five-star suites with a view of Central Park, or perhaps a series of very expensive broom closets? The vagueness here isn’t just frustrating; it’s a masterclass in financial obscurity.

Citibank rounds out this fiscal trio with a comparatively modest $10,438.67 for “out of town travel.” While we applaud their honesty in admitting it involves leaving the city, the details are as sparse as a New York apartment at Manhattan prices. It’s a reminder that in the world of public finance, sometimes what’s left unsaid speaks volumes.

This overnight travel bonanza isn’t just a matter of questionable spending; it’s a glaring example of how public funds can vanish into the night, leaving taxpayers in the dark. While New Yorkers toss and turn over rising living costs, it seems some public officials are enjoying quite the taxpayer-funded slumber party.

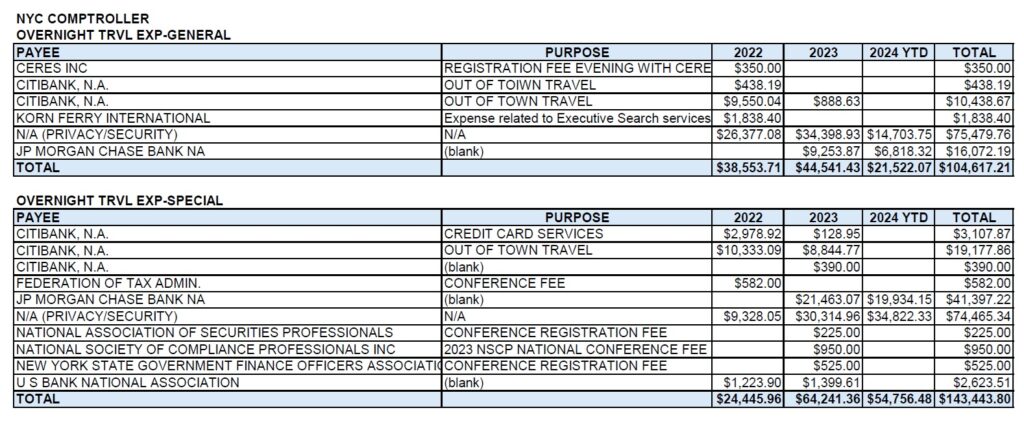

But wait, there’s more! Under “Overnight Travel Expense – Special,” we find another $74,465.34 to “N/A Privacy/Security.” JP Morgan Chase strikes again with $41,397.22 for “(blank).” That’s a lot of blank checks being written on the taxpayer’s dime.

Citibank decides to spice things up with a total of $22,675.73, broken down into a tapestry of vagueness: $3,107.87 for “credit card services” (because swiping plastic is hard work), $19,177.86 for more “out of town travel” (destination: unknown, but presumably somewhere with a well-stocked bar), and a puzzling $390 for “(blank).”

Not to be left out, US Bank National Association throws $2,623.51 into the ring, also for the thrilling purpose of “(blank).” One can only hope it wasn’t for a round of drinks for the accounting team.

The Luxury Car Levitation Trick

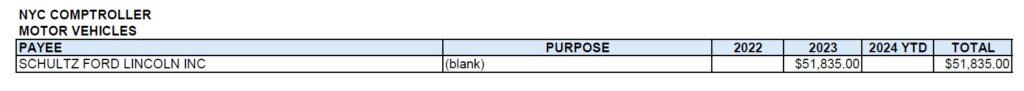

Just when it seemed the journey had ended, the NYC Comptroller’s Office spent $51,835 at Schultz Ford Lincoln Inc. Indeed, what better symbolizes fiscal prudence, than a gleaming new Ford? Maybe Lander thinks that to truly grasp the city’s fiscal workings, one must be in the driver’s seat. It remains unclear whether Lander’s limousine was replaced or if his office acquired an additional vehicle.

Jumaane Williams: Defying Fiscal Gravity

The Military Base Paradox

Now, let’s shift gears to Jumaane Williams, the champion of mass transit and pusher of the anti-car agenda. While championing policies that have led to a reported 31.8% increase in violent crime, Williams himself has taken up residence on a military base. Talk about hedging your bets! Perhaps he’s conducting an elaborate social experiment to see what happens when you advocate for defunding the police while surrounded by armed forces. It’s not hypocrisy; it’s performance art!

The Vehicle Lease Ventriloquism Act

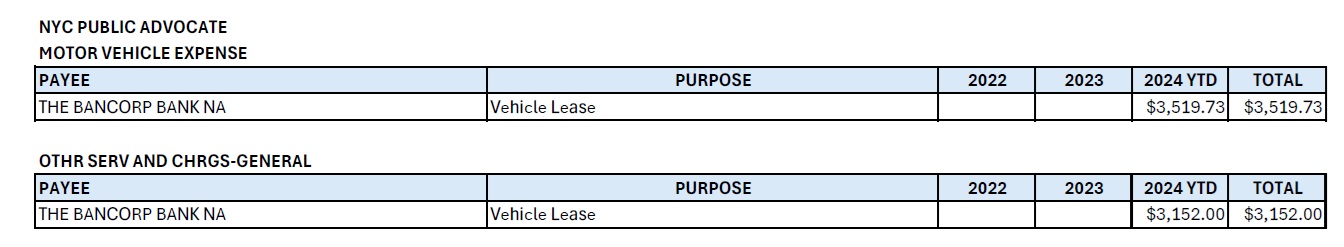

Williams’ office paid The Bancorp Bank $3,519.73 for a “vehicle lease” listed as a “motor vehicle expense,” and another $3,152.00 for the same purpose, but this time cryptically listed as “Other Service and Charges – General.” It seems even leasing a vehicle is a complex art in the world of public advocacy. One car for official business, another for… unofficial business? The plot thickens.

The E-Z Pass Enigma

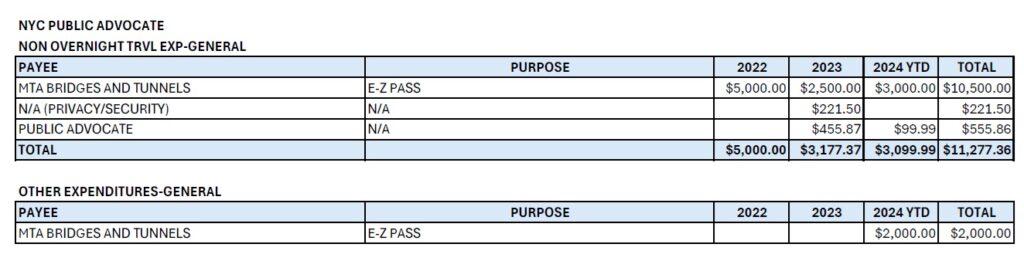

When it comes to travel expenses, Williams’ office is a veritable maze of financial acrobatics that would make even the most seasoned contortionist dizzy. They spent $10,500 on E-Z Pass for MTA Bridges and Tunnels under “non-overnight travel,” and another $2,000 under “Other Expenditures- General.” The reason for categorizing the same expense in two different ways is unclear. Is one for the scenic route and the other for the express lane to fiscal obscurity?

For “non-overnight travel” expenses, his office didn’t stop at E-Z Pass. They also spent $221.50 on “N/A Privacy/Security” for “N/A,” and another $555.86 was paid to the “Public Advocate” himself, but the purpose was mysteriously listed as “N/A.” It seems the road to transparency is full of potholes. This resembles a financial shell game, but instead of peas, we’re shuffling taxpayer dollars.

The Overnight Travel Money Pit

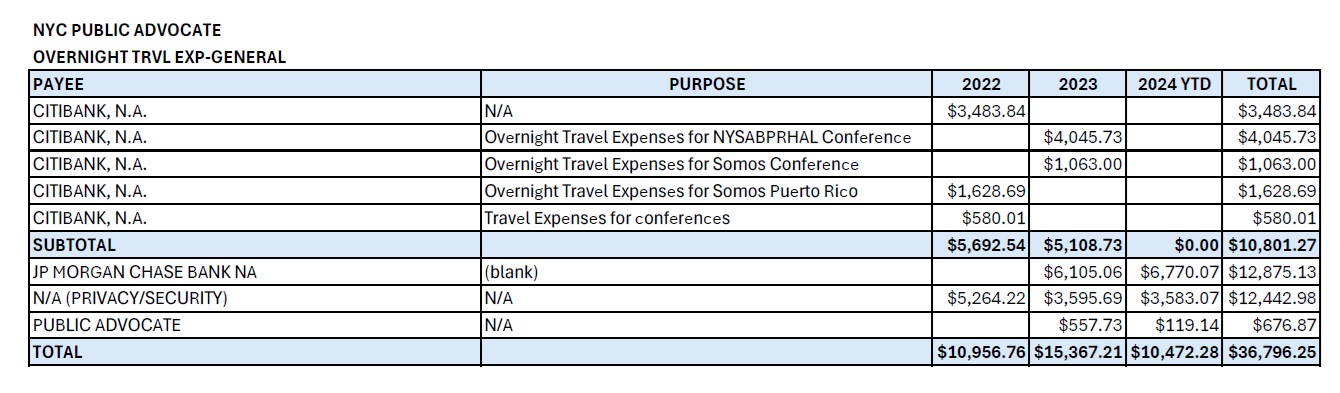

From 2022 to 2024 (with 2024 being year-to-date), Williams’ office made $36,796.25 in “Overnight Travel Expenses” disappear into the ether. Citibank facilitated a mysterious $3,483.84 expense for the enigmatic purpose of “N/A.” Credit card concealment at its finest, folks. One can only imagine the critical public advocacy work being done under such a cryptic label. Perhaps Williams was investigating the impact of room service on local economies?

The crown jewel of this fiscal circus is the $12,442.98 attributed to “N/A (PRIVACY/SECURITY)” over the three-year period. One can’t help but wonder if Williams is moonlighting as a secret agent. Perhaps these funds went towards developing an invisibility cloak for his already phantom-like commitment to public transit?

Not to be outdone, JP Morgan Chase swoops in with a grand total of $12,875.13 over 2023 and 2024, all for the illuminating purpose of “(blank).” Another masterclass in credit card obscurity. It’s refreshing to see such transparency in public spending, isn’t it?

And let’s not forget the $676.87 paid directly to the “PUBLIC ADVOCATE” himself for the ever-informative purpose of “N/A.” Because who needs itemized expenses when you can just… not?

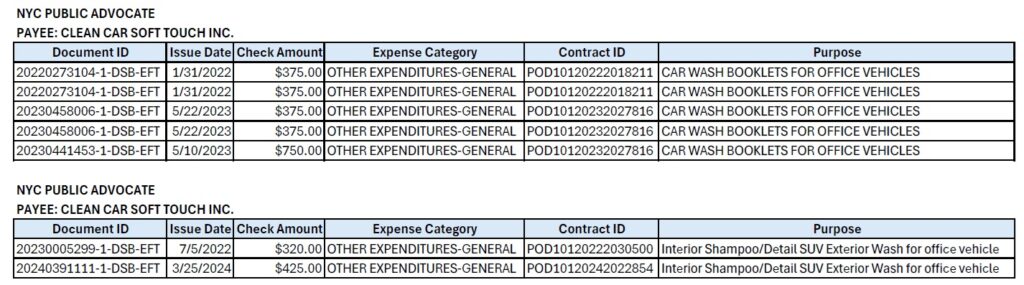

The Car Wash Chronicles

But the true star of this financial theater is Clean Car Soft Touch Inc. Williams’ office graciously bestowed upon them $750 in 2023 and $1,500 in 2024 (year-to-date) for “car wash booklets.” And for those extra tough advocacy stains? A mere $320 in 2022 and $425 in 2023 for detailing services. Because nothing says “I’m fighting for the common man” like a freshly vacuumed floor mat and spotless windshield.

The Grand Finale: Irony on Wheels

Behold the spectacle: transit champions cruising in taxpayer-funded luxury. As NYC grapples with gridlock, crime, and subway woes, our officials perfect the art of the government car spa.

But the show’s not over! Lander and Williams are reportedly eyeing the mayor’s office, should the indicted Adams bow out. Because what better solution to city problems than more fiscal magic and policy gymnastics?

Conclusion: Accounting Never Sleeps

So, as you’re squeezed between a breakdancer and a mariachi band on your delayed train, picture a public servant in a gleaming car, conjuring new expense categories. In New York, creative accounting is the real 24/7 service.

Stay tuned, taxpayers. The fiscal roller coaster never stops in the city where your dollars go to take bubble baths.

Written by Sam Antar

© 2024 Sam Antar. All rights reserved.