My three-year battle to make Overstock.com comply with accounting rules and the vicious retaliation campaign its CEO Patrick M. Byrne unleashed against me

This is the story of how I exposed Overstock.com’s accounting fraud and faced a vicious backlash from its CEO Patrick M. Byrne. Overstock.com (NASDAQ: OSTK) is an online retailer that repeatedly violated accounting rules and overstated its earnings for several years. I uncovered a pattern of accounting shenanigans on my blog, such as:

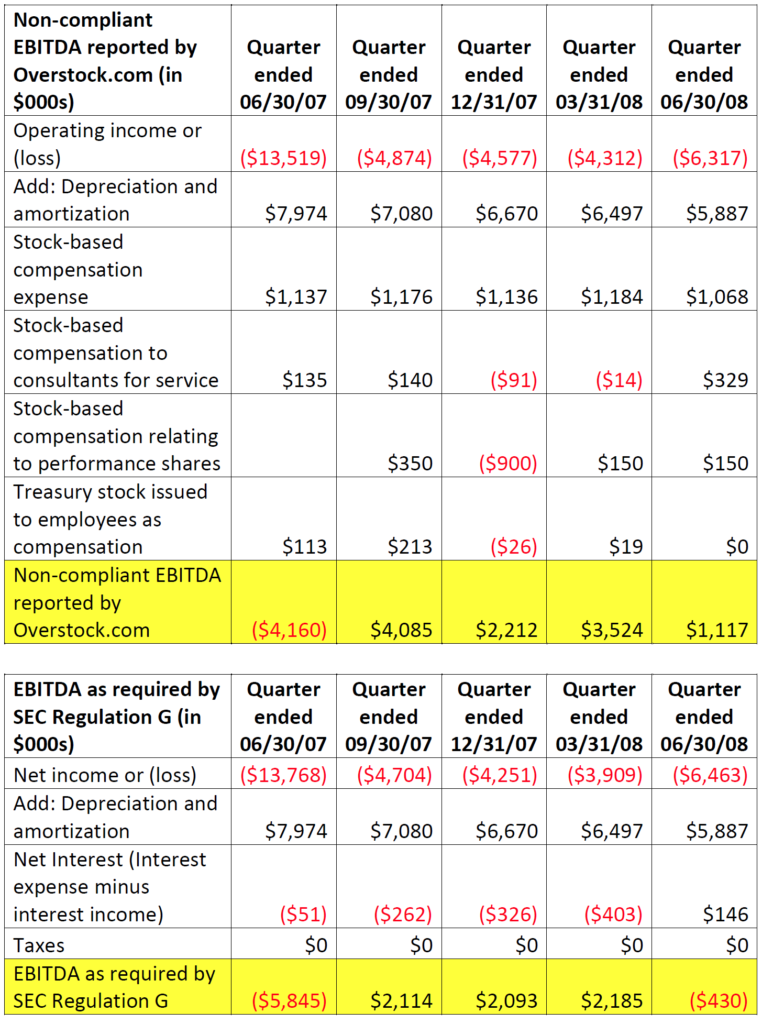

- Using improper EBITDA calculations to inflate its financial performance in violation of SEC Regulation G from Q2 2007 to Q2 2008.

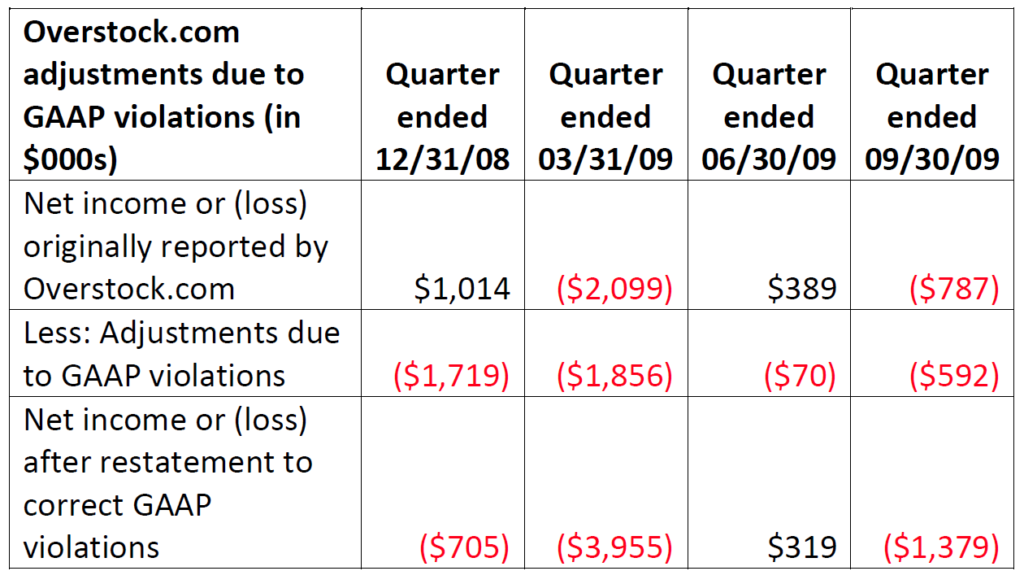

- Violating Generally Accepted Accounting Principles (GAAP) and inflating its reported earnings from Q4 2008 to Q3 2009.

I informed the company of its accounting irregularities, but instead of fixing them, its management attacked me personally. My forensic accounting analysis was vindicated by the company’s later corrections and restatements of its financial reports. However, Overstock.com’s CEO Patrick Byrne continued to slander me in retaliation for exposing his fraud.

Byrne boasted of having a photographic memory

In February 2000, Patrick Byrne boasted that he possessed a photographic memory. Fortune Magazine reported:

He has a nearly photographic memory, which he is fond of demonstrating with what he calls his memory trick: If he studies a deck of cards for a couple of minutes, he can recite them back, one by one, in either direction. He can even recite the same list again six months later. [Emphasis added.]

Seven years later, in December 2007, Byrne appeared on Utah Now and displayed his photographic memory. He asked the interviewer Doug Fabrizio, “What is your birthday?” Fabrizio answered, “July 18.” Within seconds, Byrne correctly told Fabrizio the exact day of the week he was born on: Saturday. Byrne further bragged, “When I was seven, I could memorize cards.” [See transcript.]

Despite his alleged photographic memory, Byrne told several media outlets that Overstock.com was profitable when it was actually losing money.

False claims of profitability

On December 11, 2001, Overstock.com CEO Patrick Byrne appeared on Fox News and claimed, “We’re profitable.” Brenda Buttner asked, “Your real honest-to-goodness profit, not pro forma?” Patrick Byrne responded, “None of that stuff.”

On March 1, 2002, Business 2.0 Magazine reporter Owen Thomas asked, “Are you profitable? Patrick Byrne responded, “Yes, that’s real GAAP profit, not Amazon-bullshit-accounting profit.”

Patrick Byrne criticized companies that used non-GAAP pro forma financial measures such as EBIDTA (earnings before interest, depreciation, taxes, and amortization) to show profits. He made it clear that Overstock.com was reporting profits on a GAAP basis. However, later filings with the SEC contradicted Byrne’s claims that Overstock.com was “profitable.” It was losing money.

On March 5, 2002, Overstock.com filed an S-1 report in connection with its planned initial public offering. It contradicted Byrne’s claim that his company was anywhere near “profitable.” The company lost money in every quarter since its inception. It lost $13.8 million in 2001 and $2.997 million in the quarter ended December 31, 2001. That was the same quarter that Byrne appeared on Fox and claimed, “We’re profitable.”

In the quarter ended March 31, 2002, Overstock.com lost another $3 million and continued to lose money in subsequent quarters. That was the same quarter where Byrne was asked by Business 2.0 if Overstock.com is “profitable” and replied, “Yes, that’s real GAAP profit….”

In the following years, Patrick Byrne continued to criticize companies that used non-GAAP pro forma financial measures such as EBITDA to show profits. Byrne’s deceptive behavior continued as Overstock.com violated accounting rules to materially overstate its financial performance and even falsely report profits when it was actually losing money. Anyone who questioned Byrne’s actions or his company’s financial performance faced harsh retaliation.

Attacks on journalists and critics

Patrick Byrne viciously attacked and smeared journalists who wrote articles about Overstock.com that he disliked. For example, on November 14, 2005, Fortune Magazine columnist Bethany McLean reported Byrne’s disgusting remarks directed at her:

Even in that successful year, there were signs that Byrne was remarkably thin-skinned. In the fall of 2004, I wrote a FORTUNE story titled “Is Overstock the Next Amazon?” After the piece came out, Byrne sent me an e-mail saying “Fair. And balanced.” Two days later he wrote another e-mail: “I actually thought it was crap…. So, why exactly did you become a reporter? Giving Goldman traders blowjobs didn’t work out?”

In August 2006, Byrne hired Judd Bagley to run an anonymous blog called antisocialmedia.net, which he used as a platform to smear journalists and bloggers who criticized Overstock.com. In January 2007, New York Post reporter Roddy Boyd exposed Byrne’s scheme to smear critics on the web.

Bagley used anonymous aliases on stock chat boards to attack Byrne’s critics. He hacked into the accounts of stock chat board posters and implanted spyware in emails to improperly gain personal information on critics. He attempted to blackmail a tech-savvy blogger who exposed his activities. John Carney from Dealbreaker called Judd Bagley “Sleazy McSleaze.”

In April 2007, I was researching Bagley’s activities and visited antisocialmedia.net multiple times over a couple of days. Bagley used an anonymous alias “panamapump” to post a message on a Yahoo stock chat board detailing every time I visited the blog. He threatened me saying:

On behalf of your family and in the interest of your own employability I ask you to please never visit ASM again. I’ll email you new articles when they come out.

Later, as I uncovered accounting irregularities at Overstock.com, Bagley made good on his threat.

Overstock.com did not comply with SEC Regulation G, which regulates non-GAAP pro forma numbers

On April 23, 2004, Patrick Byrne, who appeared on CNBC’s Kudlow and Cramer show, said, “Well, first of all, I’m all about GAAP. I have criticized the companies that use–I don’t believe in one-time charges; I don’t believe in EBITDA. If someone talks about EBITDA, put your hand on your wallet; they’re a crook.”

In October 2004, Patrick Byrne boasted, “We don’t use any pro forma accounting tricks to make the numbers look better.”

In January 2006, Patrick Byrne emailed Tom Mullaney from Business Week and said, “…I think ‘EBITDA’ is the stupidest thing I ever heard from Wall Street (no small feat)….”

However, Overstock.com changed its stance and began using EBITDA in its financial reports starting from Q2 2007, despite Byrne’s previous criticism of companies that used that non-GAAP financial measure in their reports. In February 2008, the company even told the SEC that, “A multiple of EBITDA is currently the most standard measure of valuation in the industry.” With that admission in mind, Overstock.com violated SEC rules by using an incorrect EBITDA calculation that significantly overstated its financial performance from Q2 2007 to Q2 2008.

How Overstock.com violated Regulation G by using an incorrect EBITDA calculation to significantly boost its income

According to Regulation G, EBITDA can only be calculated by starting with net income or net loss and adding back net interest (interest expense minus interest income), taxes, depreciation, and amortization.

On December 3, 2007, I explained how Overstock.com wrongly started its EBITDA calculation with operating income or loss (instead of net income or loss) and wrongly added back stock-compensation costs. By wrongly starting its EBITDA calculation with operating income or loss rather than net income or loss, the company could inflate EBITDA by the amount of losses from discontinued operations. By wrongly adding back stock compensation costs to calculate EBITDA, the company could inflate EBITDA by the amount of such costs.

On May 28, 2008, I reported how the SEC Division of Corporation Finance reviewed similar incorrect EBITDA calculations by two other public companies and made them comply with Regulation G. During this period, I sent multiple emails with links to my blog posts informing the SEC and Overstock.com about the incorrect EBITDA calculations. However, the company stubbornly continued to use an incorrect EBITDA calculation and significantly overstated its financial performance. (See the chart below. Click on image to enlarge.)

By using an incorrect calculation method, Overstock.com reported a positive EBITDA of $1.117 million in Q2 2008 (period ending 06/30/08). However, if it had followed Regulation G, its EBITDA would have been negative $0.430 million.

Overstock management’s false statements and personal attacks

Management made false comments to justify its EBITDA calculations and attacked me during various conference calls.

On July 18, 2008, during the Q2 2008 earnings call, former CFO David Chidester falsely claimed that the company had the right to add back stock compensation costs to compute EBITDA. He said, “It’s completely the convention in our industry….”

On October 24, 2008, during the Q3 2008 earnings call, Patrick Byrne falsely asserted that “The claim that EBITDA is not compliant with SEC definition, nonsense.” Byrne then called me, “Sam Antar the Crook.”

Reporting violations of Regulation G vindicated

On November 7, 2008, Overstock.com filed its Q3 2008 10-Q and disclosed that it had made errors in accounting for customer refunds and credits. The company had to restate its financial reports from Q1 2007 to Q2 2008 to correct those errors. It was the second time in two years that Overstock.com had to revise its reports for violating GAAP.

Moreover, the company finally complied with SEC Regulation G and stopped using the non-GAAP financial measure (operating income plus stock compensation) as EBITDA. It cautioned investors that it used an “adjusted EBITDA” calculation.

Lee Webb from Stockwatch reported:

“Antar the Crook” was clearly right and “Wacky Patty” was clearly wrong.

On July 26 and September 12, 2010, I reported how seven other public companies had used improper EBITDA calculations and violated SEC Regulation G. Unlike Overstock.com, those companies fixed their improper EBITDA calculations in their next financial report and did not attack me for pointing it out.

Overstock.com did not comply with GAAP

On January 30, 2009, Overstock.com announced a net income of $1 million for the fourth quarter of 2008. Patrick Byrne, the CEO, said to investors, “It is a relief to return to GAAP profitability after a tough three years.” However, Overstock.com’s “return to GAAP profitability” was achieved by violating GAAP and not restating previous financial reports that were affected by an accounting error. If Overstock.com had followed the accounting rules correctly, it would have reported a loss of $800,000 instead of a profit of $1 million.

During the earnings call for Q4 2008, Steve Chesnut, the new CFO who replaced David Chidester, said to investors:

Gross profit dollars were $43.6 million, a 6% decrease. This included a one-time gain of $1.8 million relating to payments from partners who were under-billed earlier in the year.

In February 4, 2009, I explained how Overstock.com violated GAAP and materially overstated its earnings in Q4 2008:

That “one-time gain of $1.8 million” referred to above by CFO Steve Chesnut was actually an improper one-time cumulative adjustment of an accounting error.

According to Statement of Financial Accounting Standards No. 154 and SEC Staff Accounting Bulletin No. 99, Overstock.com should have restated all prior accounting periods, rather than use a “one-time gain” to correct its accounting errors “relating to payments from partners who were under-billed earlier in the year.”

Under GAAP, we are required to use an accrual basis of accounting. Income is recognized when it is earned and not when it is later billed or when amounts are collected. The “one-time gain of $1.8 million relating to payments from partners who were under-billed earlier in the year” was earned before Q4 2008 and should have been recognized in prior periods. Since the accounting error is material under SAB No. 99, Overstock.com is required to restate prior period financial reports under SFAS No. 154 and cannot use a “one-time gain” to correct its error.

As a result of violating SFAS No. 154 and SAB No. 99, Overstock.com improperly reported a Q4 2008 net profit of $1 million, instead of an $800,000 net loss.

According to SFAS No. 154 paragraph 25:

Any error in the financial statements of a prior period discovered subsequent to their issuance shall be reported as a prior-period adjustment by restating the prior-period financial statements.

Among the criteria that SAB No. 99 uses to define a material accounting error that requires a restatement of prior period financial reports are:

- whether the misstatement masks a change in earnings or other trends

- whether the misstatement hides a failure to meet analysts’ consensus expectations for the enterprise

- whether the misstatement changes a loss into income or vice versa

Overstock.com’s accounting error met all three materiality criteria above and the company should have restated its prior financial reports, rather than use a one-time gain to correct its accounting error in Q4 2008.

I reported the GAAP violations to the SEC and Overstock.com. I urged Overstock.com’s management to revise their financial reports to correct their unlawful accounting practices. However, Overstock.com continued to violate GAAP and materially inflated its earnings from Q1 to Q3 2009 by treating recoveries from its underbilled fulfillment partners as income.

Back in October 2008, Overstock.com found errors in accounting for customer refunds and credits. The company restated its financial reports from Q1 2007 to Q2 2008 and reduced its retained earnings by 8.2 million to correct those errors due to its income overstatement during those periods.

It also failed to bill its fulfillment partners for some offsetting fees and reimbursements that the company was entitled to because of those errors. However, Overstock.com’s restated financial reports did not account for the income that it had already earned from those offsetting fees and reimbursements during those periods.

Public companies must use accrual basis accounting. Income is recognized in the period it is earned and not when it is later billed or when amounts are subsequently collected. Instead, the company recorded income when it received payments from its fulfillment partners on a non-GAAP cash basis in later accounting periods (Q4 2008 to Q3 2009).

In other words, Overstock.com shifted income that belonged to previous reporting periods (Q2 2008 and earlier) to later reporting periods (Q4 2008 and later) to inflate its financial performance in those later periods. The company created a “cookie jar” reserve to boost future earnings.

Patrick Byrne’s reply

Patrick Byrne replied to my initial accounting analysis on February 6, 2009, with his usual spiteful attack on the InvestorVillage message board. He claimed that “Antar’s ramblings are gibberish. Show them to any accountant and they will confirm. He has no clue what he is talking about.”

Moreover, Byrne tried to justify Overstock.com’s accounting for the recoveries of underbillings from its fulfillment partners:

For example: when one discovers that one underpaid some suppliers $1 million and overpaid others $1 million. For those whom one underpaid, one immediately recognizes a $1 million liability, and cleans it up by paying. For those one overpaid, one does not immediately book an asset of a $1 million receivable: instead, one books that as the monies flow in. Simple conservatism demands this (If we went to book the asset the moment we found it, how much should we book? The whole $1 million? An estimate of the portion of it we think we’ll be able to collect?) The result is asymmetric treatment. Yet Antar is screaming his head off about this, while never once addressing this simple principle. Of course, if we had booked the found asset the moment we found it, he would have screamed his head off about that. Behind everything this guy writes, there is a gross obfuscation like this. His purpose is just to get as much noise out there as he can.

I replied to Byrne’s comments on February 9, 2009.

No matter what boloney Byrne said above, Overstock.com simply had a material accounting error that required the restatement of affected prior period financial reports.

…Patrick Byrne… tried to make excuses for Overstock.com’s decision to correct its accounting errors by claiming that “conservatism demands” waiting until “monies flow in” from under-billed fulfillment partners, after such an error is discovered by the company. That is improper cash-basis accounting for a public company and does not address the restatement issue. In any case, Overstock.com is required to restate all prior period financial reports affected by its accounting error.

On her blog, forensic accountant and accounting book author Tracy Coenen expressed disagreement with Byrne’s remarks that same day.

That same day, forensic accountant and accounting book author Tracy Coenen took issue with Byrne’s remarks in her blog:

In Overstock’s case, the items at issue were earned and realizable in prior quarters, not in the 4th quarter. The fact that the company is clueless and underbilled partners changes neither of those.

If you find items in months, quarters, or years after they should have been booked, the only proper way to record them under accrual basis accounting rules would be to go back and restate the prior period financial statement.

Byrne’s Retaliation

In April 2009, Patrick Byrne sent his hired thug Judd Bagley to interfere with my divorce proceedings and contact my former spouse. Bagley used a pseudonym on a Yahoo stock chat board, which he later admitted was his, to intimidate me saying:

Here’s some advice: settle the suit… give her whatever she wants. Because if it goes to trial, I’ll probably attend.” He also used illegal pretexting tactics to “friend” my children and relatives on Facebook with a fake account.

This was clearly a retaliation for my exposing the company’s accounting violations.

Overstock.com’s pretexting operation also targeted journalists, bloggers, their families, and even minor children. Patrick Byrne collected a database of information on over 7,400 people. Judd Bagley claimed that Overstock’s internet pretexting scheme was meant to reveal connections between hedge funds and the journalists who write about them. However, Bagley only targeted journalists and bloggers (and their friends and family members) who had written about Overstock.

Journalist and author Gary Weiss discovered the pretexting and reported it:

Bagley created “Larry Bergman” and an unknown number of phony Facebook accounts to con people into “friending” him. That way he could circumvent Facebook security, violating their rules and, well, Lord knows how many laws he broke in this pretexting scheme.

Barry Ritholtz, a lawyer and the author of the Big Picture blog (which attracts over 1.5 million readers every month), accused Judd Bagley of being a “possible pederast” after discovering that he and his family members had been deceived by him. Facebook (NASDAQ: FB) eventually banned Bagley for breaking its rules. It removed both his fake “Larry Bergman” profile and his personal one.

A new justification: We had a “gain contingency”

On February 23, 2009, Overstock.com submitted its 2008 10-K report and claimed for the first time that a “gain contingency” existed to explain its accounting practices. It stated that “We found out about the underbilling and decided that we could not be sure of getting back those amounts. Therefore, we considered the possible recoveries as a gain contingency.

Challenging Overstock.com’s claim of a “gain contingency”

On May 4, 2009, I quoted various accounting rules and argued that “No gain contingency existed.” Overstock.com had made the ridiculous assumption that all potential recoveries of underbilled fees and reimbursements owed to it from fulfillment partners (every single penny) were not assured.

I observed that the company did not mention any “gain contingency” when it first disclosed the underbilling error in its Q3 2008 10-Q report filed in November 2008. It waited for three months until it filed its annual 2008 10-K report in February 2009, to assert that a gain contingency existed.

On July 22, 2009, during the Q2 2009 earnings call, Patrick Byrne called me “Sam Antar the Crook” because I dared to challenge his company’s claim of a “gain contingency”.

On August 5, 2009, I published an open letter to the Securities and Exchange Commission urging the regulator to take action to stop the ongoing GAAP violations and material overstatements of earnings by Overstock.com. The company continued to violate GAAP and materially overstate its earnings in Q1 and Q2 2009 by improperly reporting recoveries from its underbilled fulfillment partners as income.

I explained how Overstock.com used its false gain contingency argument to boost its reported earnings in Q1 and Q2 2009. The company found out that it had overcharged some vendors in 2008. Instead of revising its 2008 financial reports to fix those mistakes, it added the corrections to its 2009 income. This made its earnings look higher than they really were.

SEC investigates

The SEC Enforcement Division launched an investigation of Overstock.com on September 17, 2009. A Salt Lake Tribune article published on September 23, 2009 reported Patrick Byrne’s furious reaction with anti-Semitic overtones:

“Gary Weiss and Sam Antar are goniffs,” Byrne exclaimed, using a Yiddish term that he says means “a con man, a hustler and a scoundrel.” He added, “If the SEC is listening to them, their next step is to let Bernie Madoff write their indictment of me.”

Best-selling author and investigative reporter Gary Weiss had exposed Patrick Byrne’s past dirty trick tactics against critics. Both Gary Weiss and I are Jewish.

In October 2009, Aaron Edelstein from Crain’s New York Business asked Patrick Byrne about my reporting of accounting irregularities. Byrne responded by saying:

He’s a criminal who works for short-sellers. He throws mud day after day. No matter what he says, he finds some spurious thing to jump up and down about.

On October 1, 2009, the SEC Division of Corporation Finance began reviewing Overstock.com’s financial reports. It found out that the company had overpaid a fulfillment partner $785,000 in 2008. The company recovered that overpayment in Q1 2009 and improperly reported the overpayment recovery as income in that same quarter, rather than correctly restating its 2008 financial reports to fix that error.

Grant Thornton, who replaced PricewaterhouseCoopers as Overstock.com’s auditors in 2009, claimed that it did not know about the 2008 overpayment and the Q1 2009 recovery from the fulfillment partner until October 2009. The SEC wanted Overstock.com to restate its financial reports to correct that error and other GAAP violations previously identified in my blog. Grant Thornton agreed.

The SEC reviewers questioned why Overstock.com did not report a gain contingency when it first disclosed the underbilling error in its Q3 2008 10-Q report, filed on November 7, 2008. The company claimed that a gain contingency existed only when it filed its 2008 10-K report on February 23, 2009.

Overstock.com explained to the SEC that disclosing a gain contingency in November 2008 “…would have been inappropriate.” However, in the 10-K report, Overstock.com stated that it determined that a gain contingency existed “When the underbilling was originally discovered….” on October 24, 2008.

These two statements are contradictory. If the 10-K disclosure was true, the explanation to the SEC was false. If the explanation to the SEC was true, the 10-K disclosure was false. In any case, the SEC concluded that no gain contingency existed, as I mentioned in my August letter.

On November 13, 2009, Overstock.com dismissed Grant Thornton instead of restating its financial reports. Three days later, Overstock.com issued an “unreviewed” Q3 2008 10-Q report without fixing its GAAP violations.

On November 18, 2009, Patrick Byrne falsely claimed that even if the company had restated its financial reports, none of its previously reported profits would turn into losses. Byrne said, “In fact, as I understand it, this doesn’t change any positive quarter to a negative quarter or any negative quarter to a positive quarter.”

On November 24, 2009, the Salt Lake Tribune reported that Company President Jonathan Johnson said:

None of these changes that they [Grant Thornton] are talking about, or that people at the SEC are now asking about, make any of our quarters go from negative to positive or from positive to negative.

Johnson’s statement was untrue.

Reporting GAAP violations vindicated

On December 29, 2009, Overstock.com replaced Grant Thornton with KPMG as its auditor. On January 29, 2010, Overstock.com alerted investors that they should not rely on its previous financial reports. On March 31, 2010, Overstock.com filed its 2009 10-K report and restated its financial reports to correct the GAAP violations that I had recommended in February 2009. The company also acknowledged that the “gain contingency…was an inappropriate accounting treatment.”

See the chart below detailing restatements. (Click on image to enlarge.)

Richard Sauer, the author of “Selling America Short”, wrote:

This dispute did not end happily for. KPMG sided with ex-felon Antar. In early February 2010, Overstock announced that its financial statements for the period at issue should no longer be relied upon by anyone who might otherwise have considered doing so, pending their restatement. The result is that the company will now have restated at least once for every fiscal period since becoming a public company.

Contrary to what Patrick Byrne and Jonathan Johnson said to justify Overstock.com’s accounting policies, none of their statements were true. The company did not have a gain contingency as Overstock.com had claimed. Instead of making a profit in Q4 2008 as it had reported, the company actually lost money. It also inflated its earnings from Q4 2008 to Q3 2009, as I accurately revealed.

In February 2009, Byrne dismissed my findings as “gibberish”. He said, “Antar’s ramblings are gibberish. Show them to any accountant and they will confirm. He has no clue what he is talking about.” However, the “gibberish” was Overstock.com’s unlawful accounting practices and Byrne’s nonsense in defending his company’s accounting tricks. I knew exactly what I was talking about.

In March 2010, I asked Patrick Byrne for an apology, but he never gave me one. He only continued his spiteful campaign of revenge against me.

Ongoing conflict

In November 2010, seven California counties’ District Attorneys filed a consumer fraud lawsuit against Overstock.com. On April 12, 2011, I wrote about the DAs’ complaint to the court that Overstock.com was hiding the personal contact details of former employees who might have witnessed misconduct. That same day, a Bloomberg reporter questioned Patrick Byrne about the issue and he launched a vile attack on his Deep Capture website:

The sounds of squealing could be heard over the low hum of the air recirculation machinery in the drab, windowless federal interview room. “Please!” Sam Antar wimpered. “Let me write one more smear. Let me feel like I’m a player, one last time!”

The federal agent spoke sharply: “Silence!” She turned to look at her colleagues with bemusement. “Jesus, what is it with these finance gerbils? I haven’t seen someone break this pitifully since that bookkeeper in Reno. ” She set aside her Nutcracker Flail, took a long pull on her Gauloises, and said, “OK, let’s give Sam the night off. We’ll get him cleaned up for the judge in the morning.”

With that, Sam Antar, still restrained in straightjacket, was hauled back to the Shower Room, where he spent the night toe-writing in excrement on the linoleum.

Which would be altogether unremarkable, were it not for the fact that within hours, a Bloomberg reporter named Clyde Eltzrothis called, asking me to comment on it.

Patrick Byrne continued to criticize the California District Attorneys for their lack of integrity:

It is not our job to host DAs on a no-limits fishing trip, especially when they have not acted in good faith in the past.

On May 18, 2011, Judge Robert B. Freeman approved the California District Attorney’s request to force Overstock.com to disclose the contact details of some former employees. He dismissed Byrne’s argument.

No attempt to comply with accounting rules

Overstock.com has to admit that it broke various accounting rules. Its later revisions of financial reports confirmed my accounting analysis. The company has to try to convince the SEC that it did not act maliciously and its errors in financial reporting were accidental. That claim is false based on the company’s actions.

Ethical companies that act in “good faith” correct their accounting mistakes and move on. They don’t attack whistleblowers who expose errors in financial reports. Patrick Byrne did not seem to care that Overstock.com broke accounting rules and had to restate its financial reports. He seemed to care only because his company’s accounting problems were revealed.

Byrne’s vile prison fantasy about me shows his obsession to retaliate against me for pointing out his company’s misconduct. Byrne and his team will fabricate anything and use any slander tactic in their efforts to punish me for discovering their wrongdoing. But the fact is that I discovered violations of accounting rules that helped Overstock.com inflate its financial performance and the company had to make changes in its financial reporting to fix those violations.

If the company and its auditors want to say they acted in good faith, it means that this convicted felon and former CPA knows more about SEC reporting rules and GAAP than any of them. I must be an accounting genius. I was able to find accounting issues that PricewaterhouseCoopers and Grant Thornton (the third and sixth largest accounting firms in the world) missed, even though they had access to the company’s books and records. PricewaterhouseCoopers was Overstock.com’s auditor from 1999 to 2008 and Grant Thornton was its auditor from Q1 to Q3 2009.

The Sarbanes-Oxley Act of 2002 makes it clear that management is primarily responsible for poor internal controls and improper financial reporting, and it does not accept the excuse that a company followed the wrong advice of its auditors.

Overstock.com has restated its financial reports three times due to GAAP violations. All of its financial reports from 1999 to Q3 2009 were revised from one to three times because of GAAP violations. None of the internal control certifications signed by the CEO and CFO of the company during that period were true. All of the audits by PricewaterhouseCoopers from 1999 to 2008 and the review by Grant Thornton in 2009 were flawed.

Whistleblower protections under Dodd-Frank Act

The Dodd-Frank Act, a law that regulates the financial sector, was enacted last year. The SEC also issued final regulations to protect whistleblowers who report securities law violations. SEC Chairman Mary Schapiro stated in a speech on May 25, 2011, that:

… anyone who provides us information, even if it relates to a possible securities law violation, and regardless of whether it leads to a successful enforcement action, is protected by the statute’s whistleblower provisions.

In this case, the SEC received information from a whistleblower who exposed accounting violations that forced a public company to revise its financial reports. The issuer retaliated against the whistleblower in a blatant manner. The SEC has clear evidence of this. The ability to criticize accounting practices without fear of retaliation from public companies is vital for our democracy and the integrity of our capital markets.

Dodd-Frank protection for whistleblowers

Last year, the Dodd-Frank Act was signed into law and the SEC issued final regulations about whistleblower protections. On May 25, 2011, SEC Chairman Mary Schapiro said in a speech that, “… the final rules make clear that the statute’s whistleblower protections apply to anyone who provides us information, even if that information relates to a possible securities law violation, and regardless of whether it leads to a successful enforcement action.”

Here, the SEC has a whistleblower that correctly identified accounting violations which caused a public company to restate its financial reports. The SEC has clear evidence of blatant retaliation by the issuer against that whistleblower. The freedom to criticize accounting practices without fear of reprisal from public companies is essential to our democracy and the integrity of our capital markets.

Written by,

Sam E. Antar

Disclosure: I don’t own any Overstock securities long or short.

Note:

Originally published in my blog on 8/22/11 and subsequently updated.

© Copyright by Sam E. Antar. All rights reserved.