A Real-Time Investigation as the Media Defense Creates an Unsolvable Trap

HOW IT STARTED: THE MATHEMATICAL IMPOSSIBILITY

In February 2025, I was reading New York Attorney General Letitia James’s financial disclosure forms—the kind of work forensic accountants do that most people find incredibly boring.

That’s when I found it.

3121 Peronne Avenue, Norfolk, Virginia

James listed this property with a value of $100,000-$150,000. But in her 2023 disclosure, she listed two mortgages:

- Freedom Mortgage: $150,000 to under $250,000

- National Mortgage: $100,000 to under $150,000

Total mortgages: $250,000 to $400,000

Property value: $100,000 to $150,000

A loan-to-value ratio of 167% to 400%? That’s mathematically impossible under standard lending practices.

I ordered a title report. The two mortgages James disclosed were not recorded in connection with the Peronne Avenue property, but public records revealed an undisclosed mortgage: OVM Financial, dated August 17, 2020, principal amount $109,600—a mortgage James never disclosed from 2020-2022.

When I examined the mortgage documents, I found a Second Home Rider signed by James declaring under penalty of perjury that she would “occupy and use the Property as Borrower’s second home” and maintain “exclusive control” over occupancy.

But the disclosure pattern told a different story: from 2020 to 2023, James reported this as an “investment” property to New York State, contrary to the second home rider. The indictment would later reveal that James also claimed rental deductions on IRS tax forms (Schedule E), reporting “zero personal use days” and “rents received”—all while maintaining second home financing with a lower interest rate.

I published my findings in February 2025, documenting the phantom mortgages, the missing disclosures, and the four-way classification fraud. Within months, a federal grand jury was convened.

On October 9, 2025, Letitia James was indicted by a federal grand jury in the Eastern District of Virginia on two counts:

- Bank Fraud (18 U.S.C. § 1344) – maximum 30 years

- False Statements to a Financial Institution (18 U.S.C. § 1014) – maximum 30 years

The indictment’s allegations centered on a fundamental contradiction. On August 17, 2020, James had signed a Second Home Rider, declaring under penalty of perjury that she would “occupy and use the Property as Borrower’s second home” and maintain “exclusive control over the occupancy of the Property.” This classification gave her a favorable interest rate of 3.000% instead of the 3.815% rate for investment properties.

But according to Paragraphs 9 and 10 of the indictment, James told the property insurers and IRS something completely different:

“9. JAMES’ Universal Property application for homeowners’ insurance indicated “owner-occupied non-seasonal use,” further misrepresenting the intended use of the property.”

“10. JAMES filed Schedule E tax form(s), under penalties of perjury, treating the Perrone Property as rental real estate, reporting fair rental days, zero personal use days, thousand(s) of dollars in rents received, and claiming deductions for expenses relating to the property, further contradicting the second home classification.”

The core allegation: James told the bank “second home” to get a lower interest rate, told the insurance company “owner-occupied” to get favorable coverage, while simultaneously telling the IRS “rental property” to claim rental deductions—getting second home financing benefits (lower interest rate) without meeting second home requirements, while claiming rental property tax deductions possibly without receiving rental income.

Then the media counterattack began.

THE NEW YORK TIMES FIRES THE FIRST SHOT—AND BURIES THE LEAD

On October 11, 2025—two days after the indictment—The New York Times published an article titled “In the Eye of a Political Storm, a Tiny Yellow House in Norfolk, Va.”

But they buried the most damaging evidence.

What the Times left out entirely: Paragraph 9 of the indictment, which reveals James told her insurance company the property was “owner-occupied non-seasonal use.”

This is devastating because “owner-occupied” contradicts everything:

- James told the bank it was her “second home” (for lower interest rate)

- James told the IRS it was “rental property with zero personal use days” (for maximum deductions)

- James told NY State it was an “investment” property

- James told insurance it was “owner-occupied” (likely for lower premiums)

- But reality: Thompson and her children lived there full-time

You can’t claim “owner-occupied” to an insurance company while simultaneously telling the IRS you had “zero personal use days” and telling the bank it’s your “second home” while someone else actually lives there. This proves systematic fraud—telling each institution exactly what they wanted to hear.

But the Times said nothing about it. Not one word. The article had three bylines. Three reporters read the indictment. Three sets of eyes saw Paragraph 9. And all three somehow failed to mention that James told her insurance company the property was “owner-occupied” while telling the IRS she had “zero personal use days.”

Either they’re all remarkably incompetent, or they knew exactly how damaging Paragraph 9 was to their narrative. Instead, they focused entirely on their key evidence: Nakia Thompson, James’s great-niece, allegedly testified to a grand jury that she “did not pay rent” and lived there “rent-free.”

The Times painted a detailed picture meant to show James was simply helping family:

“The family, Nakia Thompson and her children, have lived at the address ever since [2020], according to two people familiar with the home, and until this week, the plan for a more placid existence had largely gone as expected. Several times a year, the people said, a great-aunt who had purchased the house in 2020 with Ms. Thompson in mind would come for an extended stay.”

The article continued:

“But in June, Ms. Thompson testified to a grand jury in Norfolk that she had lived in the house for years and that she did not pay rent, a person familiar with her testimony said. She was not asked to testify again, and the grand jury that voted to indict Ms. James was not seated in Norfolk, but in Alexandria.”

The Times emphasized that James wasn’t profiting from the arrangement:

“Ms. James pays even for basic upkeep.”

The implication was crystal clear: No rent paid + James visits occasionally + James pays upkeep = This is family help, not rental property = Charges are bogus.

The Times noted that Thompson testified to a grand jury in Norfolk rather than the Alexandria grand jury that indicted James. But that distinction is irrelevant. What matters is that Thompson’s testimony—regardless of which grand jury heard it—directly contradicts James’s sworn tax returns. Even if Thompson’s testimony is accurate, it doesn’t exonerate James. It implicates her in additional crimes.

There was just one problem.

I pulled up the federal indictment, Paragraph 10:

“JAMES filed Schedule E tax form(s), under penalties of perjury, treating the Perrone Property as rental real estate, reporting fair rental days, zero personal use days, thousand(s) of dollars in rents received, and claiming deductions for expenses relating to the property.”

The New York Times just created an unsolvable trap.

The Times cites Thompson’s alleged grand jury testimony that she lived there “rent-free.” This directly contradicts James’s Schedule E tax forms reporting “rents received.”

Let’s place what the New York Times documented side-by-side with what the indictment reveals:

| What The New York Times Documented | The Federal Indictment (Paragraph 10) |

|---|---|

| “She did not pay rent”

Thompson testified to a grand jury in Norfolk that she lived there without paying rent |

“Thousand(s) of dollars in rents received”

James reported receiving rental income on Schedule E forms filed under penalty of perjury |

| “Have lived at the address ever since [2020]”

“The family, Nakia Thompson and her children” have occupied the property as their residence continuously since 2020 |

“Zero personal use days”

James swore under penalty of perjury she had NO personal use of the property |

| “Several times a year…would come for an extended stay”

James visits the property regularly for extended periods |

“Treating the Perrone Property as rental real estate…further contradicting the second home classification”

James filed tax forms classifying it as rental property, directly contradicting her sworn declaration that it was her second home |

| “Ms. James pays even for basic upkeep”

James covers maintenance costs for the property |

“Claiming deductions for expenses relating to the property”

James deducted these expenses on her tax returns—deductions only allowed for rental properties, not second homes, proving she treated it as a rental for tax purposes |

These statements cannot all be true.

Either the testimony contradicts the tax returns, or the tax returns are false. There is no third option.

“A STRAIGHTFORWARD FACTUAL DISPUTE”? THE TIMES GETS IT BACKWARDS

The Times tries to frame this as an ambiguous case needing more evidence:

“Ms. Thompson and Ms. James’s yearslong use of the house and Ms. Thompson’s testimony to the grand jury — neither of which has been previously reported — illuminate the straightforward factual dispute that will animate the case. Real estate and legal experts said that it would be difficult to assess the strength of Ms. Halligan’s case until more facts were presented in court.”

But there is no factual dispute. The documents ARE the facts.

This isn’t a “he said, she said” case where we need testimony to clarify ambiguities. This is a documentary contradiction case where sworn statements to different government entities cannot all be true:

- Insurance application: “owner-occupied non-seasonal use” (binding representation)

- Second Home Rider: “exclusive control” (signed under penalty of perjury)

- Schedule E forms: “rents received” (signed under penalty of perjury)

- Thompson testimony: “did not pay rent” (given under oath)

No additional facts will resolve this. Either the insurance application is false, or the tax forms are false, or the testimony is false, or all of them are false. That’s not a “factual dispute”—that’s documented fraud.

The “legal experts” the Times consulted don’t need more facts. They need to read Paragraphs 9 and 10 of the indictment—the paragraphs the Times conveniently ignored.

THE PERFECT TRAP: EVERY ANSWER IS MULTIPLE CRIMES

Here’s why there’s no escape from the documentary evidence.

The Times documented: Thompson “did not pay rent”

James’s Schedule E forms: “rents received”

These cannot both be true.

IF THE TIMES’ REPORTING IS ACCURATE:

Thompson paid no rent, as reported

Then James committed FOUR federal crimes:

Crime #1: Tax Fraud

- James’s Schedule E forms showing “rents received” are false

- James reported receiving rental income she never received

- James falsely claimed rental property deductions

- This is tax fraud (26 U.S.C. § 7206 – false tax return, up to 3 years)

Crime #2: Additional Tax Fraud

- James reported “zero personal use days” but the Times reports she visits regularly

- If she visited, those are personal use days that reduce deductions

- This is also tax fraud (26 U.S.C. § 7206)

Crime #3: Possible Wire/Mail Fraud

- The indictment alleges Schedule E forms were filed “during the relevant time period” (August 2020 through at least January 2024)

- James reported rental income of $1-5K to NY State in 2020, then $0 for 2021-2024

- Critical question: Did James file Schedule E forms showing “rents received” for tax years 2021, 2022, 2023, or 2024?

- If yes, and she reported $0 to NY State for those years, this is wire/mail fraud (18 U.S.C. § 1343/1341, up to 20 years per count)

Crime #4: Mortgage Fraud

- Thompson lived there full-time and controlled occupancy

- James violated the Second Home Rider requirement for exclusive control

- James gave “another person” control over occupancy (explicitly prohibited)

- This is mortgage fraud (18 U.S.C. § 1014, up to 30 years)

IF THE TIMES’ REPORTING IS INACCURATE:

James’s Schedule E: “rents received”

Then Thompson’s testimony was false:

- Thompson testified falsely under oath to the grand jury

- This is perjury (18 U.S.C. § 1623, up to 5 years)

And James still committed mortgage fraud:

- Even if Thompson paid rent, the Times documented that Thompson and her children lived there full-time since 2020

- This violates the “exclusive control” and “personal use” requirements of the Second Home Rider

- This is still mortgage fraud (18 U.S.C. § 1014)

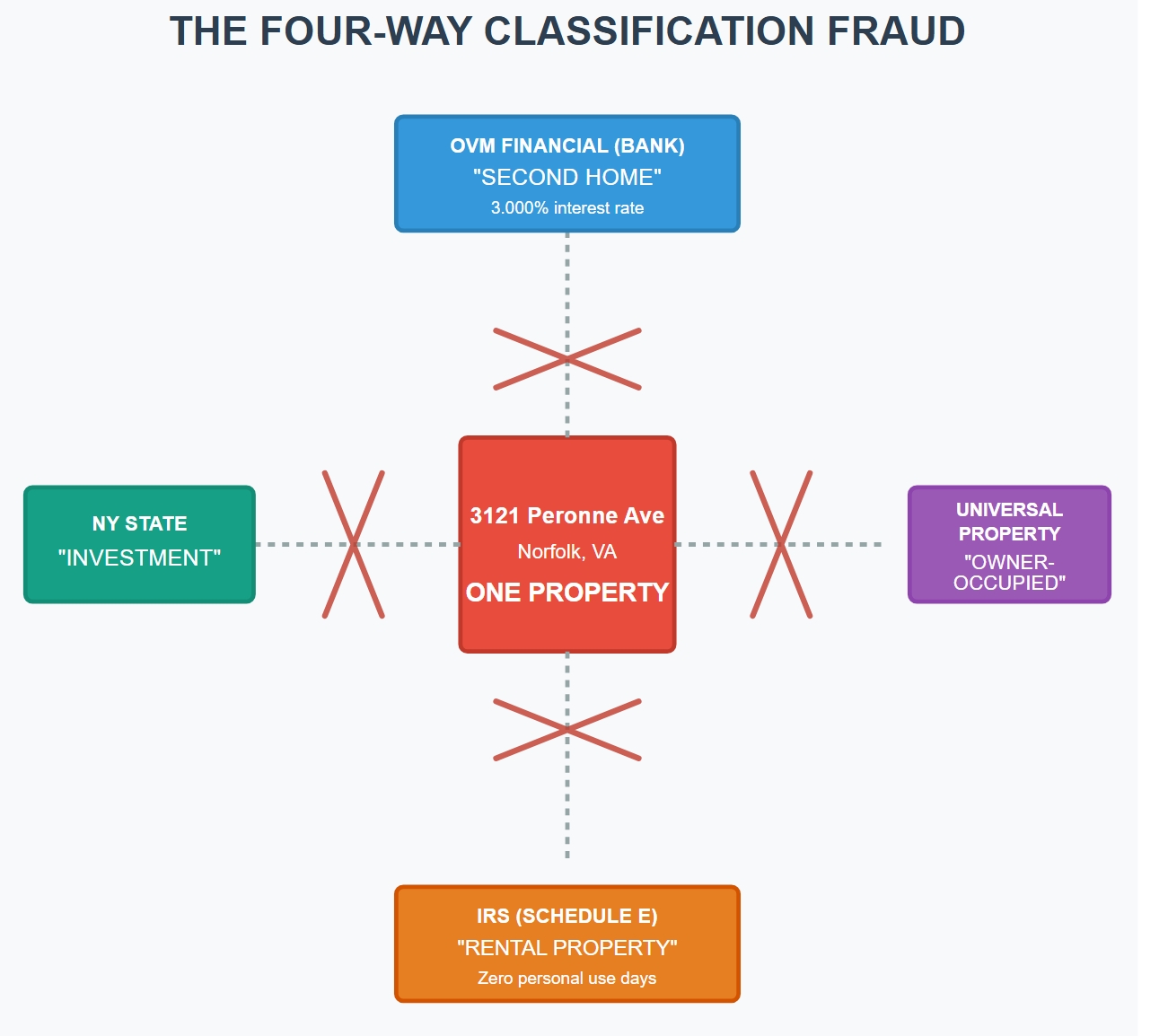

THE FOUR-WAY CLASSIFICATION FRAUD

James classified the same property four different ways to four different entities—all under penalty of perjury or with legal consequences for misrepresentation:

To OVM Financial (Mortgage, August 2020):

- Classification: “Second Home”

- Interest rate: 3.000%

- Requirement: Personal use and exclusive control

- Signed under penalty of perjury

To Universal Property (Insurance, 2020):

- Classification: “Owner-occupied non-seasonal use”

- Purpose: Homeowners insurance coverage

- Requirement: Owner personally occupies the property

- Likely benefit: Lower premiums than rental/investment property

To IRS (Tax Returns, 2020-2024):

- Classification: Rental Property (Schedule E)

- Reported: “zero personal use days”

- Reported: “rents received”

- Purpose: Claim maximum rental deductions

- Signed under penalty of perjury

To NY State (Disclosures, 2020-2024):

- Classification: “Investment”

- Income: $1-5K (2020), then $0 (2021-2024)

- Signed under penalty of perjury

Four classifications. Four different entities. At least three must be false.

Here’s the fraud mechanism:

- Bank: If James told OVM Financial this was an investment/rental property (which it was), she would have paid 3.815% interest instead of 3.000%. By claiming “second home” while actually using it as rental property, she saved 0.815% through fraud.

- Insurance: By claiming “owner-occupied” to Universal Property, she likely received lower premiums than if she’d disclosed it was occupied by tenants or family members—and certainly lower than if she’d disclosed it was a rental property.

- IRS: By claiming “rental property” with “zero personal use days,” she maximized tax deductions while contradicting both the bank (second home) and insurance (owner-occupied) classifications.

- NY State: By reporting $0 income to NY State after 2020 while reporting “rents received” to the IRS, she created yet another contradiction. But even if we assume the $0 income is accurate and James received no rental income after 2020, the classification fraud remains: she still told four different entities four different stories about what the property was—second home, owner-occupied, rental property, investment—when at most one could be true.

The pattern is unmistakable: James told each entity exactly what it wanted to hear to maximize financial benefits—lower interest rates, lower insurance premiums, maximum tax deductions—while the classifications directly contradicted each other.

The insurance misrepresentation is particularly damaging because:

- It’s a fourth sworn or binding statement that contradicts the others

- “Owner-occupied” directly contradicts “rental property” (IRS)

- “Owner-occupied” contradicts the reality that Thompson and her family lived there full-time (Times reporting)

- It shows systematic pattern of telling different stories to different institutions

- It demonstrates intent—this wasn’t an innocent mistake, but a deliberate strategy

CONCLUSION: THE TRAP IS SPRUNG

The New York Times published what they thought was exculpatory evidence.

They proved systematic fraud instead.

The Times’ own reporting creates an unsolvable trap:

- If their reporting is accurate → James committed tax fraud (false “rents received”), additional tax fraud (“zero personal use days”), and mortgage fraud (violated exclusive control)

- If their reporting is inaccurate → Thompson committed perjury and James still committed mortgage fraud

There is no third option.

The documents don’t lie:

- Second Home Rider: James agreed to occupy and control the property for personal use

- Insurance Application: James claimed “owner-occupied non-seasonal use”

- Times’ own reporting: “The family, Nakia Thompson and her children, have lived at the address ever since [2020]”

- Schedule E forms: James reported “zero personal use days” and “thousand(s) in rents received”

- Times’ own reporting: Thompson “did not pay rent”

- State disclosures: James reported $0 income after 2020

- Title records: The mortgages she disclosed in 2023 don’t exist

This isn’t political persecution. This is documentary fraud—exposed by the very article meant to defend it.

When Letitia James said “there cannot be different rules for different people,” she set a standard.

The New York Times just proved why that standard must apply to her.

An earlier version of this article incorrectly stated the title of The New York Times article as “The Mortgage Fraud Case Against Letitia James, Explained.” The correct title is “In the Eye of a Political Storm, a Tiny Yellow House in Norfolk, Va.” The article has been updated to reflect this correction. All other details and quotations are accurate and taken directly from that article.

Follow @SamAntar on X

Written by Sam Antar

Forensic Accountant & Fraud Investigator

© 2025 Sam Antar. All rights reserved.