Breaking Investigation: Bend the Arc endorsement reveals sixth channel in systematic charitable-to-political conversion network—balance sheet evidence exposes circular funding scheme

When Bend the Arc Jewish Action endorsed Queens Assemblyman Zohran Mamdani for New York City mayor on September 26, 2025—the organization’s first-ever mayoral endorsement—voters saw what appeared to be an independent grassroots political decision. Within 72 hours, professional fundraising campaigns and organized training events were operational, raising questions about pre-existing infrastructure. (Click on any image to view it in a larger size)

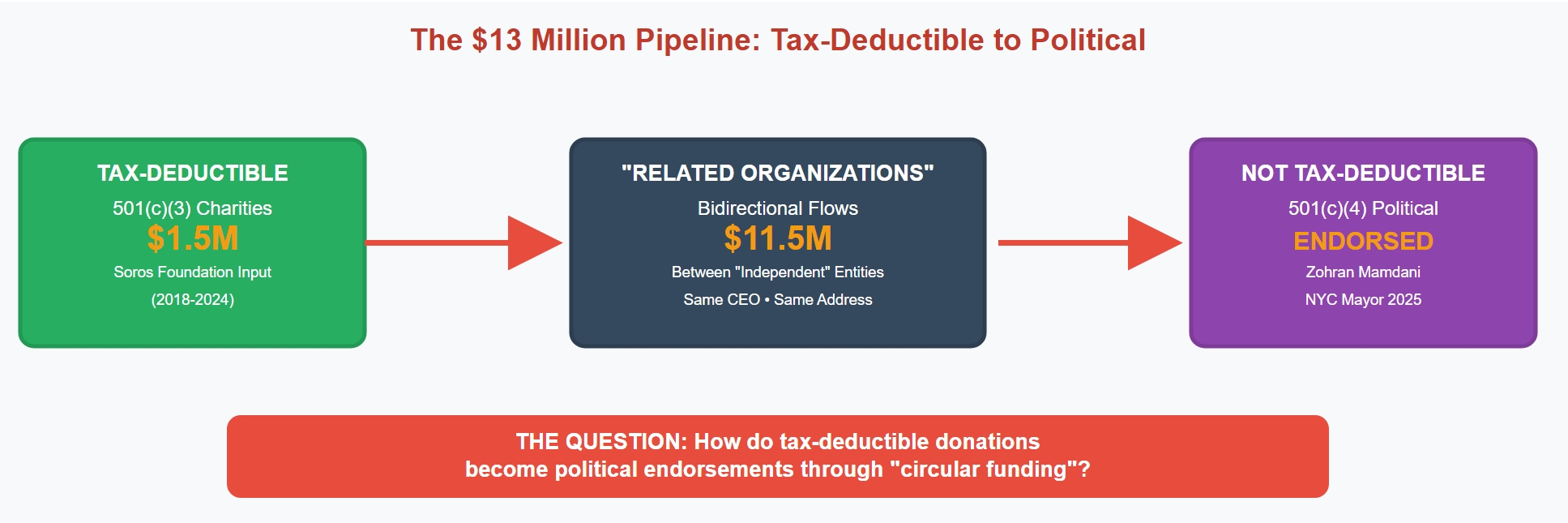

What voters didn’t see: $13+ million in systematic financial flows connecting George Soros’s Foundation to Promote Open Society to Bend the Arc’s 501(c)(3) charitable arm, then converting through to its 501(c)(4) political operation where Alex Soros serves as founding chair—and a forensic accounting discovery that exposes what appears to be a sophisticated circular funding scheme designed to disguise the true nature of these transactions.

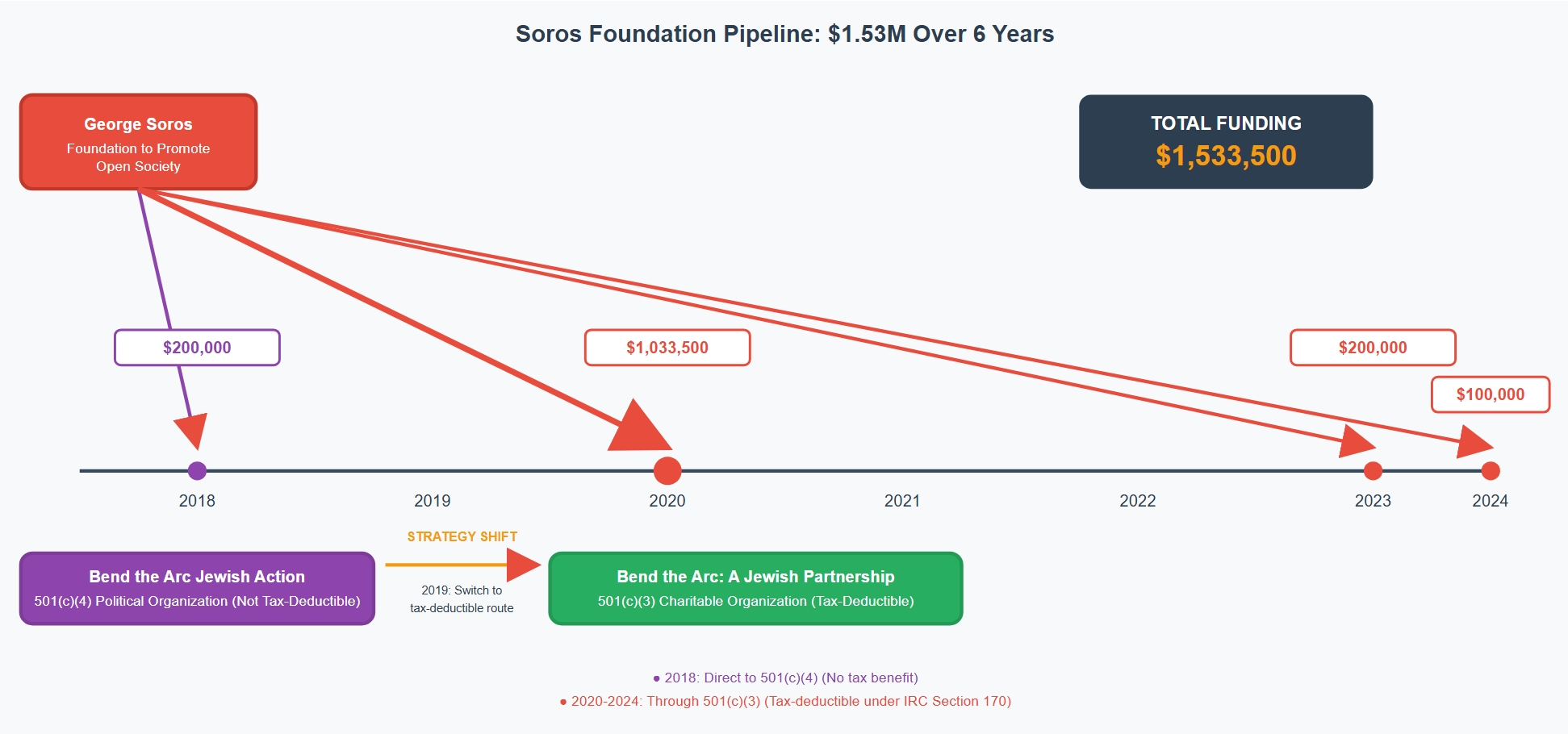

Federal tax filings show George Soros’s foundation has provided $1,533,500 to Bend the Arc: A Jewish Partnership for Justice (501(c)(3)) since 2018, while his son Alex Soros holds the title of “Founding Chair” on the board of Bend the Arc Jewish Action (501(c)(4)), the political advocacy arm that endorsed Mamdani. The same CEO controls both the 501(c)(3) charitable organization receiving Soros foundation money and the 501(c)(4) political organization where Alex Soros serves as founding chair—raising questions about how family influence and foundation funding may connect through organizational structures.

None of this appears in New York City campaign finance reports. Voters researching Mamdani’s support or examining PACs supporting his candidacy and opposing Andrew Cuomo will find no trace of the $13+ million pipeline, the Soros foundation funding, Alex Soros’s founding role, or the circular funding patterns documented in federal tax filings.

The information is technically visible—buried in hundreds of pages of IRS Form 990 filings across multiple organizations and multiple years—but only if you undertake the tedious process of connecting the dots. Each individual transaction appears routine and innocent when viewed in isolation: a foundation grant here, a reimbursement there, a cost-sharing agreement.

The pattern only emerges when you systematically connect these transactions across entities and examine the repetitive behavior over multiple tax years. The coordination operates in a disclosure gap—documented in federal tax forms but invisible in the campaign finance system where voters typically look, and practically invisible even in the tax filings unless someone does the forensic work to piece it all together.

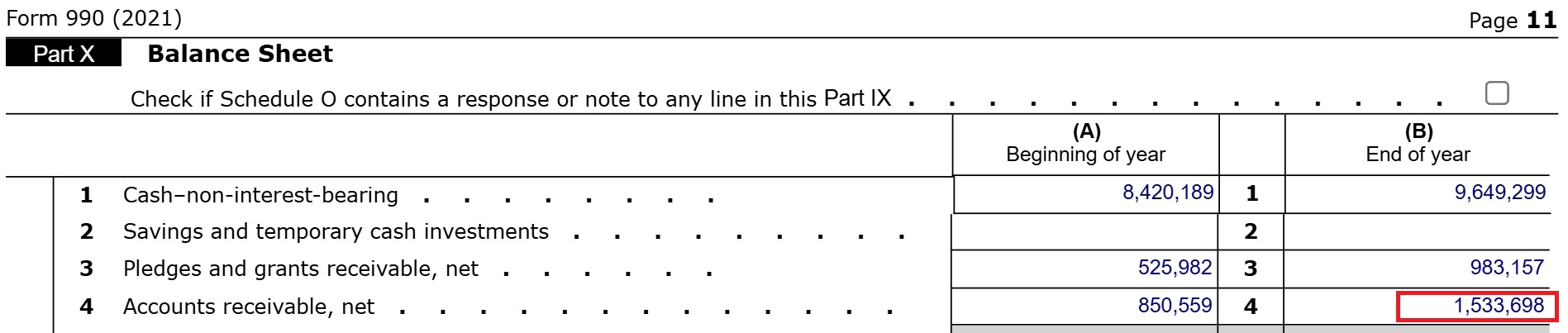

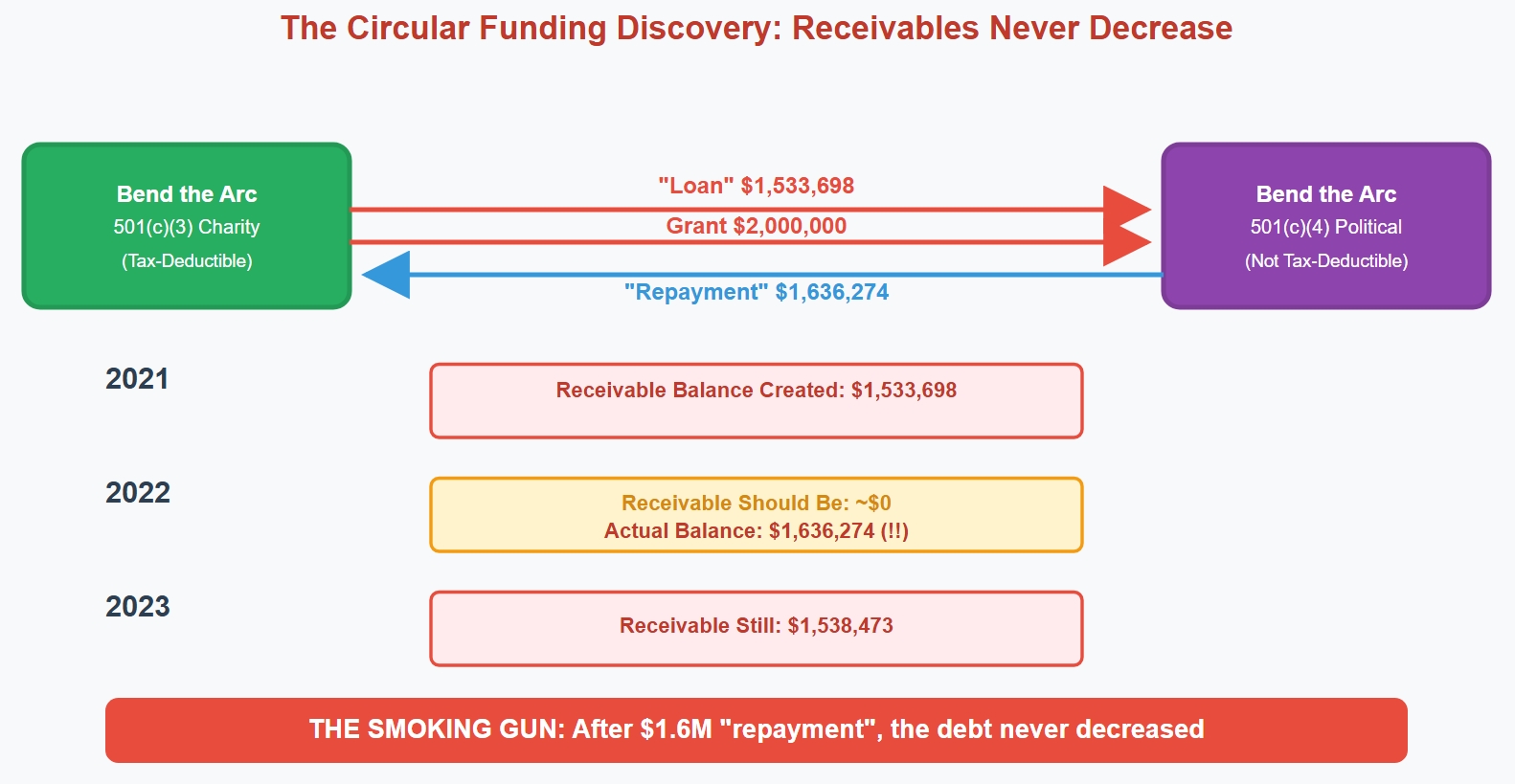

Federal tax filings reveal a pattern that challenges conventional accounting: Bend the Arc’s 501(c)(3) charitable organization shows exactly $1,533,698 in accounts receivable on its 2021 balance sheet—an amount that precisely matches $1,533,698 in “loans” the 501(c)(3) charity reported making to its affiliated 501(c)(4) political arm in the same year.

Then in 2022, while the 501(c)(4) political arm “repays” $1,636,274 to the 501(c)(3) charity, it simultaneously receives $2,000,000 in new grants from that same 501(c)(3) charity.

By 2023, the receivable remains at $1,538,473—virtually unchanged from the original 2021 loan. The pattern reveals money flowing in a circle across three years: grants out, reimbursements back that never reduce the debt, new grants out again—all controlled by the same CEO managing both sides of these transactions.

If the 501(c)(4) political organization is using grant money to “repay” loans to the 501(c)(3) charity that gave it those grants, are these genuine loans at all? Or are they disguised grants with artificial loan paperwork designed to create the appearance of arm’s length transactions between related entities?

The circular funding discovery transforms questions about compliance into questions about financial engineering. And it represents the sixth documented channel in a systematic network that has now been traced across $25+ million in coordinated flows—all using identical methodology to convert tax-deductible charitable contributions into political power.

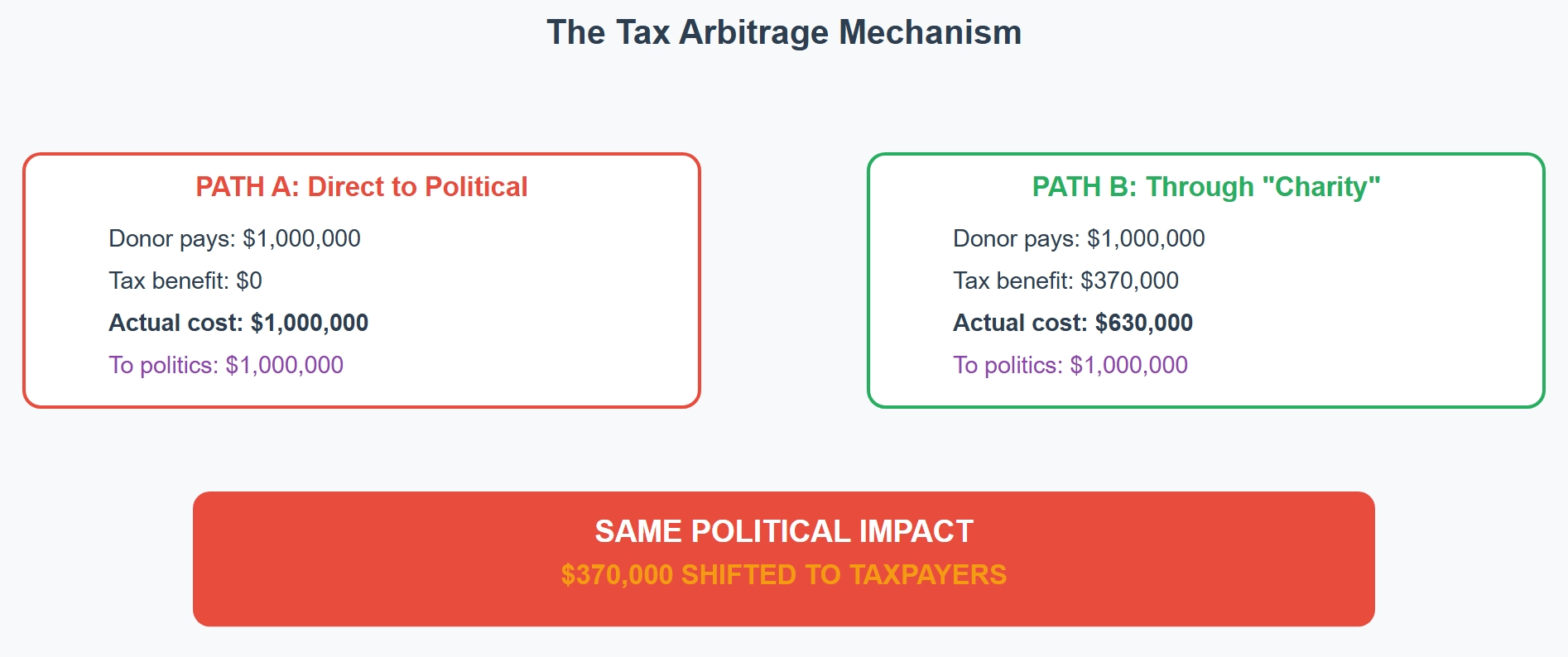

The Core Mechanism: Tax Arbitrage Through Organizational Conversion

The pattern operates with mathematical precision. Wealthy donors contribute to 501(c)(3) charitable organizations and claim tax deductions under IRC Section 170. Money then systematically transfers to affiliated 501(c)(4) organizations that engage in unlimited political activity. The structure raises a fundamental question: If donors had contributed directly to 501(c)(4) organizations, they would receive no tax deduction. When charitable contributions systematically convert to political operations through related entities sharing CEOs, addresses, and payroll systems, are donors effectively claiming tax benefits for what becomes political activity funding?

Channel 6 demonstrates this mechanism with particular clarity through $13+ million in documented flows and a balance sheet discovery that raises questions about sophisticated transaction engineering.

The Five-Step Framework: Questions About Tax Deduction and Political Activity Relationships

Our comprehensive investigation across nine IRS whistleblower submissions has documented patterns that raise questions about how tax-deductible charitable contributions may relate to political campaign support. The patterns suggest strategic use of tax code distinctions between 501(c)(3) and 501(c)(4) organizations across six documented channels:

Step 1: Tax-Deductible Charitable Contributions

Wealthy donors make contributions to 501(c)(3) charitable organizations and claim tax deductions under IRC Section 170, receiving immediate tax benefits averaging 37% of contribution amount for highest-bracket donors. Taxpayer funds through government grants provide additional foundation funding with favorable tax treatment.

Step 2: Pass-Through Foundation Network

Elite funding moves through 501(c)(3) charitable organizations that receive tax-deductible donations while maintaining what appear to be coordinated relationships through shared infrastructure. At this stage, donors have already received their charitable deductions, but money has not yet reached political operations.

Step 3: The Conversion Question – 501(c)(3) to 501(c)(4) Transfers

Money systematically transfers to 501(c)(4) organizations that can engage in unlimited political activity. This raises significant questions: If donors had contributed directly to 501(c)(4) organizations, they would receive NO tax deduction. The 501(c)(3) to 501(c)(4) transfer structure raises questions about whether donors are effectively claiming tax benefits for what becomes political activity funding through what appears to be a form of tax arbitrage that may convert charitable deductions into political power.

Step 4: PACs and Direct Campaign Support

Funds flow to political committees supporting specific candidates. The charitable tax benefits obtained in Step 1 appear to have systematically converted to direct political campaign support, while voters remain unaware of the funding pipeline. The patterns suggest possible coordination through what may be concealment from federal tax authorities, with entities appearing to deny relationships on Schedule R while admitting coordination elsewhere in the same filings.

Step 5: Policy Feedback Loop

Elected officials support policies benefiting the funding network, potentially completing the cycle and ensuring continued resource flows.

The Tax Arbitrage Question:

To understand the potential significance, consider a $1 million contribution:

- Direct to 501(c)(4): Donor pays $1M, receives $0 tax benefit, $1M reaches political operations

- Through 501(c)(3) to 501(c)(4) conversion: Donor pays $1M, receives $370K tax deduction (37% bracket), $1M still reaches political operations through transfer

- Net difference: Same political impact, $370K lower cost to donor, $370K cost potentially shifted to taxpayers

When this appears to operate systematically across $13M+ in a single channel and $25M+ across six channels, the patterns raise questions about tens of millions in potential tax benefit conversions.

Channel 6: The Bend the Arc Pattern

The September 26, 2025 Politico report that “Bend the Arc Jewish Action is endorsing Queens Assemblyman Zohran Mamdani for mayor — the first time the advocacy group has backed a candidate in a mayoral race” provides an opportunity to examine organizational relationships that raise significant questions.

Step-by-Step Channel 6 Analysis

Steps 1-2: Foundation Input and Pass-Through Network

Federal tax filings reveal a multi-year pattern of Foundation to Promote Open Society (501(c)(3)) support to Bend the Arc: A Jewish Partnership for Justice (501(c)(3)):

Historical Foundation Support (2018-2024): $1,533,500

- 2024: $100,000 (Open Society Grants Database)

- 2023: $200,000 (2023 IRS Form 990-PF, Section XIV)

- 2020: $1,033,500 (2020 IRS Form 990-PF, Section XIV)

- 2018: $200,000 (Open Society Grants Database)

These tax-deductible charitable contributions establish what appears to be a foundation layer, creating favorable tax treatment for initial funding while positioning resources for potential transformation across multiple years.

Step 3: The Transformation Pattern – Multi-Year Systematic Relationships

Federal tax filings reveal what appears to be persistent three-year bidirectional flows between related organizations:

2023 Bi-Directional Flows: $3,809,977

- $1,000,000 grant from Bend the Arc: A Jewish Partnership for Justice (501(c)(3) charitable organization) to Bend the Arc Jewish Action (501(c)(4) political advocacy organization)

- $1,538,473 reimbursement from 501(c)(4) political advocacy organization to 501(c)(3) charitable organization

- $1,271,504 reimbursement from 501(c)(3) charitable organization to 501(c)(4) political advocacy organization

- Source: 2023 Bend the Arc Jewish Action Form 990 Schedule R, Part V

2022 Bi-Directional Flows: $3,636,274

- $2,000,000 grant from 501(c)(3) charitable organization to 501(c)(4) political advocacy organization

- $1,636,274 reimbursement from 501(c)(4) political advocacy organization to 501(c)(3) charitable organization

- Source: 2022 Bend the Arc Jewish Action Form 990 Schedule R, Part V

2021 Bi-Directional Flows: $4,033,698

- $1,533,698 in loans from 501(c)(3) charitable organization to 501(c)(4) political advocacy organization

- $2,500,000 grant from 501(c)(3) charitable organization to 501(c)(4) political advocacy organization

- Source: 2021 Bend the Arc Jewish Action Form 990 Schedule R, Part V

Three-Year Total Bi-Directional Flows: $11,479,949

Total Channel 6 Pattern: $13,013,449+ (Foundation input plus internal flows)

This multi-year pattern raises questions about whether these represent isolated compliance issues or systematic multi-year coordination. Federal tax filings document these transformations using “fair value” methodology, raising questions about charitable-to-political conversion that may enable unlimited political activity while the organizations maintain they operate separately despite their related status.

The Balance Sheet Smoking Gun: Circular Funding Discovery

The most significant breakthrough in Channel 6 analysis comes from a forensic examination of balance sheet data that reveals what appears to be sophisticated circular funding—a pattern that raises questions about whether reported “loans” are actually disguised grants designed to create the appearance of arm’s length transactions.

The Critical Discovery: Perfect Mathematical Match

Federal tax filings reveal a pattern that challenges conventional accounting explanations. Bend the Arc: A Jewish Partnership for Justice (501(c)(3) charitable organization)’s 2021 Form 990 balance sheet (Part X, Line 4) shows:

- Accounts Receivable (End of Year): $1,533,698

This amount exactly matches the $1,533,698 in “loans” that Bend the Arc: A Jewish Partnership for Justice (501(c)(3)) reported making to Bend the Arc Jewish Action (501(c)(4)) in the same year’s Schedule R, Part V.

The Devastating Three-Year Balance Sheet Proof

Tracking the 501(c)(3) charitable organization’s accounts receivable across three years reveals the smoking gun that transforms this from a pattern into mathematical proof of circular funding. If the 501(c)(4) political organization’s “reimbursements” were genuinely repaying the loans, the accounts receivable balance should have dropped to near zero. Instead:

2021 Balance Sheet (Bend the Arc: A Jewish Partnership for Justice (501(c)(3))):

- Beginning of year accounts receivable: $850,559

- End of year accounts receivable: $1,533,698

- This exactly matches the $1,533,698 in “loans” reported to the 501(c)(4) political organization

- Source: 2021 IRS Form 990

2022 Balance Sheet (Bend the Arc: A Jewish Partnership for Justice (501(c)(3))):

- Beginning of year accounts receivable: $1,533,698

- 501(c)(4) political organization makes $1,636,274 in “reimbursements” during the year

- End of year accounts receivable: $1,636,274

- The Mathematical Impossibility: If the $1,636,274 reimbursement simply paid down the beginning receivable of $1,533,698, the ending balance should be negative $102,576 (meaning the 501(c)(3) charitable organization would owe money to the 501(c)(4) political organization). Instead, the ending receivable is $1,636,274—exactly matching the reimbursement amount

- What this proves: To produce an ending balance of $1,636,274, the 501(c)(3) charitable organization must have created approximately $1,738,850 in NEW charges/receivables to the 501(c)(4) political organization during 2022—while simultaneously receiving the $1,636,274 “reimbursement.” The exact matching of the ending receivable ($1,636,274) to the reimbursement payment ($1,636,274) demonstrates engineered maintenance of a constant debt balance

- The circular funding mechanism: The 501(c)(3) charitable organization makes a $2,000,000 grant to the 501(c)(4) political organization in 2022, which enables the 501(c)(4) to pay $1,636,274 in “reimbursements” back to the 501(c)(3), while the 501(c)(3) simultaneously bills approximately $1,738,850 in new charges, maintaining a perpetual receivable balance of roughly $1.5-1.6M

- Source: 2022 IRS Form 990

2023 Balance Sheet (Bend the Arc: A Jewish Partnership for Justice (501(c)(3))):

- Beginning of year accounts receivable: $1,636,274

- End of year accounts receivable: $1,538,473

- Still virtually identical to the original 2021 loan amount of $1,533,698

- Source: 2023 IRS Form 990

The Mathematical Impossibility:

If Bend the Arc Jewish Action (501(c)(4) political organization) genuinely repaid $1,636,274 to Bend the Arc: A Jewish Partnership for Justice (501(c)(3) charitable organization) in 2022, the 501(c)(3)’s accounts receivable should have dropped from $1,533,698 to approximately zero. Instead, the receivable balance increased to $1,636,274 and remained at virtually the same level ($1,538,473) through 2023.

This three-year balance sheet tracking provides irrefutable evidence: the “reimbursements” from the 501(c)(4) political organization to the 501(c)(3) charitable organization never paid down the loan. The receivable persisted at roughly the same level across all three years. These cannot be genuine loan repayments—the balance sheet mathematics make that impossible.

The only explanation consistent with these numbers is circular funding: grant money flowing out, “reimbursements” flowing back that don’t reduce the receivable, and new grants flowing out again—all while the same accounts receivable balance remains on the books year after year.

Both entities share the same CEO (Jamie Beran, paid $206,199 by the charitable organization), the same address (266 W 37th St Suite 803), and operate under written cost-sharing agreements. The same management team controls both sides of these circular transactions. Both organizations are classified as “related organizations” on IRS Schedule R—entities required to disclose their relationship due to shared control, finances, or governance.

Despite being related organizations, they claim to operate independently by answering “No” when asked if they share employees on Schedule R, while simultaneously admitting extensive staff sharing through cost-sharing agreements in Schedule O within the same returns. This internal contradiction across multiple tax years raises questions about whether the employee-sharing denials on Schedule R accurately reflect the operational reality documented elsewhere in their own filings.

Steps 4-5: Political Output and 72-Hour Infrastructure Activation

The September 26, 2025 endorsement was followed by immediate professional political infrastructure deployment, raising questions about systematic coordination capacity:

September 26, 2025 (Day 1): Bend the Arc Jewish Action (501(c)(4)) endorses Zohran Mamdani for NYC Mayor – first-ever mayoral endorsement by the organization (Politico New York Playbook)

September 26, 2025 (Same Day): Active fundraising campaign launched at bendthearc.us/new_year_new_mayor_zohran_mamdani

September 29, 2025 (72 Hours Later): Professional campaign training event organized via Mobilize.us platform (Event #848565) addressing “concerns about Mamdani’s candidacy”

The temporal precision—from endorsement to fundraising to organized training within 72 hours—raises questions about whether this represents pre-existing infrastructure rather than spontaneous grassroots activity.

The endorsement specifically cites Mamdani’s positions on affordable housing, immigration, and economic justice—policy areas that could benefit the organizational network through increased government funding and regulatory positioning. CEO Jamie Beran, paid $206,199 by the 501(c)(3) charitable organization, speaks for the 501(c)(4) political organization in making this decision, raising questions about how shared management may enable coordinated political decision-making while maintaining legal separation (2023 A Jewish Partnership for Justice Form 990 Schedule J, Part II).

Network Integration: Channel 6 as Pattern Validation

The Bend the Arc pipeline represents Channel 6 in the systematic coordination network documented in our comprehensive investigation spanning multiple submissions:

Previously Documented Channels (Submissions 1-7):

- Channel 1: Direct Political Pipeline ($5.15 million in George Soros funding)

- Channel 2a: Direct Charitable Conversion ($4.56 million systematic conversion)

- Channel 2b: Indirect Charitable Conversion ($430,000 distributed mechanisms)

- Channel 3: Government-Subsidized Infrastructure ($52+ million taxpayer funding)

- Channel 4: Make the Road Circuit (dual-track coordination)

- Channel 5: Center for Popular Democracy Pipeline (national network)

Channel 6 Pattern Similarities:

- Same Funding Source: Foundation to Promote Open Society appears in Channels 2a, 2b, and 6

- Same Conversion Pattern: 501(c)(3) to 501(c)(4) transformation in all channels

- Same Reporting Patterns: Schedule R questions across all channels

- Same Operational Integration: Shared management and infrastructure across all channels

- Same Multi-Year Persistence: Systematic patterns across multiple tax years

- Same Political Outcomes: Measurable electoral impact across all channels

Enhanced Network Totals (All Six Channels):

- Direct Coordination Flows: $25+ million across all documented channels

- Cumulative Pattern: $1.75+ billion in systematic relationships

- Channel 6 Contribution: $13+ million provides additional pattern validation

The systematic consistency across six independent channels raises questions about coincidence versus coordinated methodology operating across multiple organizational networks. The scale suggests this extends far beyond isolated compliance issues.

December 2024 Validation and Continuing Operations

The accuracy of this systematic coordination analysis gained additional validation through December 2024 Federal Election Commission filings documented in our previous investigation showing a $2 million redistribution from Working Families Organization (501(c)(4)) to Working Families Party PAC—occurring as predicted by the coordination analysis.

This redistribution raised questions about whether 501(c)(4) organizations receiving charitable funds through systematic patterns serve as active political coordination hubs rather than independent grassroots operations, providing some validation for the methodology used to identify Channel 6 through the Bend the Arc pipeline.

The temporal progression from 2021-2023 financial infrastructure through 2024 redistribution to 2025 political endorsements raises questions about whether these represent continuing operations rather than historical compliance issues.

The NYC Regulatory Gap Question

The Mamdani endorsement illuminates questions about regulatory frameworks. Under current New York City campaign finance regulations, contributions from 501(c)(4) organizations like Bend the Arc Jewish Action are not classified as traditional campaign contributions, raising questions about regulatory treatment where charitable tax benefits may systematically convert into political influence without triggering standard campaign finance limitations. Most significantly, voters researching Mamdani’s support see “Bend the Arc Jewish Action endorsement” but cannot readily discover the $11.5 million multi-year coordination pipeline or the circular funding patterns between these related organizations—while the entities themselves maintain contradictory statements about employee sharing in their federal tax filings.

This raises questions about potential incentives:

- Tax Benefit Conversion: Wealthy donors make tax-deductible contributions to 501(c)(3) organizations

- Systematic Transfer: 501(c)(3) charitable organizations transfer funds to 501(c)(4) affiliates across multiple years

- Circular Funding: Pattern suggests loans may be disguised grants repaid with grant money in coordinated cycle

- Political Activity: 501(c)(4) organizations engage in unlimited political activity

- Regulatory Treatment: Activity may avoid campaign finance disclosure and limitation requirements

- Appearance Management: Systematic coordination may maintain appearance of independent grassroots activity

The mathematical precision of the coordination patterns across six channels and multiple years, combined with the circular funding discovery, raises questions about whether this represents systematic enterprise designed to utilize these regulatory frameworks.

Conclusion: When Forensic Accounting Exposes Systematic Coordination

The September 26, 2025 Bend the Arc endorsement of Zohran Mamdani validates what three years of balance sheet analysis revealed: systematic coordination between related organizations operating through sophisticated financial engineering. When accounts receivable persist at $1.5M across three years despite alleged “repayments,” when $1,738,850 in new charges materialize to maintain constant debt balances, and when political infrastructure activates within 72 hours of endorsement—the patterns demonstrate coordination rather than coincidence.

This represents the sixth documented channel using identical methodology to convert charitable tax benefits into political operations. The systematic consistency across $25+ million in coordinated flows raises questions regulatory frameworks designed for arm’s length transactions cannot address: When related organizations sharing CEOs, addresses, and payroll systems maintain legal separation while achieving operational coordination, when charitable deductions systematically convert to political power through 501(c)(3) to 501(c)(4) transfers, and when voters see “grassroots endorsements” while forensic accounting reveals multi-million dollar coordination pipelines between related entities—democratic transparency faces fundamental challenges.

The implications extend beyond New York. If sophisticated transaction engineering between related organizations can maintain the appearance of separate operations while achieving systematic coordination—if balance sheets can reveal circular funding invisible to campaign finance systems—then the infrastructure of democratic participation requires examination at the intersection of tax law, campaign finance regulation, and organizational governance.

This investigation builds on comprehensive analysis documented in nine IRS whistleblower submissions and previous systematic coordination investigations. All source documentation is available for independent verification through inline links to federal tax filings, FEC records, and campaign finance disclosures.

Follow @SamAntar on X for updates on this investigation

Written by Sam Antar | Forensic Accountant & Fraud Investigator

© 2025 Sam Antar. All rights reserved.