When You Can’t Refute the Evidence, Attack the Messenger: Lawfare’s Failed Defense of Letitia James

THE TELL: WHEN LEGAL EXPERTS RESORT TO CHARACTER ASSASSINATION

One day after New York Attorney General Letitia James was indicted on federal bank fraud charges, Lawfare—a publication that bills itself as providing rigorous legal analysis—published their take on the case.

They called it “dangerously weak.”

But buried in their analysis was something far more revealing than their legal arguments. Molly Roberts, a senior editor at Lawfare and former member of The Washington Post’s editorial board who covers legal affairs, wrote:

“Sam Antar, the convicted felon and former certified public accountant who carried out a massive securities scam in the 1980s and has now transformed himself into a muckracking ‘fraud expert,’ surfaced many of the documents now at the center of the James investigation.”

Note the scare quotes around “fraud expert.” Not just identifying my background—actively mocking my expertise.

Lawfare’s dismissiveness didn’t stop there. Later in the article, they described the financial disclosures as documents I had “trawled up”—as if reading mandatory public ethics filings that James was legally required to submit constitutes desperate evidence-hunting.

These aren’t obscure documents buried in some archive. They’re official annual disclosures available on the New York State Commission on Ethics and Lobbying in Government website. Every elected official in New York files them. Calling basic document review “trawling” reveals everything: when you can’t refute the evidence, you attack the process of finding it.

When a legal publication attacks the messenger instead of addressing the evidence, that’s not analysis. That’s admission.

Let me address this directly, then show you exactly why Lawfare had no choice but to attack me personally.

YES, I’M A CONVICTED FELON. THAT’S WHY I KNOW FRAUD WHEN I SEE IT.

I was the CFO of Crazy Eddie, Inc. I helped mastermind one of the largest securities frauds of the 1980s. I helped my family defraud investors out of over $500 million. I was caught, prosecuted, convicted, and I served my time.

I’ve been transparent about this for over 30 years—in over 1,000 interviews, speaking appearances at more than 100 colleges and universities, and in plain sight on my website. I don’t rationalize what I did. I own it completely.

That history is precisely why I’m qualified to identify fraud.

I was a Certified Public Accountant who scored in the top 1% on the CPA exam. While I no longer hold my license, I’ve taught over 20,000 CPAs who received continuing professional education (CPE) credits from my lectures on fraud detection. I understand fraud because I committed it. I know how fraudsters think because I was one. I know what fraud looks like in documents because I created fraudulent documents. I know the techniques, the schemes, the patterns—and I know them because I used them.

For three decades, federal prosecutors, the FBI, the SEC, and major corporations have used my expertise precisely because of—not despite—my past.

But here’s what Lawfare desperately hopes you won’t notice:

Every document I cited is a public record.

- The Second Home Rider? Public record in Virginia land records.

- The NY State financial disclosures? Public records on the NY State Ethics Commission website.

- The federal indictment? Public court document.

Documents don’t lie. And they don’t care who finds them.

So why would Lawfare attack my character instead of refuting the evidence?

Because they can’t refute it.

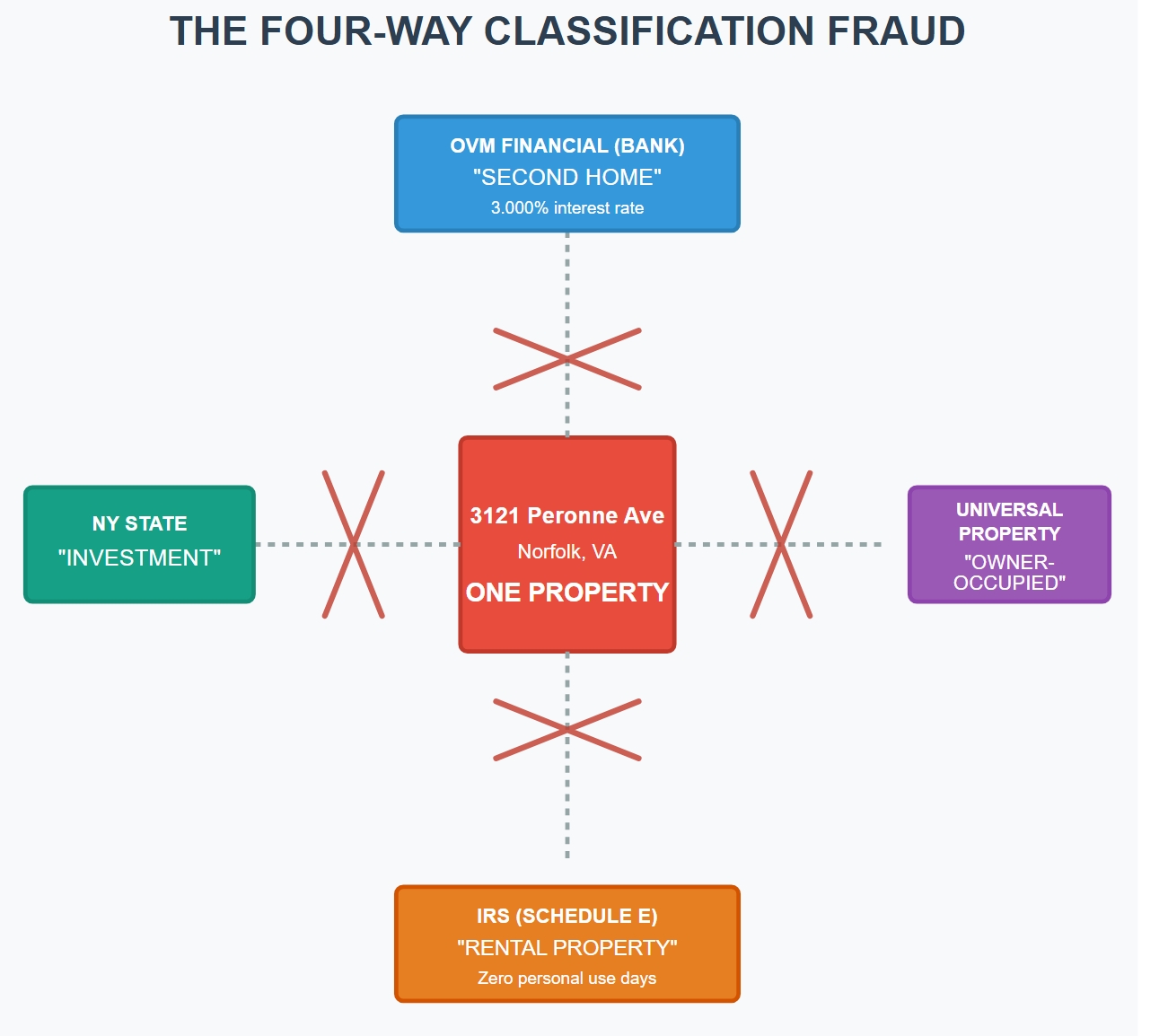

THE DOCUMENTS: FOUR CONTRADICTORY SWORN STATEMENTS

On October 9, 2025, a federal grand jury indicted Letitia James on bank fraud and false statements charges related to a Norfolk, Virginia property she purchased in August 2020.

The indictment alleges something straightforward: James made four different representations about the same property to different entities—all under penalty of perjury or with binding legal consequences.

To OVM Financial (Bank) – August 17, 2020:

- Signed a Second Home Rider declaring under penalty of perjury

- “Borrower will occupy and use the Property as Borrower’s second home”

- “Borrower will maintain exclusive control over the occupancy of the Property”

- Interest rate: 3.000% (instead of 3.815% for investment properties)

- Savings: approximately $18,933 over the life of the loan

To Universal Property (Insurance) – 2020:

- Paragraph 9 of indictment: Application indicated “owner-occupied non-seasonal use“

To IRS (Tax Returns) – 2020-2024:

- Paragraph 10 of indictment: Schedule E forms filed under penalties of perjury

- Property treated as “rental real estate“

- Reported “zero personal use days“

- Reported “thousand(s) of dollars in rents received“

- Claimed deductions for expenses

To NY State (Financial Disclosures) – 2020-2024:

- Property classified as “Investment“

- Reported $1,000-$5,000 rental income in 2020

- Reported $0 income for 2021-2024

You cannot occupy a property as your “second home” with “exclusive control” while simultaneously reporting “zero personal use days” and treating it as “rental real estate.”

You cannot tell insurance it’s “owner-occupied” while telling the IRS you never personally used it.

Four sworn statements to different entities. At least three must be false.

That’s the case. Now watch how Lawfare tries to explain it away.

LAWFARE’S FATAL ERROR: REWRITING CONTRACT LAW

Lawfare’s most spectacular failure is their interpretation of the Second Home Rider. Roberts—a journalist with no law degree—writes:

“But prosecutors don’t even bother to allege she ever entered into such an arrangement. All they allege is that she rented out the property, and that she didn’t personally use it. That behavior, the rider doesn’t prohibit.”

This is so wrong it would make every second home mortgage meaningless.

Here’s what the Second Home Rider actually requires:

“Borrower will occupy and use the Property as Borrower’s second home. Borrower will maintain exclusive control over the occupancy of the Property, including short-term rentals, and will not subject the Property to any timesharing or other shared ownership arrangement or to any rental pool or agreement that requires Borrower either to rent the Property or give a management firm or any other person or entity any control over the occupancy or use of the Property. Borrower will keep the Property available primarily as a residence for Borrower’s personal use and enjoyment for at least one year after the date of this Second Home Rider.”

Now read Lawfare’s interpretation: renting out the property and not personally using it “the rider doesn’t prohibit.”

The rider explicitly requires:

- “Occupy and use” the property as your second home

- “Maintain exclusive control over the occupancy”

- Keep it “available primarily as a residence for Borrower’s personal use”

James told the IRS she had “zero personal use days.”

That’s not “occupy and use.” That’s the exact opposite.

Under Lawfare’s logic, any borrower could:

- Sign a Second Home Rider to get a lower rate

- Rent it out full-time

- Never use it personally

- Report “zero personal use days” to the IRS

- Claim it’s still a “second home”

That’s absurd. It would render the entire Second Home Rider—and the interest rate distinction—meaningless.

LAWFARE’S “AVAILABLE” LOOPHOLE THAT DOESN’T EXIST

Lawfare then compounds the error with an even more creative misreading. Roberts—remember, not a lawyer—writes:

“On the contrary, it explicitly allows short-term renting during the first year according to certain conditions. One of those conditions does concern occupancy: The home must be ‘available primarily as a residence for [her] personal use’—but only available. James need not actually have used it.”

This is legal malpractice dressed up as analysis.

Let’s break down why this interpretation is absurd:

Claim 1: “It explicitly allows short-term renting during the first year”

The rider says: “Borrower will maintain exclusive control over the occupancy of the Property, including short-term rentals.”

Lawfare reads this as permission to rent out the property. But that’s backwards. The phrase “including short-term rentals” means that even during any short-term rentals, the borrower must maintain exclusive control.

It’s a restriction, not a permission slip.

The rider is saying: “You maintain exclusive control at all times—even if you do short-term rentals, YOU control them, not a management company or tenant.”

Claim 2: “‘Available’ means she doesn’t need to actually use it”

This is where Lawfare’s interpretation becomes farcical.

The Second Home Rider doesn’t just say “available.” It says:

“Borrower will occupy and use the Property as Borrower’s second home. Borrower will maintain exclusive control over the occupancy of the Property, including short-term rentals, and will not subject the Property to any timesharing or other shared ownership arrangement or to any rental pool or agreement that requires Borrower either to rent the Property or give a management firm or any other person or entity any control over the occupancy or use of the Property. Borrower will keep the Property available primarily as a residence for Borrower’s personal use and enjoyment for at least one year after the date of this Second Home Rider.”

Notice there are two separate requirements:

- “Borrower will occupy and use the Property” – This is a direct requirement to OCCUPY and USE

- “Keep the Property available primarily as a residence for Borrower’s personal use” – This is an additional requirement that it remain available for that purpose

Lawfare cherry-picks the word “available” from the second requirement while completely ignoring the first requirement to “occupy and use.”

You cannot satisfy a requirement to “occupy and use” a property by simply making it “available.”

That’s like saying a requirement to “drive a car” is satisfied by parking it in your garage. The words “occupy” and “use” have meanings. They require action, not passive availability.

Moreover, James reported “zero personal use days” to the IRS.

Under Lawfare’s interpretation:

- James could rent it out 365 days a year

- Never set foot in it personally

- Report “zero personal use days” to the IRS

- And still claim she “occupied and used” it as her second home

That’s not contract interpretation. That’s contract elimination.

The “available” requirement is about PRIMARY purpose, not actual use:

The rider says the property must be “available primarily as a residence for Borrower’s personal use.”

If you’re renting it out and treating it as a rental property (reporting rental income, claiming rental deductions, reporting zero personal use), then it’s NOT available “primarily” for your personal use. Its primary purpose is income generation.

Lawfare’s interpretation would gut every second home mortgage:

If “available” means you never have to actually use it, and “occupy” is satisfied without occupancy, then:

- Every investor could claim “second home” status

- Get the lower interest rate

- Rent it out full-time

- Never use it personally

- Report it as rental property on taxes

- And banks could never prove fraud

The entire second home vs. investment property distinction—and the 0.815% interest rate difference—would be meaningless.

This isn’t what the law allows. This is what Lawfare wishes the law allowed so they could defend James.

SECTION B: THE CONTRACT EXPLICITLY DEFINES THIS AS MATERIAL FRAUD

Here’s what Lawfare really doesn’t want you to see. The Second Home Rider contains Section B, titled “Borrower’s Loan Application”:

“Borrower shall be in default if, during the Loan application process, Borrower or any persons or entities acting at the direction of Borrower or with Borrower’s knowledge or consent gave materially false, misleading, or inaccurate information or statements to Lender (or failed to provide Lender with material information) in connection with the Loan. Material representations include, but are not limited to, representations concerning Borrower’s occupancy of the Property as Borrower’s second home.“

Read that again.

The contract James signed explicitly states that representations about occupancy as a second home are MATERIAL.

This obliterates Lawfare’s entire argument that:

- The rules are “squishy”

- It’s unclear what constitutes a violation

- Proving materiality will be difficult

The borrower agreed—under penalty of perjury—that occupancy representations are material.

James signed this. She agreed to these terms. She acknowledged that false statements about occupancy would constitute default.

Then, according to the indictment:

- She reported “zero personal use days” to the IRS

- She told insurance it was “owner-occupied”

- She treated it as rental property on tax returns

- She reported it as “investment” to NY State

The contract she signed defines this as material fraud. Not the prosecutor. Not a judge. THE CONTRACT ITSELF.

Lawfare completely ignores Section B. Why? Because it proves that James explicitly agreed that misrepresenting occupancy is material—eliminating any defense that the rules were unclear or that she didn’t understand the significance of her representations.

When you sign a contract that says “representations about occupancy are material,” you can’t later claim you didn’t know occupancy mattered.

Lawfare then compounds the error by claiming the rider “explicitly allows short-term renting during the first year.”

False. The rider says the property must be “available primarily as a residence for Borrower’s personal use and enjoyment.” That’s a requirement, not a loophole.

This isn’t a close call. It’s legal malpractice masquerading as analysis.

WHAT LAWFARE BURIED: PARAGRAPH 9 AND THE FOUR-WAY FRAUD

Just like The New York Times before them, Lawfare completely ignores Paragraph 9 of the indictment.

Not a single word analyzing James’s insurance application claiming the property was “owner-occupied non-seasonal use.”

Why the silence?

Because Paragraph 9 proves this wasn’t an innocent misunderstanding about “squishy” mortgage rules. It was systematic fraud.

James told:

- The bank: “Second home” (for 3.000% interest rate)

- The insurance company: “Owner-occupied” (for lower premiums)

- The IRS: “Rental property, zero personal use” (for maximum deductions)

- NY State: “Investment” with varying income reports

She told each entity exactly what they wanted to hear to maximize financial benefits.

That’s not confusion about guidelines. That’s deliberate misrepresentation for financial gain.

Lawfare can’t acknowledge Paragraph 9 because it destroys their “weak case” narrative. You can’t call a case weak when there are four contradictory sworn statements to different institutions.

THE “ZERO PERSONAL USE DAYS” SMOKING GUN

Lawfare also completely ignores that James reported “zero personal use days” on her Schedule E tax forms.

This creates an inescapable trap:

- If she accurately reported zero personal use days → She violated the Second Home Rider (mortgage fraud)

- If she actually used it personally → She filed false tax returns (tax fraud)

There is no third option.

You cannot tell a bank “I will occupy this as my second home” while simultaneously telling the IRS “zero personal use days.”

One of these statements must be false. Either the mortgage application was fraudulent, or the tax returns were fraudulent.

Lawfare’s complete omission of this issue isn’t an oversight. It’s avoidance.

THE “SQUISHY RULES” DEFENSE THAT ISN’T

Throughout the article, Lawfare claims Fannie Mae guidelines are too “squishy” to support criminal charges.

But read the Second Home Rider requirements:

- “Borrower will occupy and use the Property as Borrower’s second home“

- “Borrower will maintain exclusive control over the occupancy“

- “Available primarily as a residence for Borrower’s personal use“

These aren’t ambiguous.

“Exclusive control” doesn’t mean “someone else lives there full-time.”

“Occupy and use” doesn’t mean “zero personal use days.”

“Personal use” doesn’t mean “rental property.”

The only thing “squishy” here is Lawfare’s attempt to rewrite plain English.

THE INTENT STANDARD: LAWFARE GETS IT BACKWARDS

Lawfare claims proving James’s intent to defraud will be difficult because the rules are ambiguous.

But when you make four contradictory sworn statements to different entities, that IS proof of intent.

It proves:

- Deliberate misrepresentation – She told each entity what they wanted to hear

- Financial motive – Lower rate, lower premiums, maximum deductions

- Sophisticated knowledge – As AG, she understood legal classifications

- Systematic pattern – This wasn’t one mistake, it was a scheme

You don’t accidentally tell four different stories under penalty of perjury.

WHY THE PERSONAL ATTACK? BECAUSE THE DOCUMENTS ARE DEVASTATING

Now we return to Lawfare’s attack on my credibility.

Molly Roberts—a journalist and editor who has never prosecuted a fraud case, never conducted a forensic accounting investigation, and holds no law license—called me a “convicted felon” and a “muckracking ‘fraud expert'”—complete with scare quotes to suggest my expertise is somehow illegitimate.

This is a textbook ad hominem fallacy: attack the person when you can’t refute the argument.

But notice what the scare quotes reveal: Roberts isn’t just noting my criminal history. She’s actively trying to delegitimize my expertise—to make readers dismiss the evidence because of who found it.

The irony is remarkable: a journalist with no law degree and no forensic accounting background mocking someone who has:

- Cooperated extensively with federal prosecutors, the FBI, and the SEC

- Trained over 10,000 CPAs in fraud detection through CPE-accredited courses

- Testified as an expert witness in fraud cases

- Been used by major corporations and law enforcement for three decades

But here’s what she can’t attack:

- The Second Home Rider is a public document

- The indictment is a public document

- The NY State disclosures are public documents

- The requirements are written in plain English

If Lawfare could explain how James’s four contradictory sworn statements are all consistent with the law, they would have.

Instead, they attacked the person who found the documents.

That’s not legal analysis. That’s desperation.

CONCLUSION: DOCUMENTS DON’T LIE

Lawfare wants you to believe this is a “dangerously weak” case based on “squishy” guidelines.

But the evidence isn’t squishy. It’s documentary:

| Entity | What James Swore | Legal Consequence | Benefit |

|---|---|---|---|

| Bank | “Second home, exclusive control” | Penalty of perjury | $18,933 savings |

| Insurance | “Owner-occupied” | Binding representation | Lower premiums |

| IRS | “Rental property, zero personal use” | Penalty of perjury | Maximum deductions |

| NY State | “Investment, $0 income” | Penalty of perjury | Minimal disclosure |

Four sworn statements. At least three must be false.

Lawfare had two choices:

- Explain how these four contradictory sworn statements are all legally consistent

- Attack the credibility of the person who found them

They chose option 2.

That tells you everything you need to know about the strength of their legal analysis.

When legal experts can’t refute the evidence, they attack the messenger.

When they misread basic contract language to reach absurd conclusions, it’s not analysis—it’s advocacy.

When they ignore entire paragraphs of the indictment, it’s not oversight—it’s avoidance.

The documents speak for themselves.

And they don’t care who finds them—or what that person’s background is.

Written by Sam Antar

Forensic Accountant & White Collar Fraud Investigator

Yes, I’m a convicted felon. That’s exactly why I know fraud when I see it.

Follow @SamAntar on X

© 2025 Sam Antar. All rights reserved.