The One Year POLITICO Forgot to Check

Three words in Letitia James’s mortgage contract could doom the fraud case against her, according to POLITICO.

Three legal experts agreed: the phrase “including short-term rentals” meant James was permitted to rent the Norfolk property to her grandniece Thompson. The indictment is doomed.

There was just one problem.

Nobody checked what happened during the mandatory first year.

THE TWELVE MONTHS THAT MATTER

On August 17, 2020, Letitia James signed a Second Home Rider to obtain a Fannie Mae-backed mortgage for 3121 Peronne Avenue in Norfolk, Virginia. Buried in that contract was this requirement:

“Borrower will keep the Property available primarily as a residence for Borrower’s personal use and enjoyment for at least one year after the date of this Second Home Rider.”

One year.

From August 17, 2020 through August 17, 2021.

During these twelve months, James had to establish that she was using this property as her second home. Not after the first year. Not eventually. During the mandatory compliance period.

So what did Letitia James do during those critical twelve months?

WHAT THE INDICTMENT ALLEGES

According to paragraph 7 of the federal indictment:

“Despite these representations, the Peronne Property was not occupied or used by JAMES as a secondary residence and was instead used as a rental investment property, renting the property to a family of (3).”

Not after the first year. From the beginning.

James’s grandniece, Nakia Thompson, and her children moved in. During the exact period when James had sworn she would “keep the Property available primarily as a residence for [her] personal use and enjoyment.”

The indictment doesn’t allege James violated the contract after establishing compliance. It alleges she never complied at all.

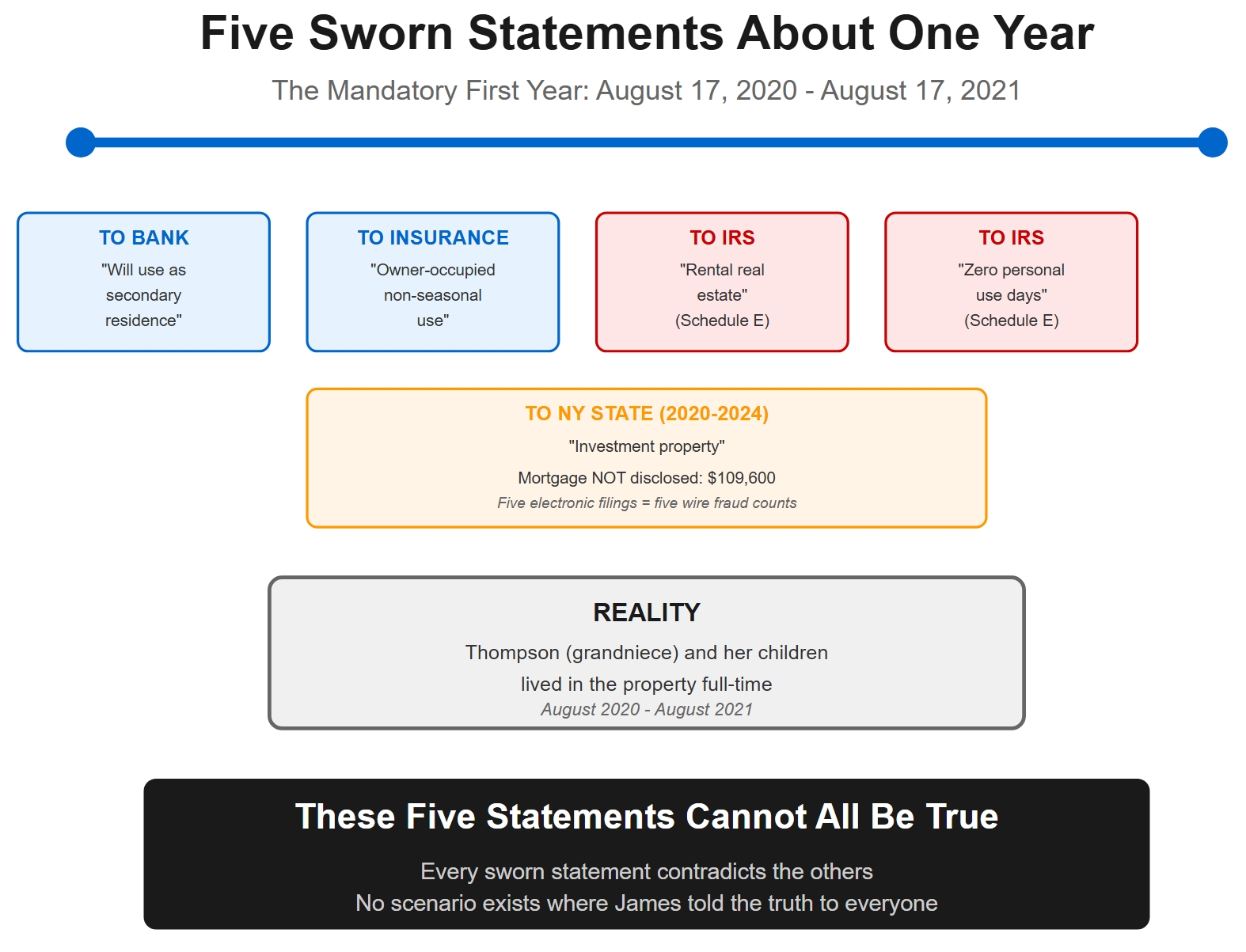

FIVE SWORN STATEMENTS ABOUT ONE YEAR

During or immediately after the mandatory first year, James made five different sworn statements to four different entities about how she used the property. Here’s what she told each:

| When | To Whom | James’s Statement About First Year | Source |

|---|---|---|---|

| August 17, 2020 | Bank (OVM Financial) | “Will occupy and use the property as her secondary residence” | Indictment ¶6 |

| August 2020 | Universal Property Insurance | “Owner-occupied non-seasonal use” | Indictment ¶9 |

| April 2021 | IRS (2020 Schedule E) | “Zero personal use days” + rental real estate | Indictment ¶10 |

| 2020-2024 | NY State (Financial Disclosure) | “Investment property” (mortgage not disclosed) | FDS filings |

| Aug 2020 – Aug 2021 | Reality | Thompson (grandniece) and children lived there full-time | Indictment ¶7 |

Five different accounts of the same twelve months. These statements cannot all be true.

THE INSURANCE MISREPRESENTATION

In August 2020—the same month James signed the Second Home Rider—she also applied for homeowner’s insurance. According to paragraph 9 of the indictment:

“JAMES’ Universal Property application for homeowners’ insurance indicated ‘owner-occupied non-seasonal use,’ further misrepresenting the intended use of the property.”

“Owner-occupied non-seasonal use” represents year-round occupancy by the owner. But during that mandatory first year:

- Thompson occupied the property, not James

- James reported “zero personal use days” to the IRS for 2020

- James classified it as “rental real estate” on her Schedule E

The indictment explicitly calls this a misrepresentation. Federal prosecutors don’t include insurance applications in fraud indictments unless the statements were material and false.

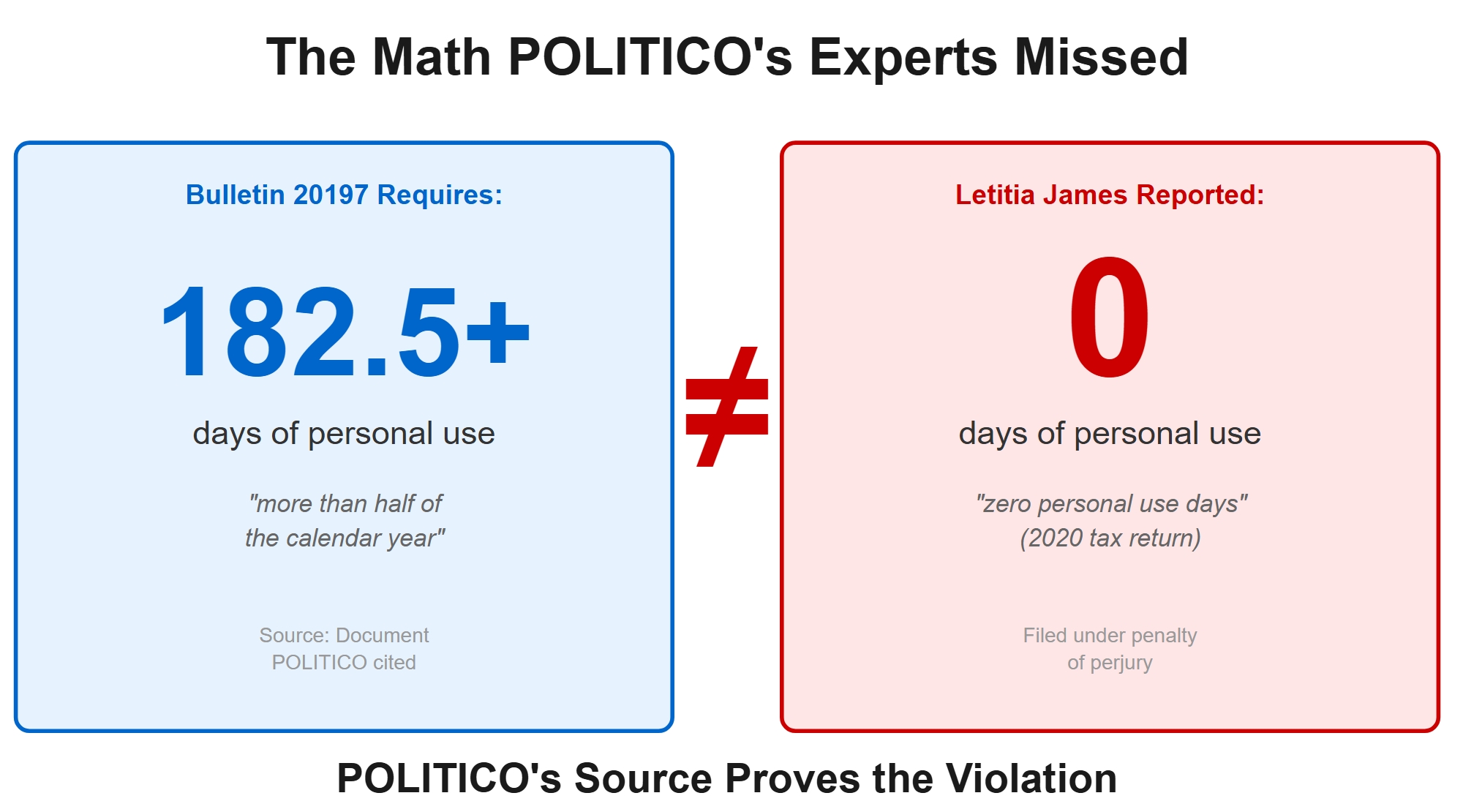

THE DOCUMENT POLITICO USED TO DEFEND JAMES

POLITICO didn’t just consult legal experts. They also relied on Freddie Mac Bulletin 20197 (April 3, 2019)—the official guidance that updated the Second Home Rider requirements.

From the POLITICO article:

“According to Freddie Mac’s 2019 guidance, that means keeping the home available for more than half of the year.”

POLITICO is citing Bulletin 20197, which states:

“Specify that the property may be rented out on a short-term basis provided that:

- The Borrower keeps the property securing the second home Mortgage available primarily (i.e., more than half of the calendar year) as a residence for the Borrower’s personal use and enjoyment; and

- The property is not subject to any rental pools or agreements that require the Borrower to rent the property, give a management company or entity control over the occupancy of the property or involve revenue sharing between any owners and developer or another party”

Let’s be clear about what this means:

| What Bulletin 20197 Requires | What James Actually Did (2020) | Result |

|---|---|---|

| Requirement 1: “Available primarily” = more than half of calendar year for borrower’s personal use | Reported “zero personal use days” to IRS | 0 days ≠ more than half the year (182.5 days) |

| Requirement 2: “Not subject to any rental pools or agreements that require the Borrower to rent the property” | Thompson (family) occupied full-time during mandatory first year | Full-time occupancy by family ≠ “short-term basis” |

| “For Borrower’s personal use and enjoyment” | Thompson (family) used the property, not James | No borrower personal use |

POLITICO cited the very document that defines TWO requirements James violated.

Bulletin 20197 Created the Second Home Rider James Signed

The bulletin explicitly states:

“Freddie Mac and Fannie Mae have revised the Multistate Second Home Rider-Single-Family – Fannie Mae/Freddie Mac Form 3890 (rev. 4/19).”

James’s Second Home Rider is Form 3890 (rev. 4/19)—the exact form revised by Bulletin 20197. The rider James signed on August 17, 2020 incorporated these requirements:

- Available primarily = more than half the year (per Bulletin 20197)

- For Borrower’s personal use = James’s actual use, not family occupancy

- Short-term rentals permitted = but not full-time occupancy by family

During the mandatory first year (August 2020 – August 2021):

- James reported zero personal use days

- Zero days is not “more than half of the calendar year”

- Thompson’s full-time occupancy is not “short-term”

POLITICO’s defense proves the violation.

WHAT JAMES TOLD THE IRS ABOUT THAT FIRST YEAR

In April 2021—covering the period August 17, 2020 through December 31, 2020—James filed her tax return. According to paragraph 10 of the indictment:

“JAMES filed Schedule E tax form(s), under penalties of perjury, treating the Peronne Property as rental real estate, reporting fair rental days, zero personal use days, thousand(s) of dollars in rents received, and claiming deductions for expenses relating to the property, further contradicting the second home classification.”

Read that again.

“Zero personal use days.”

Not “some” personal use days. Not “minimal” personal use days. Zero.

Filed under penalty of perjury.

For the tax year covering the mandatory first year when the Second Home Rider required her to keep the property “available primarily as a residence for [her] personal use and enjoyment.”

THE TRAP POLITICO’S EXPERTS WALKED INTO

Let’s accept everything POLITICO’s experts said. Let’s agree the Second Home Rider permits James to rent the property to Thompson.

Now here’s what POLITICO forgot to check.

When you rent a property to family members, the IRS has specific rules. From IRS Topic 415:

“A day of personal use of a dwelling unit is any day that the unit is used by: A member of your family or of a family of any other person who has an interest in it, unless the family member uses it as their main home and pays a fair rental price.”

Thompson is James’s grandniece. Family.

According to reporting cited by POLITICO, Thompson paid “$1,350 in rental income, which was paid to cover the cost of utilities” for 2020. Fair market rent in Norfolk was $1,400-$1,700 per month.

Under IRS rules, every single day Thompson occupied the property during that first year counts as James’s personal use day.

James reported: “zero personal use days.”

That’s not ambiguous contract interpretation. That’s a false statement under penalty of perjury.

HOW POLITICO’S DEFENSE PROVES MULTIPLE CRIMES

POLITICO’s three experts relied on Bulletin 20197 to defend James. But that same bulletin defines the standard she violated:

| Expert | Their Argument | What Bulletin 20197 Actually Says |

|---|---|---|

| Adam Levitin Georgetown Law |

“The contract language does not prohibit rentals.” | Permits rentals “on a short-term basis” IF “available primarily (i.e., more than half of the calendar year)” for borrower’s use. James reported zero days. Zero ≠ more than half. |

| Eric Forster Real Estate Expert |

“There’s nothing that says when you’re not using [the home] that it must be vacant.” | Bulletin permits short-term rentals, not full-time family occupancy during the mandatory first year. Thompson lived there full-time = not “short-term.” |

| Benjamin Klubes Former HUD Counsel |

“‘Available primarily’ doesn’t require actual use.” | Bulletin 20197 explicitly defines “available primarily” as “more than half of the calendar year” for borrower’s personal use. James reported zero personal use days for 2020. |

Every expert interpreted Bulletin 20197 to permit the rental.

But Bulletin 20197 requires “more than half of the calendar year” for borrower’s personal use.

James reported “zero personal use days.”

The bulletin they cited proves she violated the requirement.

THE TIMELINE POLITICO MISSED

| Date | Event | Source |

|---|---|---|

| August 17, 2020 | James signs Second Home Rider promising to “keep the Property available primarily as a residence for Borrower’s personal use and enjoyment for at least one year” | Second Home Rider |

| August 2020 | Thompson (grandniece) and children move in | Indictment ¶7 |

| Aug 2020 – Aug 2021 | THE MANDATORY FIRST YEAR During this period, James must establish second home use |

Second Home Rider |

| April 2021 | James files 2020 tax return reporting “zero personal use days” for the property | Indictment ¶10 |

| August 17, 2021 | Mandatory first year ends James never established personal use during required period |

Second Home Rider + Schedule E |

WHAT FANNIE MAE ACTUALLY REQUIRES

POLITICO’s experts spent 2,000 words analyzing the Second Home Rider. They cited Freddie Mac Bulletin 20197 (April 3, 2019), which revised the requirements for both Freddie Mac and Fannie Mae second home mortgages. These requirements were incorporated into the August 5, 2020 Fannie Mae Selling Guide—the official guidance in effect when James signed her loan documents.

From the August 5, 2020 Fannie Mae Selling Guide, Second Home Requirements:

Second Home Properties must:

- be occupied by the borrower for some portion of the year

- not be rental property or a timeshare arrangement

- the borrower must have exclusive control over the property

And from Bulletin 20197 (which updated both Fannie Mae and Freddie Mac requirements):

“Specify that the property may be rented out on a short-term basis provided that:

- The Borrower keeps the property securing the second home Mortgage available primarily (i.e., more than half of the calendar year) as a residence for the Borrower’s personal use and enjoyment; and

- The property is not subject to any rental pools or agreements that require the Borrower to rent the property, give a management company or entity control over the occupancy of the property”

During the mandatory first year (August 2020 – August 2021), James:

- Never occupied the property (reported “zero personal use days” for 2020)

- Classified it as “rental real estate” (her own Schedule E designation per the indictment)

- Gave Thompson and her children full-time occupancy

- Used it for 0 out of the required 182.5+ days

James violated every single Fannie Mae requirement from the August 2020 Selling Guide during the one year when compliance was mandatory.

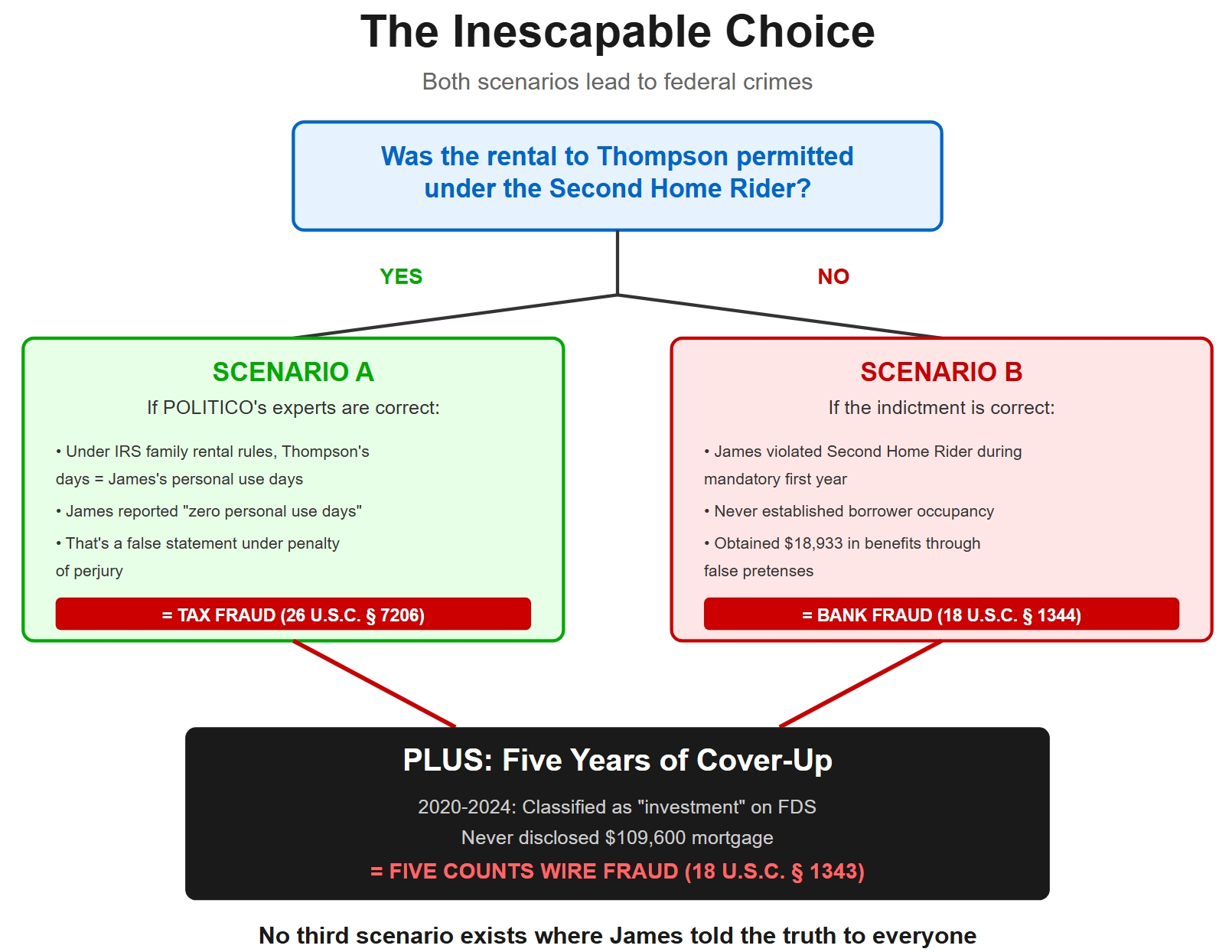

THE INESCAPABLE CHOICE

There are only two possibilities. Both lead to federal crimes committed during the mandatory first year:

Possibility #1: The Rental Was Permitted

If POLITICO’s experts are correct and the Second Home Rider permits James to rent to Thompson, then:

- Every day Thompson occupied the property = James’s personal use day (IRS rules for family rentals at below-market rates)

- James reported “zero personal use days” for 2020

- The property was classified as “rental real estate,” violating Fannie Mae’s “must not be rental property” requirement

- Result: Tax fraud (26 U.S.C. § 7206) + Mortgage fraud (18 U.S.C. § 1344)

Possibility #2: The Rental Violated the Contract

If the indictment is correct and renting to Thompson violated the Second Home Rider, then:

- James broke her promise to “keep the Property available primarily” for her personal use during the mandatory first year

- James gave Thompson control of occupancy during the exact period she was required to establish personal use

- James never established the required borrower occupancy per Fannie Mae guidelines

- Result: Mortgage fraud (18 U.S.C. § 1344) + False statements (18 U.S.C. § 1014)

Either Way:

- James obtained $18,933 in benefits by misrepresenting the property’s use

- James filed contradictory sworn statements to the bank, insurance company, IRS, and NY State about the mandatory first year

- James misrepresented “owner-occupied non-seasonal use” to the insurance company during the period she reported zero personal use to the IRS

- James never complied with the Second Home Rider’s first-year requirement

There is no third scenario where James complied with her obligations during the mandatory first year.

THE FDS DISCLOSURE FRAUD

The contradictions get worse. Every year from 2020-2024, James filed a Financial Disclosure Statement with New York State. These are sworn statements filed by mail, subject to federal mail fraud statutes.

On every FDS filing, James classified the Norfolk property as an “investment property.”

But if it’s an investment property, New York State FDS rules require disclosure of any mortgage debt exceeding $10,000. From the 2020 FDS Guide:

“List below all liabilities of the reporting individual and such individual’s spouse or domestic partner, in EXCESS of $10,000… Include the name of the creditor and any collateral pledged.”

James’s mortgage loan amount: $109,600

James disclosed the mortgage on her FDS: Never. Not once from 2020-2024.

Why not? Because the FDS Guide provides an exemption:

“Any loan issued in the ordinary course of business by a financial institution to finance… the cost of home purchase or improvements for a primary or secondary residence… shall be excluded.”

The exemption only applies to primary or secondary residences. Not investment properties.

Here’s James’s problem:

| If She Filed Honestly | What Would Happen |

|---|---|

| Classify as “second home” Use mortgage exemption |

Contradicts Schedule E “rental real estate” classification Exposes tax fraud |

| Classify as “investment property” Disclose $109,600 mortgage |

Contradicts second home loan application Exposes mortgage fraud |

| Classify as “investment property” Use “second home” exemption anyway |

Violates FDS disclosure rules Five counts of wire fraud |

Either the property classification was false, or the mortgage non-disclosure was false. Both can’t be correct.

The Wire Fraud Connection

FDS statements are filed electronically with New York State. Using electronic transmission to file false sworn statements is wire fraud under 18 U.S.C. § 1343.

For five consecutive years (2020-2024), James electronically filed FDS statements that:

- Classified the Norfolk property as “investment”

- Failed to disclose the $109,600 mortgage

- Used the “second home” exemption while claiming “investment” classification

Each electronic filing is a separate act of wire fraud. Five years = five potential counts.

THE PATTERN OF CONTRADICTORY STATEMENTS

The fraud isn’t just about the mortgage contract. It’s about the pattern of contradictory sworn statements James made about the same property during the same mandatory twelve months—and the continuing fraud through false FDS filings:

- To the bank: “I will use this as my second home”

- To the insurance company: “Owner-occupied non-seasonal use”

- To the IRS: “Zero personal use days” + rental real estate

- To NY State: “Investment property” (but no mortgage disclosure)

- Reality: Thompson (family) lived there full-time

These aren’t minor discrepancies or good-faith mistakes. These are fundamentally incompatible representations about how James used the property during the one year when the Second Home Rider required her to establish personal occupancy.

The FDS fraud is particularly damning because it continued for five years:

- If it’s truly an “investment property” → must disclose the $109,600 mortgage

- If it’s a “second home” → can use exemption, but then “investment” classification is false

- James classified as “investment” but used the “second home” mortgage exemption

- That’s having it both ways. That’s wire fraud—five counts, one for each year.

THE FINANCIAL BENEFIT FROM THE FRAUD

Why does this matter? Because James obtained substantial benefits during the mandatory first year by misrepresenting her intended use. From paragraph 8 of the indictment:

“This misrepresentation allowed JAMES to obtain favorable loan terms not available for investment properties, including a note rate of 3.000% (avoiding a 0.815% higher comparable investment property rate of 3.815%, resulting in approximately $17,837 in rate savings over the life of the loan), a seller credit of approximately $3,288 (exceeding the seller credit for investment properties by approximately $1,096), for total ill-gotten gains of approximately $18,933 over the life of the loan.”

The bank gave James these favorable terms based on her sworn promise to occupy and use the property during the first year. During that exact period:

- Thompson and her children occupied the property full-time

- James told the IRS: “zero personal use days”

- James classified it as “rental real estate”

- James never personally used the property

The Second Home Rider explicitly addresses this scenario:

“Borrower shall be in default if, during the Loan application process, Borrower gave materially false, misleading, or inaccurate information. Material representations include, but are not limited to, representations concerning Borrower’s occupancy of the Property as Borrower’s second home.”

The contract itself defines occupancy representations as “material.” There’s no dispute about materiality.

WHAT POLITICO ACTUALLY FOUND (WITHOUT REALIZING IT)

Georgetown Law professor Adam Levitin told POLITICO: “The core of the allegations is that James knowingly lied that she was not going to rent. The problem is there is absolutely no statement ever made by James that she would not rent out the property.”

Professor Levitin is technically correct. James never explicitly promised “I will not rent this property.”

But she did promise: “I will keep the Property available primarily as a residence for my personal use and enjoyment for at least one year.”

And POLITICO itself cited Bulletin 20197, which explicitly defines “available primarily” as “more than half of the calendar year.”

Then James filed a sworn statement saying: “zero personal use days” for that exact year.

That’s not a contract interpretation dispute. That’s a false statement about what actually happened during the mandatory first year, measured against the very standard POLITICO cited to defend her.

| Requirement | Source | James’s Actual Use (2020) |

|---|---|---|

| “Available primarily” = more than half the year | Bulletin 20197 (cited by POLITICO) | Zero personal use days (filed under penalty of perjury) |

| 182.5 days minimum required | More than half of 365 days | 0 days reported |

| Short-term rentals permitted | Bulletin 20197 | Full-time occupancy by Thompson (family) |

Zero days does not equal “more than half of the calendar year.”

POLITICO cited the document that proves James violated the requirement.

| Crime | Statute | Evidence From Mandatory First Year | Maximum Sentence |

|---|---|---|---|

| Bank Fraud | 18 U.S.C. § 1344 | Promised to occupy during first year; never did; obtained $18,933 in benefits | 30 years |

| False Statements | 18 U.S.C. § 1014 | Represented property as second home; used as rental during mandatory year | 30 years |

| Tax Fraud | 26 U.S.C. § 7206 | Reported “zero personal use days” when family member occupied property | 3 years |

| Wire Fraud | 18 U.S.C. § 1343 | Electronically filed FDS classifying as “investment” without disclosing $109,600 mortgage | 20 years per count (5 years = 5 counts) |

All charges are based on what happened during the mandatory twelve-month period from August 17, 2020 through August 17, 2021, plus the subsequent false FDS filings to cover up the fraud.

THE VERDICT

POLITICO spent 2,000 words on why “including short-term rentals” saves Letitia James.

They never asked the most important question: What happened during the mandatory first year?

The answer is devastating:

- August 17, 2020: James signed a promise to “keep the Property available primarily” for her personal use “for at least one year”

- August 2020: James told her insurance company “owner-occupied non-seasonal use”

- August 2020: Thompson moved in and occupied the property full-time

- August 2020 – August 2021: James never personally used the property during the mandatory compliance period

- April 2021: James filed a tax return reporting “zero personal use days” for 2020

- 2020-2024: James electronically filed five consecutive FDS statements classifying the property as “investment” while failing to disclose the $109,600 mortgage

Seven events over five years. Five contradictory sworn statements during the mandatory year. Five acts of wire fraud covering it up.

POLITICO’s “including short-term rentals” defense only matters if James actually used the property during the first year.

She reported zero personal use days. That ends the debate.

And POLITICO itself cited Bulletin 20197—the document that explicitly defines “available primarily” as “more than half of the calendar year” for the borrower’s personal use.

Zero days is not more than half the year.

Zero days is not 182.5 days.

Zero days is zero compliance.

Once you accept POLITICO’s interpretation—once you agree James could rent to Thompson during the first year—then every day Thompson occupied the property counts as James’s personal use under IRS rules.

And “zero personal use days” becomes a lie filed under penalty of perjury.

Every defense of the mortgage proves the tax fraud.

Every defense of the rental proves the Fannie Mae violation.

Every sworn statement contradicts the others.

And the bulletin POLITICO cited proves James failed to meet the “more than half” standard.

There is no scenario where Letitia James told the truth to everyone during the mandatory first year.

THE COVER-UP THAT BECAME ITS OWN CRIME

The FDS fraud reveals how a single act of mortgage fraud in 2020 metastasized into five years of continuing crimes.

Once James obtained the second home mortgage through false pretenses, she faced an impossible choice every year when filing her New York State Financial Disclosure:

| If She Filed Honestly | What Would Happen |

|---|---|

| Classify as “second home” Use mortgage exemption |

Contradicts Schedule E “rental real estate” classification Exposes tax fraud |

| Classify as “investment property” Disclose $109,600 mortgage |

Contradicts second home loan application Exposes mortgage fraud |

| Classify as “investment property” Use “second home” exemption anyway |

Violates FDS disclosure rules Five counts of wire fraud |

James chose option three. For five consecutive years.

Each year’s FDS filing presented the same dilemma. Each year, James chose to commit wire fraud rather than expose the original fraud. This is what prosecutors call “consciousness of guilt.”

It’s one thing to make a false statement during a loan application. It’s another thing entirely to maintain that lie through five years of sworn statements to state authorities, each transmitted electronically, each a separate federal crime.

The cover-up wasn’t just about hiding the crime. The cover-up became the crime.

THE STANDARD

When Letitia James prosecuted Donald Trump in her $454 million civil fraud case, she said:

“No one is above the law. There cannot be different rules for different people.”

POLITICO’s analysis—despite its intentions—proved why that standard must apply to everyone.

Including the Attorney General of New York.

For daily updates, follow @SamAntar on X (formerly Twitter)

Written by Sam Antar | Forensic Accountant & Fraud Investigator

© 2025 Sam Antar. All rights reserved.