How 330,000 Views Bought a Defense That Confused Two States, Missed the Indictment’s Most Damaging Evidence, and Accidentally Proved the Crime

Attorney Andrew Torrez and legal commentator Liz Dye published a Substack article and created a 21-minute video on LegalEagle’s channel defending Letitia James from federal fraud charges.

330,000 people watched them argue the case is weak, politically motivated, and based on unclear mortgage rules.

Then they proved the opposite.

They confused two mortgages in two different states. They ignored the insurance fraud in Paragraph 9. They misunderstood the legal standard without checking Supreme Court precedent. And they used a “no rent” defense that accidentally proves tax fraud.

Let me show you exactly where it falls apart.

WHAT THE INDICTMENT ACTUALLY CHARGES

Before we dissect where Torrez and Dye went wrong, let’s establish what the federal grand jury actually charged.

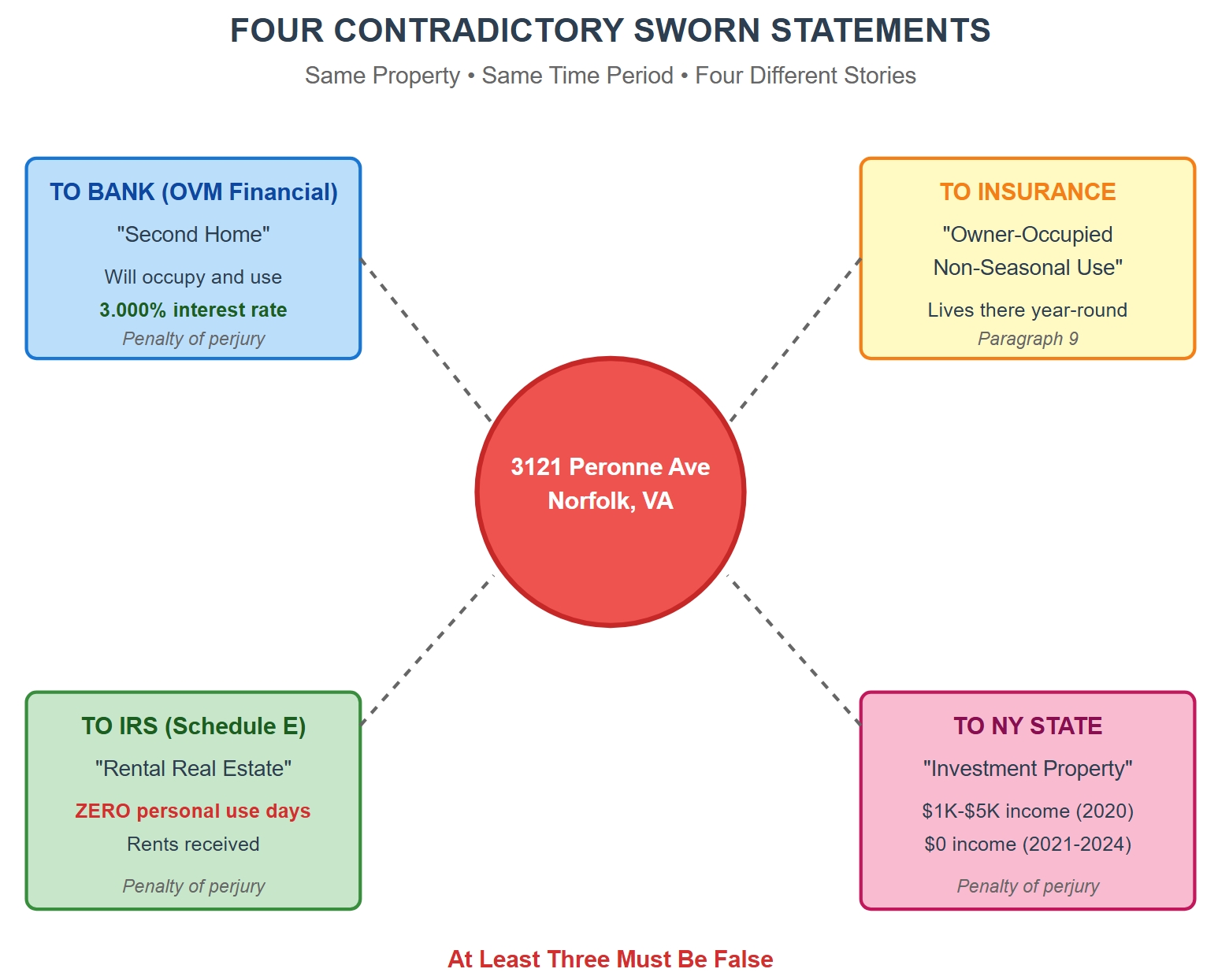

On October 9, 2025, Letitia James was indicted on two federal counts related to one property:

3121 Peronne Avenue, Norfolk, Virginia

Purchased August 17, 2020 for $137,000. Financed with $109,600 mortgage from OVM Financial.

The charges:

- Count One: Bank Fraud (18 U.S.C. § 1344)

- Count Two: False Statements to a Financial Institution (18 U.S.C. § 1014)

The core allegation is straightforward: James signed a Second Home Rider under penalty of perjury, swearing she would “occupy and use” the Norfolk property as her second home. She never did. Her grandniece Thompson and family moved in the same month and have lived there ever since.

According to the indictment:

Paragraph 9: James told her insurance company the property was “owner-occupied non-seasonal use”

Paragraph 10: James filed Schedule E tax forms reporting “zero personal use days” and treating it as “rental real estate”

Paragraph 11: The loan was acquired by First Savings Bank in March 2021

That’s the case. One property. Norfolk, Virginia. Four contradictory sworn statements to different entities about how she used it.

Now watch what happens when Liz Dye tries to defend it.

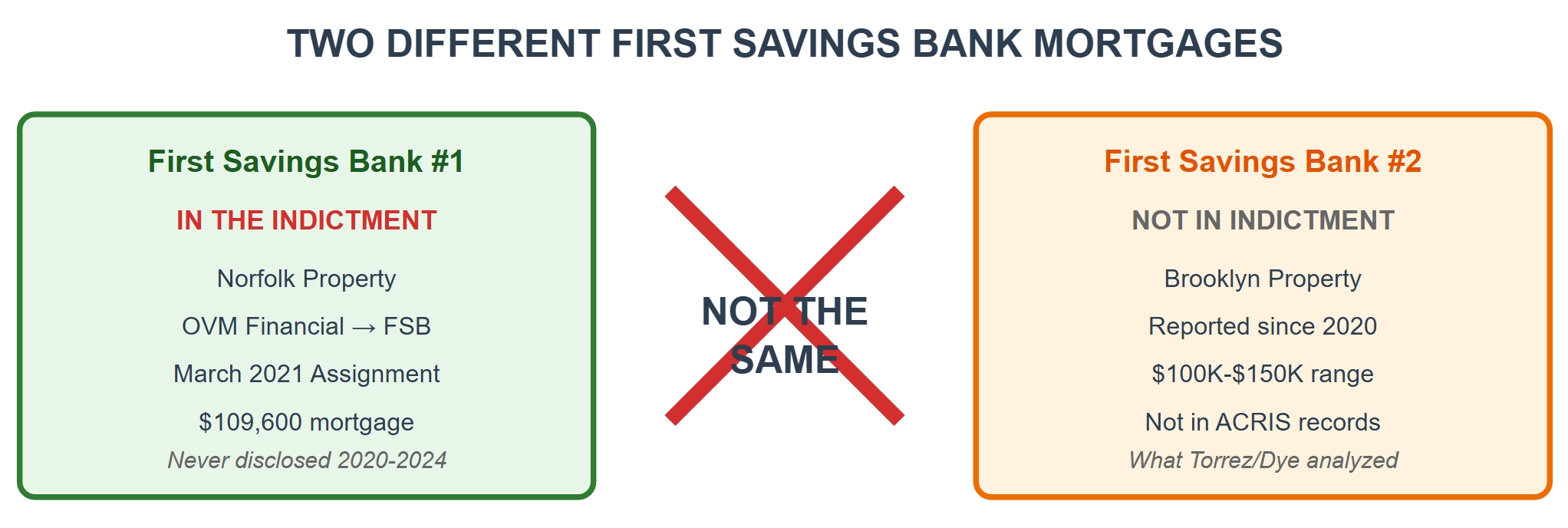

THEIR FIRST MAJOR ERROR: THE BROOKLYN MORTGAGE CONFUSION

In the Substack article, Torrez and Dye quote from my forensic analysis of James’s financial disclosures. Here’s what they write:

“Adding to the mystery, James consistently reported this mortgage in the range of $100,000-$150,000 for three consecutive years (2020–2022), but then in 2023, the reported value inexplicably drops to $75,000-$100,000 without explanation.”

Then they deliver this sarcastic zinger:

“She paid down her mortgage? Lock her up!”

Here’s the problem: They’re quoting my analysis of a completely different mortgage on a completely different property in a completely different state.

That analysis was about a First Savings Bank mortgage James has been reporting on her Brooklyn residence since at least 2020—a mortgage that doesn’t appear in any public property records despite years of disclosure reporting.

The Norfolk indictment has nothing to do with the Brooklyn First Savings Bank mortgage.

The Norfolk case is about the OVM Financial mortgage that James never disclosed on any financial forms from 2020-2024 despite reporting the property as an “investment.”

So when they mockingly write “She paid down her mortgage? Lock her up!” they’re being sarcastic about… the wrong mortgage. On the wrong property. In the wrong state.

They confused Brooklyn with Norfolk.

BUT WAIT—THERE’S PARAGRAPH 11

Now here’s where it gets interesting.

Paragraph 11 of the indictment states:

“The loan was acquired by or assigned to First Savings Bank by March 2021, exposing it to risks associated with the misrepresented loan.”

When the authors saw “First Savings Bank” in the indictment, they appear to have made an assumption: “Aha! This must be that First Savings Bank mortgage Sam Antar identified on James’s Brooklyn property.”

Wrong.

Paragraph 11 is describing standard mortgage loan assignment. OVM Financial originated the Norfolk loan in August 2020. First Savings Bank acquired it through assignment in March 2021. This is routine mortgage business—loans get sold and assigned to other institutions constantly.

So there are actually TWO different First Savings Bank mortgages in this story:

First Savings Bank #1 (in the indictment): Acquired the OVM Financial Norfolk mortgage through assignment in March 2021

First Savings Bank #2 (not in the indictment): The Brooklyn mortgage James reports on financial disclosures but doesn’t exist in ACRIS records

Two different loans. Two different properties. Two different states. Same bank name. Total confusion.

The authors spent time in their analysis discussing the wrong mortgage because they saw “First Savings Bank” and assumed they were the same thing.

They’re not.

WHAT THEY COMPLETELY MISSED: THE NORFOLK MORTGAGE NON-DISCLOSURE

While the authors were busy being sarcastic about a Brooklyn mortgage that has nothing to do with the case, they completely missed an actual disclosure violation sitting in plain sight.

Letitia James disclosed the Norfolk property as an “investment” on her New York State financial disclosure forms every year from 2020 to 2024.

But she never disclosed the $109,600 OVM Financial mortgage on that property.

Not once. Not in 2020, 2021, 2022, 2023, or 2024.

New York ethics law requires disclosure of mortgages over $10,000. This mortgage was $109,600.

She reported owning the asset. She concealed the liability. For five consecutive years.

That’s a clear disclosure violation documented in public records.

Neither the YouTube video nor the Substack article mentions it.

THEIR SECOND MAJOR ERROR: “SHORT-TERM RENTALS ARE ALLOWED”

Here’s the main legal argument from the Substack article:

“Plainly the intent of that rider is that the borrower agrees to ‘maintain exclusive control’ over the property. So, while James couldn’t turn the home into a time-share or sign an agreement that required her to rent the property, there was no bar to renting it in the short term. That’s why the rider says that James agreed to keep the property ‘available primarily as a residence.'”

They continue:

“In fact, Fannie Mae revised this rider in 2019 to make it clear that buyers were free to rent out their second homes on sites like Airbnb. As one mortgage specialist noted at the time, the new rider ‘explicitly’ allows for those sorts of short-term rentals of second homes.”

This argument sounds reasonable. Except it completely ignores what actually happened.

The Second Home Rider James signed contains two separate requirements:

Requirement #1: “Borrower will occupy and use the Property as Borrower’s second home”

Requirement #2: “Borrower will keep the Property available primarily as a residence for Borrower’s personal use and enjoyment for at least one year”

The article focuses entirely on “available primarily” to argue James could rent it short-term.

But it completely ignores “Borrower will occupy and use.”

You cannot satisfy a requirement to “occupy and use” a property by simply keeping it “available.” Those are different words with different meanings.

More importantly: According to the indictment, James reported “zero personal use days” to the IRS.

Zero. Not some. Zero.

Under this interpretation:

- James could rent the property 365 days per year

- Never set foot in it personally

- Report “zero personal use days” to the IRS

- And still satisfy the requirement to “occupy and use” it as her second home

That’s not contract interpretation. That’s contract elimination.

If “occupy and use” can be satisfied with zero occupancy and zero use, then those words mean nothing.

The article continues:

“In fact, Fannie Mae revised this rider in 2019 to make it clear that buyers were free to rent out their second homes on sites like Airbnb. As one mortgage specialist noted at the time, the new rider ‘explicitly’ allows for those sorts of short-term rentals of second homes. And so, even if James had rented out the Norfolk property, she probably wouldn’t have violated the Fannie Mae rider.”

This argument misses four critical points:

First, the 2019 revision actually defines what “available primarily” means.

Fannie Mae Bulletin 2019-7 (April 2019), which revised the Second Home Rider, explicitly states that “available primarily” means the property must be available for the borrower’s personal use more than half of the calendar year—that’s 183 days minimum.

James reported zero personal use days. Zero is not more than half of 365.

Second, Thompson wasn’t a “short-term rental.”

The New York Times confirms Thompson and her family “have lived at the address ever since” August 2020. That’s not Airbnb. That’s not short-term. That’s permanent, full-time occupancy by a family member starting the same month James signed the rider.

Third, “short-term rentals” require you to actually occupy it as YOUR second home.

The 2019 revision permits short-term rentals while maintaining the core requirement that you “occupy and use the Property as Borrower’s second home.” You can Airbnb it occasionally between your personal uses. You cannot rent it full-time to family and never occupy it yourself.

Fourth, James reported “zero personal use days.”

According to Paragraph 10 of the indictment, James filed Schedule E forms under penalty of perjury reporting “zero personal use days” for the Norfolk property.

Zero days of personal use means she never occupied it as her second home—not even once.

The 2019 revision allowing Airbnb doesn’t eliminate the 183-day requirement or the requirement to actually use the property yourself. It just clarifies you can have short-term guests between your visits.

James had a permanent tenant from day one and never visited. That’s the opposite of what the 2019 revision permits.

THE EVIDENCE DYE NEVER MENTIONS: PARAGRAPH 9

Want to know what’s completely absent from their analysis?

Paragraph 9 of the indictment.

Here’s what it says:

“JAMES’ Universal Property application for homeowners’ insurance indicated ‘owner-occupied non-seasonal use,’ further misrepresenting the intended use of the property.”

“Owner-occupied non-seasonal use” means the owner lives there year-round.

Not vacation home. Not short-term rental. Full-time owner occupancy.

James declared this to her insurance company in August 2020—the same month she bought the property.

Where was James actually living? Brooklyn. Where she’d been living for years.

Who was living in Norfolk? Thompson and her family. They moved in August 2020.

This is insurance fraud. From month one.

Why don’t they mention Paragraph 9?

Because once you acknowledge that James told her insurance company she was living there full-time while actually living in Brooklyn and letting Thompson occupy it, the entire “short-term rental” defense collapses.

You can’t claim short-term rentals are allowed when you’re committing insurance fraud by declaring “owner-occupied non-seasonal use.”

THE THIRD MAJOR ERROR: THE INTENT STANDARD

From the video transcript, Dye argues:

“In other words, if this case were to somehow go to trial, prosecutors would have to prove beyond a reasonable doubt that James concocted a fraudulent scheme in advance to get an eight-tenths-of-one-percent reduction on a modest loan that she voluntarily paid off eleven years early… all so that she could earn a couple thousand dollars in rent income.”

Then she says:

“When you say it out loud, it doesn’t make much sense.”

This reveals Dye doesn’t understand the legal standard.

Under United States v. Wells, 519 U.S. 482 (1997), prosecutors charging violations of 18 U.S.C. § 1014 need NOT prove:

- That the false statement actually influenced the bank’s decision

- That the bank relied on the statement

- That the statement caused any particular financial benefit

The Supreme Court held: “The phrase ‘for the purpose of influencing’ covers conduct intended to influence even if the influence is not achieved.”

In plain English: The crime is making the false statement for the purpose of influencing the bank. Whether it actually influenced them, whether they relied on it, whether she benefited from it—all irrelevant.

So when Dye argues “it doesn’t make much sense” to defraud for such a small benefit, she’s arguing against… a requirement that doesn’t exist.

The statute doesn’t require proof of substantial financial benefit. It requires proof of false statements made for the purpose of influencing a financial institution.

James signed a Second Home Rider swearing she’d occupy the property. She never did. The New York Times confirms Thompson has lived there since 2020. James reported zero personal use days. Thompson testified she paid no rent.

That’s the crime. The dollar amount is irrelevant under Wells.

THERE’S ACTUAL DOJ PRECEDENT FOR THIS EXACT CRIME

In United States v. Muhammad, No. 17-30193 (9th Cir. 2018), DOJ successfully prosecuted Felicia Muhammad for false FHA occupancy declarations based on contradictory Section 8 housing certifications versus loan applications.

The Ninth Circuit upheld her conviction on appeal.

James’s case presents even stronger evidence than Muhammad:

- Immediate occupancy by family member proving false intent from day one

- Multiple contradictory sworn statements to different entities

- Documentary evidence spanning multiple years

- Insurance fraud, mortgage fraud, and tax fraud in same transaction

When they dismiss this as a weak case, they’re ignoring that DOJ has successfully prosecuted identical conduct with weaker evidence.

THE CONTRACT EXPLICITLY DEFINES THIS AS MATERIAL

The Second Home Rider James signed contains Section B, titled “Borrower’s Loan Application”:

“Borrower shall be in default if, during the Loan application process, Borrower gave materially false, misleading, or inaccurate information. Material representations include, but are not limited to, representations concerning Borrower’s occupancy of the Property as Borrower’s second home.“

Read that again.

The contract James signed explicitly states that occupancy representations are MATERIAL.

So when the defense argues this is a weak case based on unclear guidelines, it ignores that James signed a contract defining occupancy representations as material fraud.

Not the prosecutor’s opinion. Not a judge’s interpretation. The contract itself.

THE “NO RENT” DEFENSE THAT PROVES TAX FRAUD

The video emphasizes:

“Ms. Thompson’s testimony that she has lived in the house rent-free — Ms. James pays even for basic upkeep, the people said — could make it difficult for prosecutors to convince a jury that the house was meant to be used as a rental investment property.”

Beautiful. Sympathetic. Family helping family.

Now let’s look at Paragraph 10 of the indictment:

“JAMES filed Schedule E tax form(s), under penalties of perjury, treating the Peronne Property as rental real estate, reporting fair rental days, zero personal use days, thousand(s) of dollars in rents received, and claiming deductions for expenses relating to the property.”

Schedule E is the IRS form for reporting rental income from investment property.

If Thompson paid no rent, then James cannot report:

- “Rental real estate”

- “Fair rental days”

- “Thousands of dollars in rents received”

- Rental expense deductions such as depreciation

You don’t file Schedule E reporting “rents received” for charitable family housing where nobody pays rent.

So pick one:

Thompson paid rent → Second Home Rider violated → Mortgage fraud proven

Thompson didn’t pay rent → Schedule E forms are false → Tax fraud proven

This sympathetic “no rent” framing doesn’t exonerate James. It proves a different crime.

THE TIMELINE THAT PROVES FALSE INTENT

In the video, Dye argues prosecutors must prove James “knew she was going to rent out the Norfolk property at the time she signed the loan application.”

Here’s the timeline from public records:

- August 17, 2020: James signs Second Home Rider promising to “occupy and use” the property

- August 2020: Thompson and family move in (The New York Times: “have lived at the address ever since”)

- August 2020: James declares “owner-occupied non-seasonal use” to insurance company

- August-December 2020: James never occupies the property

- 2020-2024: James files Schedule E tax forms reporting “zero personal use days” and “rents received” for multiple years

Thompson moved in the same month James signed the Second Home Rider. Not later. Not after James tried it out. Immediately.

When someone promises to do something and then never does it—not even once, starting from day one—that proves they never intended to do it.

This isn’t circumstantial. Thompson’s immediate occupancy combined with zero personal use by James proves false intent at origination.

CREDENTIALS DON’T EQUAL ACCURACY

Andrew Torrez has a law degree. Liz Dye is a respected legal commentator. Together they command a 3-million-subscriber platform on LegalEagle.

I’m a convicted felon who went to prison for securities fraud.

But in this analysis, only one of us got the facts right.

ABOUT THAT AD HOMINEM ATTACK

The Substack article identifies me as someone who “was convicted of securities fraud in connection with the Crazy Eddie electronics chain” and notes I’ve “since rebranded himself as an ‘investigator of financial fraud,’ presumably on the theory of it takes one to know one.”

They’re right about the conviction. I committed securities fraud at Crazy Eddie in the 1980s. I cooperated with federal authorities, served my time, and spent the last 30 years training law enforcement and exposing fraud.

Here’s what they got wrong: attacking my credibility doesn’t fix their factual errors.

I confused nothing. They confused Brooklyn with Norfolk.

I cited the correct legal standard. They ignored Supreme Court precedent.

I found the mortgage non-disclosure. They missed it.

My criminal past doesn’t make their analysis correct. It just makes their ad hominem attack irrelevant.

The documents don’t care who finds them. And the documents prove I’m right.

WHAT THIS REALLY IS: REPUTATION LAUNDERING

Let’s review what just happened.

An attorney (Andrew Torrez) and a legal commentator (Liz Dye) published a Substack article and created a 21-minute video on a 3-million-subscriber channel defending someone from federal fraud charges.

They:

- Discussed a Brooklyn mortgage that has nothing to do with the Norfolk indictment

- Confused Paragraph 11’s loan assignment with a different First Savings Bank mortgage

- Never mentioned the Norfolk mortgage non-disclosure (2020-2024)

- Ignored Paragraph 9 (insurance fraud)

- Misunderstood the legal standard under United States v. Wells

- Ignored the DOJ precedent in United States v. Muhammad

- Never mentioned the materiality clause in the contract James signed

- Used a “no rent” defense that accidentally proves tax fraud

- Argued prosecutors must prove financial benefit (they don’t)

This wasn’t legal analysis. This was reputation laundering with a veneer of credibility.

HERE’S WHAT THE DOCUMENTS ACTUALLY SAY

Forget YouTube subscribers. Forget podcast credentials. Here are the facts from public documents anyone can verify:

- August 17, 2020: James signs Second Home Rider with materiality clause

- August 2020: Thompson moves in immediately

- August 2020: James declares “owner-occupied non-seasonal use” to insurance (Paragraph 9)

- August-December 2020: James never occupies property

- 2020-2024: James files Schedule E tax forms (multiple years) reporting “zero personal use days” and “rents received” (Paragraph 10)

- 2020-2024: James discloses Norfolk property as “investment” in financial reports to New York State but never discloses $109,600 mortgage

These aren’t allegations. These are documents:

- Federal indictment (October 9, 2025) – public court record

- Second Home Rider – public record in Virginia

- Financial disclosures – public on NY Ethics Commission website

- Supreme Court precedent in Wells – published decision

- DOJ precedent in Muhammad – published decision

THE BOTTOM LINE

I’m a convicted felon who committed securities fraud 40 years ago.

Andrew Torrez is an attorney. Liz Dye is a legal commentator. Together they have access to a 3-million-subscriber platform.

I got the facts right. They got them wrong.

I distinguished Norfolk from Brooklyn. They confused them.

I cited Supreme Court precedent. They ignored it.

I found the mortgage non-disclosure. They missed it.

I based everything on public documents. They based it on assumptions.

Platform size doesn’t determine accuracy. Documents do.

And the documents prove Letitia James committed federal mortgage fraud.

When Letitia James prosecuted Donald Trump, she said “no one is above the law.”

The documents say that standard applies to her too.

Follow @SamAntar on X for updates on this investigation

Written by Sam Antar | Forensic Accountant & Fraud Investigator

© 2025 Sam Antar. All rights reserved.