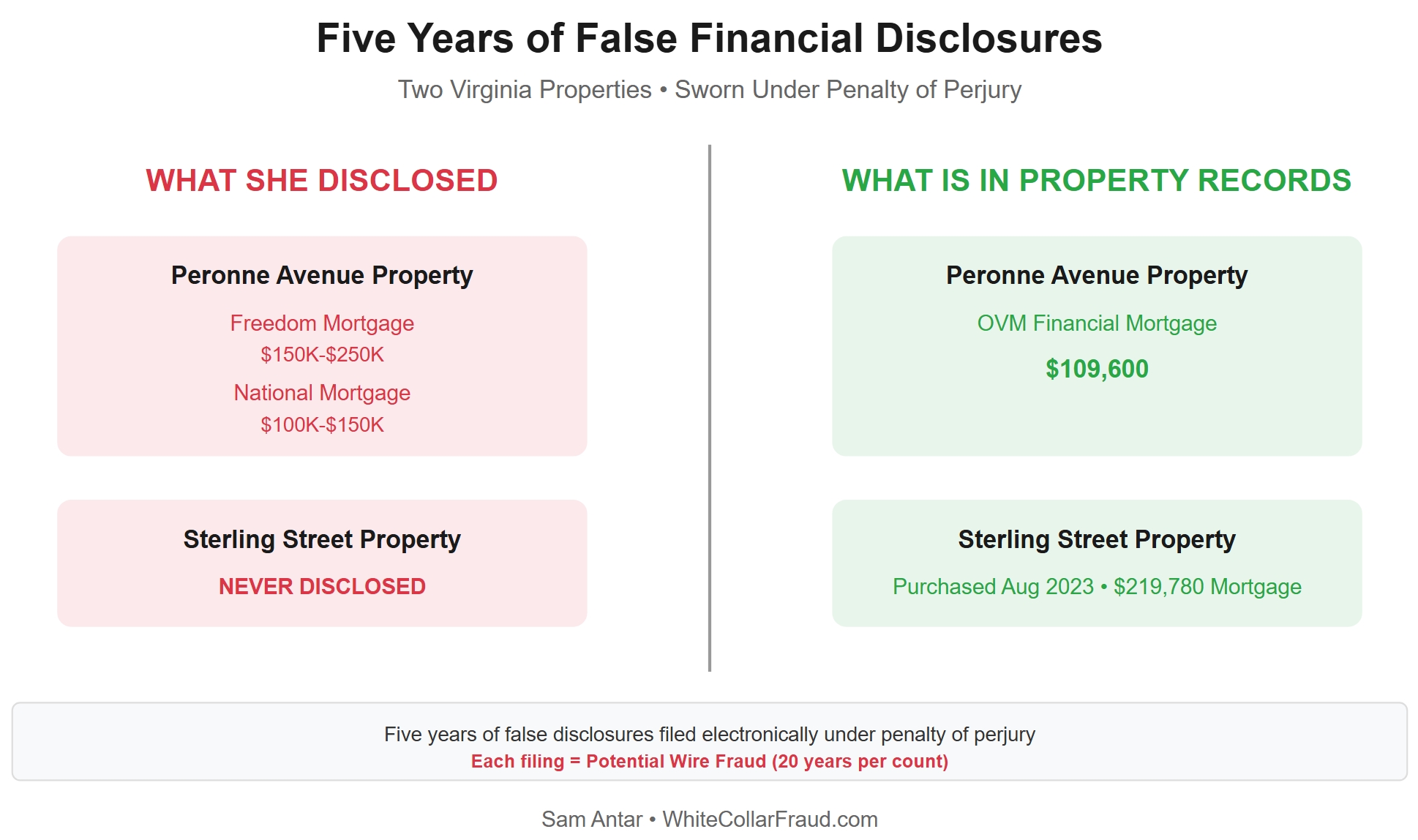

Yesterday, federal prosecutors subpoenaed the New York State Commission on Ethics and Lobbying in Government seeking Letitia James’s financial disclosure statements for the last five years, due December 5—the same financial disclosures documented in our February 8 and February 13 investigations showing phantom (unrecorded) mortgages totaling up to $400,000 while hiding real debt of $109,600 on the Peronne Avenue property, the investigations that started the chain of events leading to the federal indictment. The current indictment charges two counts of bank fraud on the Peronne Avenue mortgage for lying about how she’d use the property, but you don’t subpoena five years of state financial records to try a case about one loan—you do it when you’re building NEW charges for wire fraud, false statements, and possibly RICO based on those false disclosures.

Those financial disclosures may not be part of the charges right now, but they reveal a five-year trend of hidden mortgages, phantom loans, and undisclosed properties—all submitted under penalty of perjury while concealing actual debt on both the Peronne Avenue and Sterling Street properties (found in our April 1 investigation and not included in the current indictment).

Each electronic filing is potential wire fraud. Twenty years per count.

The December 5 deadline gives prosecutors exactly enough time to return to the grand jury with NEW charges before the January 26 trial.

Here’s what the subpoena really means.

THE PHANTOM MORTGAGES

James’s 2023 Financial Disclosure Statement listed two mortgages on 3121 Peronne Avenue, Norfolk:

- Freedom Mortgage: $150,000-$250,000

- National Mortgage: $100,000-$150,000

- Total disclosed debt: $250,000-$400,000

Property value: $100,000-$150,000

That’s a loan-to-value ratio of 167% to 400%. Mathematically impossible under standard lending.

A title search revealed the problem:

- Freedom Mortgage: Does not exist

- National Mortgage: Does not exist

- OVM Financial mortgage ($109,600): Exists but was never disclosed

She disclosed phantom mortgages totaling up to $400,000 while hiding the real $109,600 mortgage.

But there’s another problem: The OVM Financial mortgage was structured as a “second home” loan—meaning James signed documents swearing she would occupy the property for personal use. Yet on her financial disclosures to New York State, she classified the same property as “Investment.” The mortgage contract says second home. The state disclosures say investment property. Both can’t be true.

And there’s a third property issue: James purchased another Virginia property—Sterling Street—in August 2023. It should have appeared on her 2023 and 2024 financial disclosures. It never did. Another property purchased, another disclosure violation. Sterling Street is not part of the current indictment.

Brooklyn Property: A Decade of Shifting Classifications

But the disclosure problems extend beyond Virginia. James’s Brooklyn property at 296 Lafayette Avenue reveals a pattern of missing mortgages, shifting classifications, and phantom loans that cannot be verified in public records.

The Citibank HELOC: In August 2019, James recorded a Citibank HELOC for $100,000. She failed to report it in her 2019, 2020, or 2021 financial disclosures. It finally appeared in her 2022 disclosure—misclassified as a traditional mortgage. Then it vanished completely from her 2023 filing with no record of satisfaction in public documents.

The Citizens Bank Mortgage: She recorded a Citizens Bank mortgage in July 2021 but didn’t disclose it that year. It appeared in her 2022 disclosure as a mortgage, then was inexplicably reclassified as a HELOC in 2023—with no corresponding modification in public records.

The First Savings Bank Phantom Loan: James has reported this loan on her financial disclosures since at least 2020, but it wasn’t identified as a home equity loan until 2023. Despite exhaustive searches of ACRIS records, there is no trace of this loan in official property filings, raising serious questions about its existence and nature. This “phantom mortgage” appears in financial disclosures but cannot be verified through public records—a pattern consistent with the Freedom Mortgage and National Mortgage loans reported on her Virginia property.

The loan’s absence from official records is particularly concerning given James’s legal background and her position as the state’s chief law enforcement officer. This shifting classification scheme obscures the true nature of her liabilities while creating a pattern of disclosure violations spanning multiple properties and multiple states.

None of the Brooklyn disclosure violations are part of the current indictment.

The pattern holds across five years:

- 2020-2022: OVM mortgage exists. Disclosed: Nothing.

- 2023-2024: OVM mortgage exists. Disclosed: Two phantom mortgages that don’t exist. Sterling Street property purchased. Disclosed: Nothing.

Each disclosure was filed electronically. Each was signed under penalty of perjury. Each is potential wire fraud under 18 U.S.C. § 1343.

Five years. Five electronic filings. Five potential counts. Twenty years maximum per count.

WHY THE ETHICS COMMISSION MATTERS

The New York State Commission on Ethics received those false disclosures. They have the original filings, internal reviews, any staff questions about the phantom mortgages, any responses James provided.

Those records could support three potential federal crimes that are NOT currently charged:

- Wire Fraud (18 U.S.C. § 1343): False statements transmitted electronically. Five years of filings = five potential counts. Twenty years per count.

- False Statements (18 U.S.C. § 1001): False statements to government agency. Five years = five potential counts. Five years per count.

- RICO (18 U.S.C. § 1961-1968): Pattern of criminal activity conducted through an enterprise. Five years of electronic fraud = pattern. AG’s office = enterprise.

And here’s the key: Even if Judge Walker dismisses the current indictment on vindictive prosecution grounds, these potential charges aren’t barred. Different conduct. Different statutes. No double jeopardy.

LOWELL’S STRATEGIC PROBLEM

Abbe Lowell filed a motion to dismiss claiming vindictive prosecution. To make that argument, he had to document why prosecutors investigated beyond the charged Norfolk property.

So his motion attached the FHFA criminal referral showing investigations into other properties. He quoted Trump’s statements. He argued prosecutors “cherry-picked” evidence across decades.

To argue vindictiveness, he proved the pattern existed.

Now prosecutors have Lowell’s own motion documenting why pattern evidence is relevant. And they’re gathering the official records to prove it.

THE TIMELINE PROBLEM

The fraud Lowell documented in his motion predates Trump’s political career by decades:

- 1982: Queens property fraud

- 2001-2021: Brooklyn property fraud

- 2011: Federal HAMP fraud

- 2020-2024: Financial disclosure violations

You can’t blame political persecution for crimes that started during the Reagan administration.

DECEMBER 5: THE SUPERSEDING INDICTMENT TIMELINE

Fifty-two days between document production (December 5) and trial (January 26).

That’s exactly enough time to:

- December 5-20: Analyze ethics commission files. Compare disclosures to property records. Document the five-year pattern. Calculate wire fraud exposure.

- December 20-January 5: Present to grand jury. Not pattern evidence for current charges. New charges: Wire fraud (five counts), false statements (five counts), potentially RICO.

- January 5-10: Superseding indictment.

- January 26: Trial on expanded charges.

If Judge Walker dismisses on vindictive prosecution, it doesn’t matter. Dismissal isn’t acquittal. Different conduct, different time periods, different statutes. No double jeopardy bar.

JUDGE WALKER’S IMPOSSIBLE CHOICE

Judge Jamar K. Walker will rule on Lowell’s vindictive prosecution motion. Three possible outcomes:

- Denies the motion: Trial proceeds. Pattern evidence admitted. Jury sees five years of false disclosures.

- Dismisses without prejudice: Prosecutors return to grand jury. Superseding indictment on wire fraud, false statements, potentially RICO. No double jeopardy—different conduct, different charges.

- Dismisses with prejudice: Current charges barred. But other conduct not covered. State prosecution for disclosure violations. IRS enforcement. Bar proceedings. Potential federal charges on other properties.

His ruling determines the forum. Not whether accountability happens.

WHAT THE SUBPOENA MEANS

Federal prosecutors subpoenaed five years of financial disclosure records for a trial about one mortgage.

That tells you everything.

The current indictment charges two counts on the Peronne Avenue property for lying about how she’d use it. Sixty-year maximum.

But the ethics commission records document five years of phantom mortgages and undisclosed properties across multiple states—filed electronically under penalty of perjury. That’s not currently charged. But it’s potential wire fraud, false statements, and possibly RICO if prosecutors can prove pattern and enterprise.

December 5 deadline gives prosecutors exactly enough time to present NEW charges to grand jury before trial.

Lowell’s vindictive prosecution motion documented the broader pattern—trying to show political motivation, he proved systematic fraud predating politics by decades.

Judge Walker will rule on constitutional questions. But his ruling doesn’t make the documents disappear. Dismissal isn’t acquittal. Different conduct, different charges, no double jeopardy.

Two mortgages James disclosed on Peronne Avenue don’t exist in property records. The mortgage that exists was never disclosed to the state. The Sterling Street property was never disclosed at all. Brooklyn mortgages appear, vanish, and shift classifications with no corresponding changes in public records. That’s not interpretation. That’s documentary fact.

January 26, 2026, a Norfolk jury decides if they believe constitutional arguments or five years of verifiable public records spanning three properties in two states.

The subpoena says prosecutors are betting on the documents.

Follow @SamAntar on X for updates as the December 5 deadline approaches

Written by Sam Antar | Forensic Accountant & Fraud Investigator

© 2025 Sam Antar. All rights reserved.