When a syndicate of tax-exempt entities processes $11.6 million in circular money flows between entities that deny relationships on federal tax returns, demonstrates systematic EIN reporting irregularities, and converts $52+ million in taxpayer grants into political infrastructure—all while demonstrating sophisticated knowledge of the rules they’re systematically violating—it transforms questions about charity work into evidence of systematic circumvention.

The coordination methods mirror those often seen in criminal enterprises: multiple legitimate-appearing entities that obscure the true flow and purpose of funds. Sophisticated schemes don’t announce their coordination—they create plausible separation while maintaining operational control. The same structural techniques appear here: shared leadership claiming independence, circular money flows between “unrelated” entities, and selective transparency that conceals relationships from federal oversight while acknowledging them in other contexts.

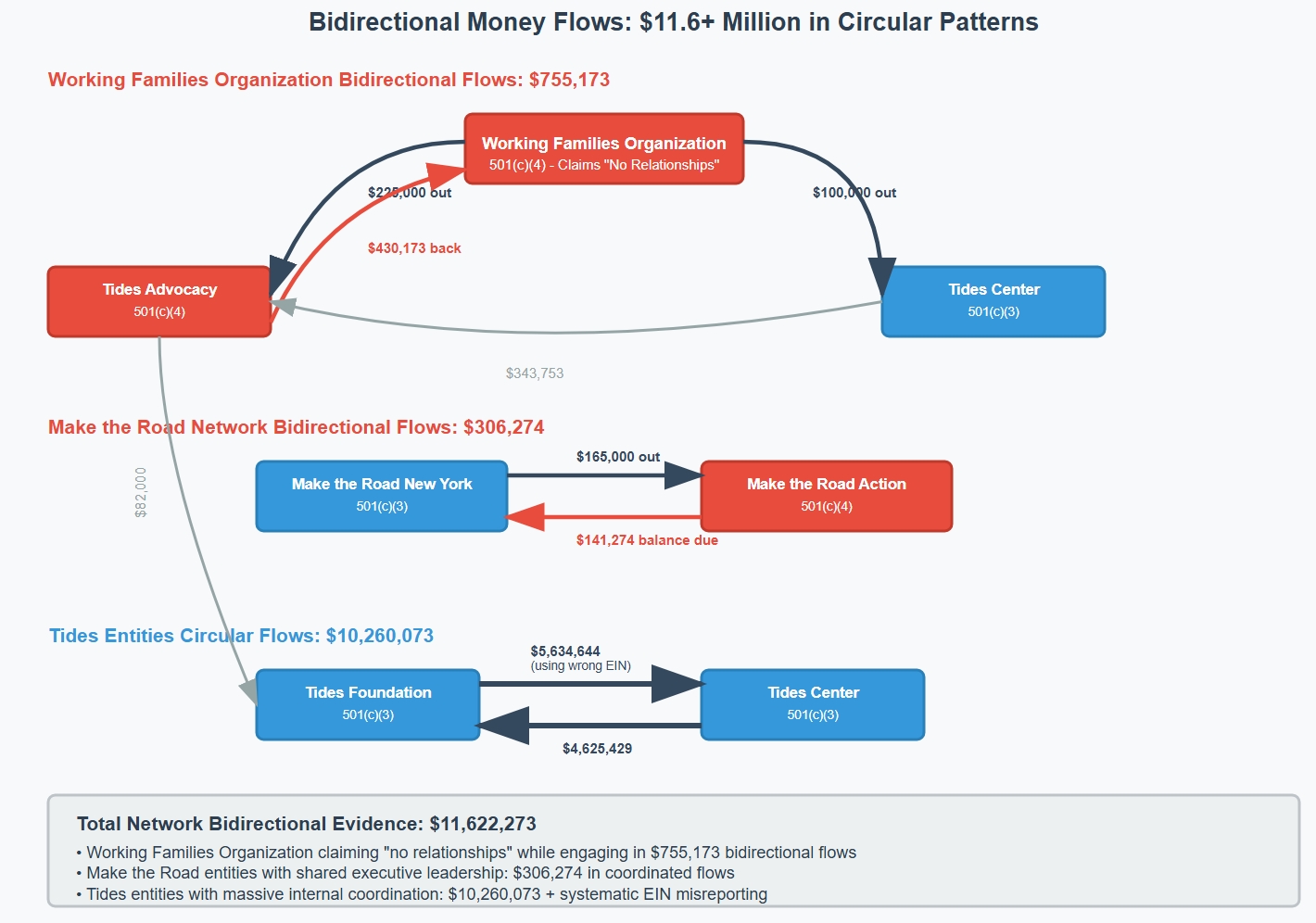

The scope extends far beyond typical coordination concerns. This investigation reveals mathematical impossibilities: bidirectional flows that independent organizations would never engage in, systematic reporting irregularities in EIN disclosures, and $8.52 million in charitable inputs converted to $4.99 million in political outputs while maintaining systematic concealment from federal oversight. When Working Families Organization sends $325,000 to entities it claims as “unrelated,” then receives $430,173 back from those same entities, the circular pattern eliminates coincidence as an explanation.

This investigation builds on our previous reporting that exposed systematic conversion of charitable tax benefits into political coordination, but the discovery of these mathematical impossibilities reveals the true scope of this operation. Zohran Mamdani’s rise from unknown candidate to New York mayoral contender represents just one product of this machinery—the coordinated infrastructure that manufactured his political ascent operates continuously, processing elite donations and taxpayer resources into manufactured grassroots campaigns while maintaining the illusion of independent democracy. The $11.6 million in circular flows documented here powered not just Mamdani’s campaign, but an entire network designed to convert charitable tax benefits into political power while systematically concealing relationships from federal oversight.

Note: This investigation is based primarily on 2023 Form 990/990-PF filings, which represent the most recent complete tax year available for public review. However, the systematic nature of the organizational structures, personnel arrangements, and financial coordination patterns documented herein indicates these practices likely operated across multiple tax years. A comprehensive IRS investigation would need to examine filings from prior and subsequent years to determine the full temporal scope of potential violations. (Click on any image to enlarge them.)

The Four-Step Conversion System

The arrangement appears to operate through a sophisticated four-step process that raises questions about the conversion of charitable tax benefits into political coordination: elite donors claim tax deductions for “charitable” contributions, those 501(c)(3) entities transfer millions to 501(c)(4) political operations, coordinated political action funds specific candidates while concealing relationships, and supported candidates advance policies that increase government funding back to the same infrastructure.

The Money Trail: Understanding the Network Through Financial Behavior

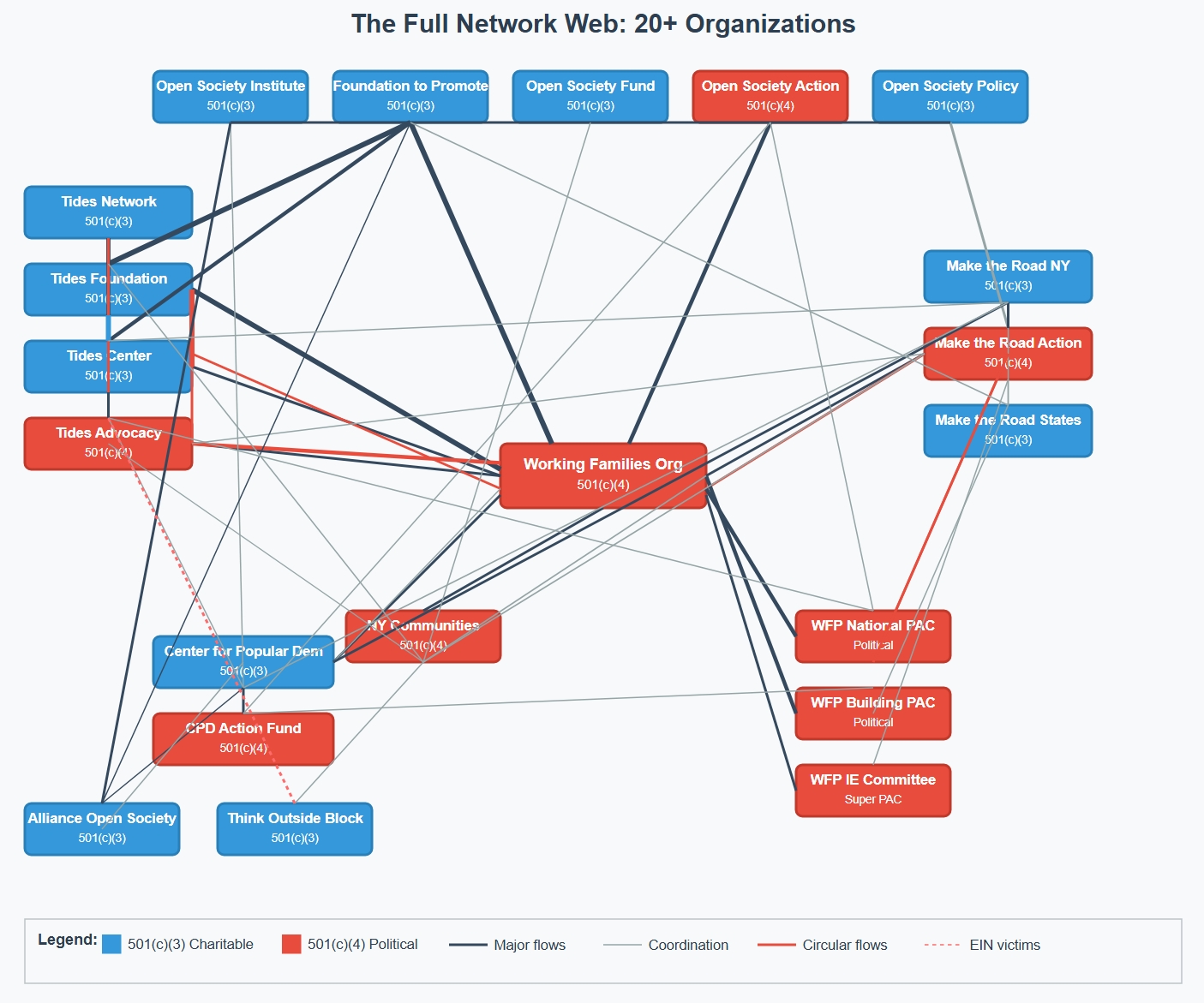

To understand this network, follow the money patterns and behavior. The financial flows operate through four documented channels that all converge at Working Families Organization (501(c)(4)), raising questions about whether this transforms elite donations and taxpayer resources into coordinated political operations while maintaining the appearance of independent grassroots democracy:

Four Channels of Enhanced Taxpayer-Subsidized Coordination

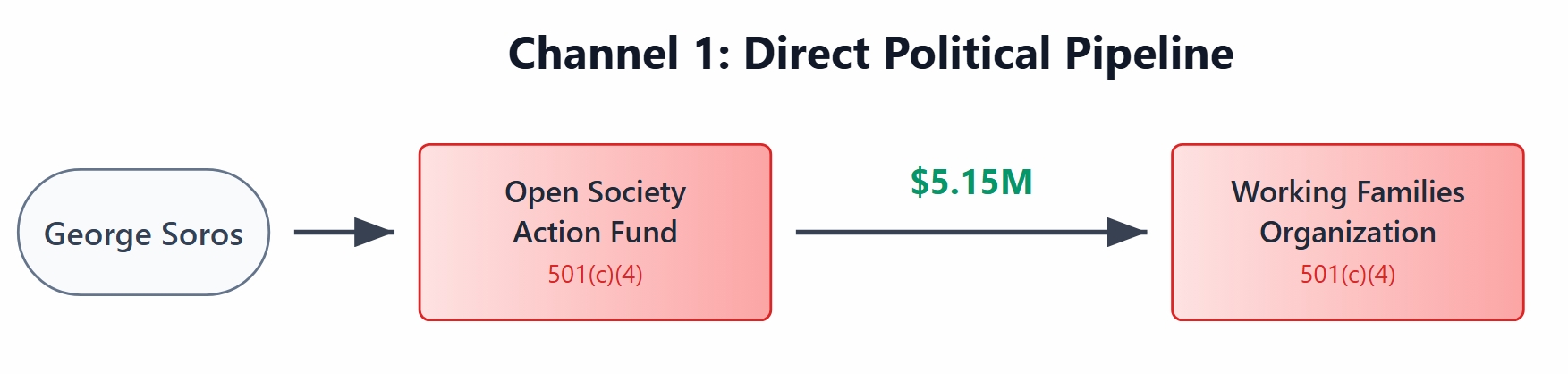

Channel 1 – Direct Soros Political Pipeline: George Soros → Open Society Action Fund (501(c)(4)) → $5.15 million → Working Families Organization (501(c)(4))

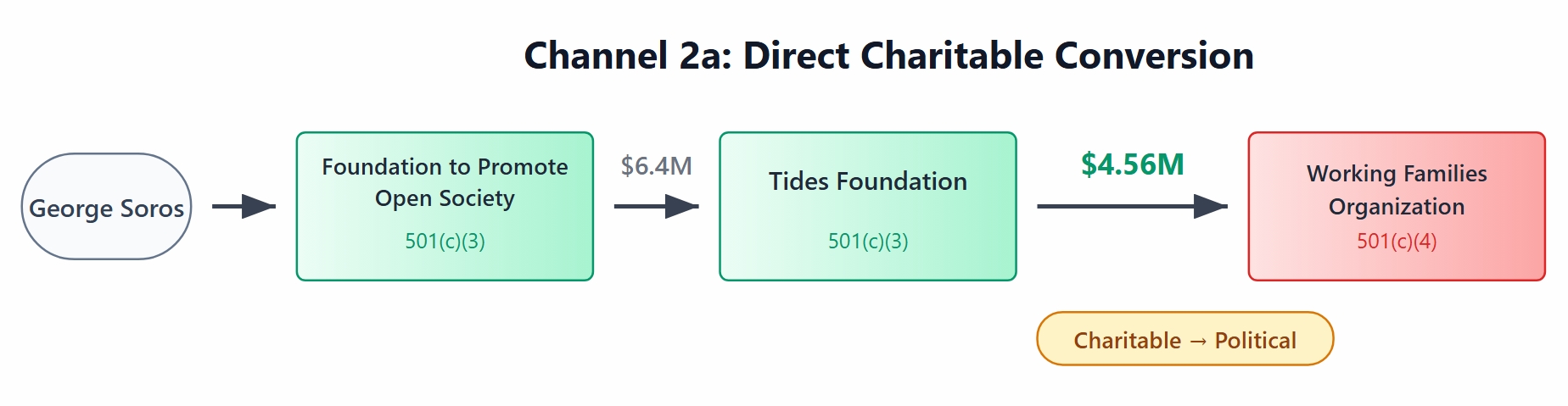

Channel 2a – Charitable-to-Political Conversion Pipeline: George Soros → Foundation to Promote Open Society (501(c)(3)) → $6.4 million → Tides Foundation (501(c)(3)) → $4.56 million → Working Families Organization (501(c)(4))

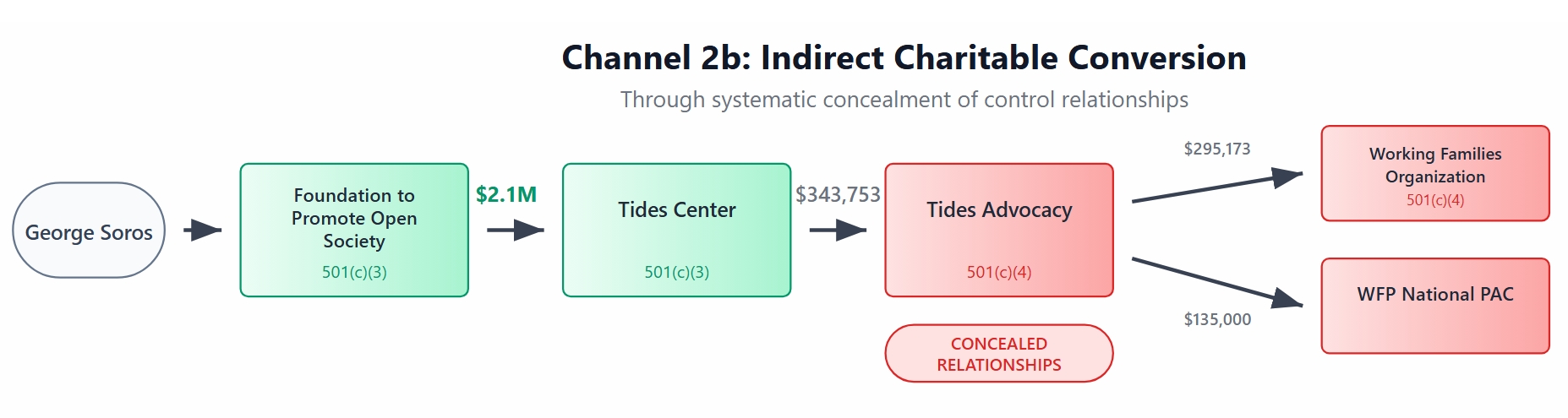

Channel 2b – Charitable-to-Political Conversion Pipeline: George Soros → Foundation to Promote Open Society (501(c)(3)) → $2.1 million → Tides Center (501(c)(3)) → $343,753 → Tides Advocacy (501(c)(4)) → $430,173 → Working Families Organization entities:

- $295,173 to Working Families Organization Inc. (501(c)(4))

- $135,000 to WFP National PAC

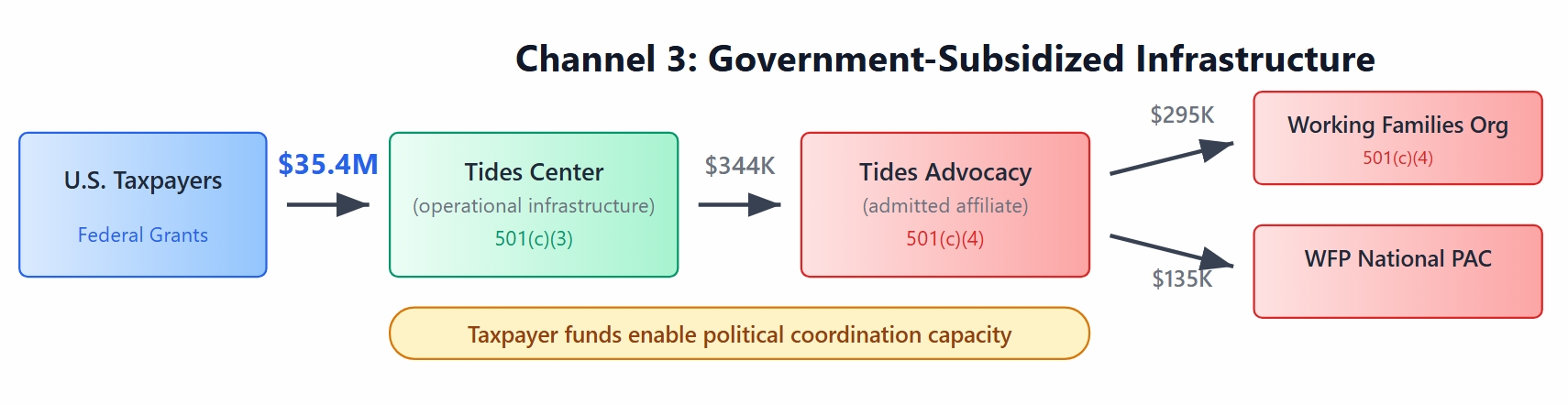

Channel 3 – Government-Subsidized Infrastructure Pipeline: U.S. Taxpayers → $35.4 million → Tides Center (501(c)(3)) (operational infrastructure) $343,753 → Tides Advocacy (501(c)(4)) (admitted affiliate) → $430,173 → Working Families Organization entities

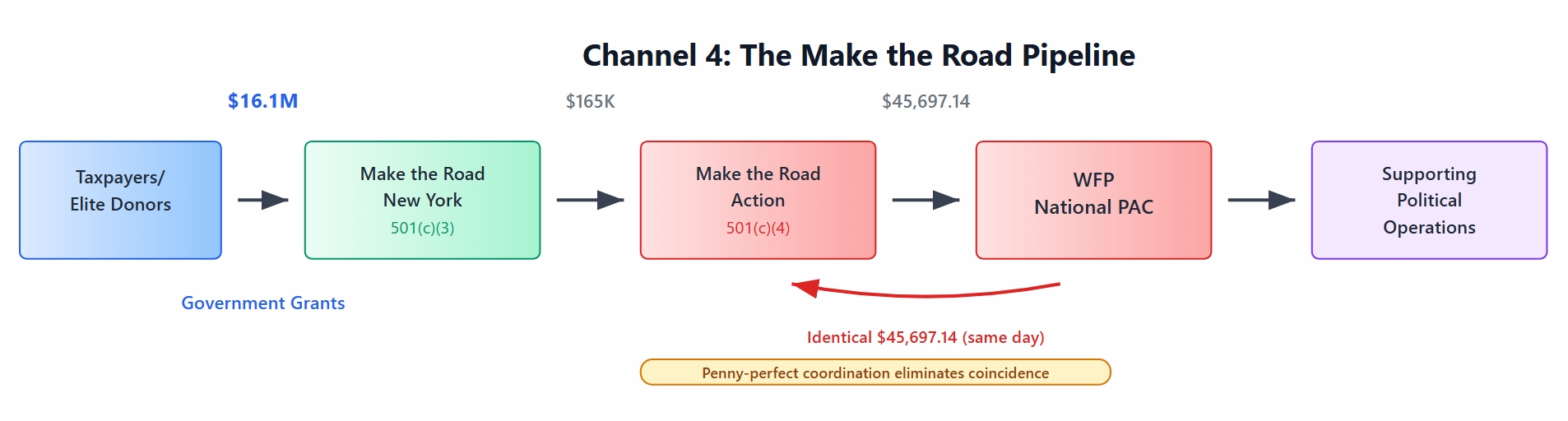

Channel 4 – The Make the Road Pipeline: U.S. Taxpayers/Elite Donors → $16.1 million government grants → Make the Road New York (501(c)(3)) → $165,000 → Make the Road Action (501(c)(4)) → $45,697.14 → WFP National PAC → supporting political operations

Total Convergence at Working Families Organization: $10.14+ million from channels 1-4, enhanced by additional network coordination flows.

Enhanced Bidirectional Flows Suggesting Coordination: The network exhibits circular money flows that raise questions about organizational independence:

Working Families Organization Bidirectional Flows: $755,173

- Money out: $225,000 to Tides Advocacy (501(c)(4)), $100,000 to Tides Center (501(c)(3))

- Money back: $430,173 from Tides Advocacy (501(c)(4))

Make the Road Network Bidirectional Flows: $306,274

- Money out: Make the Road New York (501(c)(3)) → $165,000 → Make the Road Action (501(c)(4))

- Money back: $141,274 in outstanding balances due from Make the Road Action (Withum audit documentation)

Entities Claiming Independence Despite Bidirectional Flows: $1,487,200

- Working Families Organization (501(c)(4)) ↔ Tides Advocacy (501(c)(4)): $225,000 out + $430,173 back = $655,173

- Working Families Organization (501(c)(4)) → Tides Center (501(c)(3)): $100,000

- Tides Center (501(c)(3)) → Tides Advocacy (501(c)(4)): $343,753

- Tides Advocacy (501(c)(4)) → Tides Foundation(501(c)(3)): $82,000

- Make the Road bidirectional flows: $306,274

Pattern: Working Families Organization and Tides Advocacy systematically deny all relationships on federal tax returns despite engaging in $755,173 in bidirectional flows, while related parties Tides Center and Tides Foundation route transactions through Tides Advocacy, which claims independence despite shared leadership with both entities. Make the Road entities demonstrate identical coordination patterns with Theodoro Oshiro serving as Co-Executive Director of both charitable and political operations.

Additional circular flows between Tides entities: $10,260,073

- Tides Center (501(c)(3)) ↔ Tides Foundation (501(c)(3)): $10,260,073 in total bidirectional flows

- Tides Center → Tides Foundation: $5,634,644 (notably reported using own EIN rather than correct EIN)

- Tides Foundation → Tides Center: $4,625,429 for “Healthy Individuals and Communities”

Total Bidirectional Evidence Calculation:

- Working Families Organization bidirectional flows: $755,173

- Additional “unrelated” entity flows: $607,027 ($1,487,200 – $755,173 to avoid double counting)

- Tides Center ↔ Tides Foundation flows: $10,260,073

- Total: $11,622,273 ($755,173 + $607,027 + $10,260,073 = $11,622,273)

These circular transaction patterns raise fundamental questions about whether the network operates as independent charitable organizations or as components of a coordinated political system.

Table of Contents

- Following the Money: How $52+ Million in Coordinated Flows Create Political Power

- The $10.14+ Million Convergence System

- Systematic Concealment: Website Admissions vs. Federal Denials

- Case Study: How the Network May Have Manufactured Mamdani’s Campaign

- Why This Matters: Tax System Integrity and Democratic Process

- The Case for Comprehensive IRS Investigation

Following the Money: How $52+ Million in Coordinated Flows Create Political Power

The four channels outlined above converge to create what appears to be a systematic conversion machine that transforms both elite donations and taxpayer resources into political coordination. Following these money flows reveals sophisticated architecture that raises questions about how charitable tax benefits may fund political operations while maintaining concealment from federal oversight.

Channel 1 – Direct Soros Political Pipeline

George Soros → Open Society Action Fund (501(c)(4)) → $5.15 million → Working Families Organization (501(c)(4))

This channel provides direct political funding that creates the foundation for coordinated political operations while being enhanced by the charitable conversion and government infrastructure channels operating in parallel.

Detailed Cash Flow Documentation:

Open Society Action Fund (501(c)(4)) to Working Families Organization (501(c)(4)):

- $4,150,000 (2023 Working Families Organization Form 990, Schedule B, Line 228)

- $1,000,000 (2023 Working Families Organization Form 990, Schedule B, Line 229)

Channel 1 Total: $5,150,000 in direct political funding

How This Channel Operates:

This direct political pipeline operates legitimately within federal campaign finance law as both entities are 501(c)(4) political organizations. However, questions arise when examining how this funding appears to coordinate with charitable conversion channels and government-subsidized infrastructure to create what may be a systematic political machine.

The Coordination Hub Function: Working Families Organization (501(c)(4)) serves as the convergence point where this direct political funding combines with charitable conversions and taxpayer-subsidized infrastructure. The entity reports zero employees despite processing $48.8 million in operations, suggesting coordination with other network entities for operational capacity.

Legal Significance: While this channel operates within legal parameters independently, it raises questions about potential systematic coordination when combined with charitable tax deductions and government grants flowing to the same political operations through entities that appear to conceal their relationships from federal regulators.

Where We Are Now: $5.15 million in direct political funding establishes Working Families Organization (501(c)(4)) as the apparent coordination hub for political operations. This foundation appears to be enhanced by charitable conversions that provide tax advantages and government infrastructure that provides taxpayer subsidies—creating what may be a multi-channel system that transforms both elite donations and public resources into coordinated political power.

Channels 2a & 2b – Charitable-to-Political Conversion Pipeline

The Soros charitable-to-political conversion appears to operate through two distinct pathways that raise questions about the conversion of tax-deductible charitable donations into political operations through entities that publicly acknowledge their relationships while appearing to conceal them from federal regulators.

Channel 2a – Direct Charitable-to-Political Flow:

George Soros → Foundation to Promote Open Society (501(c)(3)) → $6.4 million → Tides Foundation (501(c)(3)) → $4.56 million → Working Families Organization (501(c)(4))

This channel appears to provide the most direct conversion of Soros’s tax-deductible charitable donations into political operations, creating what may be a streamlined pipeline that transforms charitable tax benefits into coordinated political funding.

Detailed Cash Flow Documentation – Channel 2a:

Foundation to Promote Open Society (501(c)(3)) to Tides Foundation (501(c)(3)):

- $2,100,000 for “Diaspora Alliance” project

- $977,500 for “Asia Empowerment Fund”

- $3,358,050 for “Asia Advancement Fund”

Channel 2a Input: $6,435,550

Direct Political Conversion:

- Tides Foundation (501(c)(3)) → Working Families Organization (501(c)(4)): $4,555,657

Channel 2b – Indirect Charitable-to-Political Flow:

George Soros → Foundation to Promote Open Society (501(c)(3)) → $2.1 million → Tides Center (501(c)(3)) → $343,753 → Tides Advocacy (501(c)(4)) → $430,173 → Working Families Organization entities

This channel raises questions about how the charitable conversion may operate through admitted “affiliate” relationships that appear to remain concealed from federal regulators.

Detailed Cash Flow Documentation – Channel 2b:

Foundation to Promote Open Society (501(c)(3)) to Tides Center (501(c)(3)):

- $300,000 for International Corporate Accountability Roundtable

- $1,125,000 for Maria Fund (Puerto Rico organizing)

- $410,000 for strategic legal and advocacy campaigns

- $250,000 for 22nd Century Initiative

Channel 2b Input: $2,085,000

The Conversion Flows:

- Tides Center (501(c)(3)) → Tides Advocacy (501(c)(4)): $343,753 for “Healthy Individuals and Communities”

- Tides Advocacy (501(c)(4)) → Working Families Organization entities: $430,173 total

- $295,173 to Working Families Organization Inc. (501(c)(4))

- $135,000 to WFP National PAC

Additional Cross-Network Flows:

- Tides Center (501(c)(3)) → Tides Foundation (501(c)(3)): $5,634,644 for “Healthy Individuals and Communities” (notably reported by Tides Center using its own EIN 94-3213100 rather than Tides Foundation’s correct EIN 51-0198509, demonstrating systematic reporting irregularities)

- Tides Foundation (501(c)(3)) → Tides Center (501(c)(3)): $4,625,429 for “Healthy Individuals and Communities” (2023 Tides Foundation Form 990, Schedule I, Line 2042)

- Tides Center (501(c)(3)) → Tides Advocacy (501(c)(4)): $343,753

- Tides Advocacy (501(c)(4)) → Tides Foundation (501(c)(3)): $82,000 for “Environmental Advocacy”

Combined Channels 2a & 2b Total: $8,520,550 in Soros charitable pipeline input → $4,985,830 in political operations output

Why These Flows May Violate Federal Tax Law:

The Three-Layer Disclosure Contradiction: Tides Advocacy’s website raises questions about systematic concealment that may enable this conversion:

- Layer 1 – Public admission: Website identifies them as “an affiliate of Tides Network, a 501(c)(3) charitable organization”

- Layer 2 – Professional acknowledgment: Audited financial statements acknowledge “cost sharing agreements with Tides Foundation and Tides Center”

- Layer 3 – Federal denial: No Schedule R relationship disclosures filed for five consecutive years with the IRS

The Shared Leadership Evidence: Janiece Evans-Page serves simultaneously as CEO of Tides Foundation (501(c)(3)), CEO of Tides Center (501(c)(3)), and Director of Tides Advocacy (501(c)(4))—raising questions about unified control over both charitable and political operations while this relationship appears to be concealed.

The EIN Obfuscation Pattern: Related parties Tides Center and Tides Foundation engage in multiple EIN misreporting when routing transactions through Tides Advocacy, which claims independence despite shared leadership. Tides Center reported the $343,753 grant to “Tides Advocacy” using EIN 81-3812257, which actually belongs to Think Outside Da Block Inc. (501(c)(3))—objective evidence of reporting irregularities. Additionally, Tides Center reported the $5,634,644 grant to “Tides Foundation” using its own EIN 94-3213100 instead of Tides Foundation’s correct EIN 51-0198509—demonstrating systematic confusion or deliberate misreporting where organizations use their own identification numbers when reporting grants to different entities.

Where We Are Now: Combined with Channel 1’s $5.15 million in direct political funding, the Soros charitable pipeline appears to channel an additional $4.99 million through what may be systematic conversion of tax-deductible donations into political operations. Total Soros pipeline to Working Families Organization: $10.14 million enhanced by $11.6+ million in total bidirectional coordination flows ($5.15M direct + $4.56M Channel 2a + $0.43M Channel 2b).

The $11.6+ million includes both $1.49+ million in flows between entities claiming to be “unrelated” and $10.260 million in properly disclosed relationships within the Tides network. The two-track structure (direct via Channel 2a, indirect via Channel 2b) suggests sophisticated financial engineering that may be designed to maximize both tax advantages and political impact while maintaining concealment from federal oversight.

Channel 3 – Government-Subsidized Infrastructure Pipeline

U.S. Taxpayers → $35.4 million → Tides Center (501(c)(3)) (operational infrastructure) $343,753 → Tides Advocacy (501(c)(4)) (admitted affiliate) → $430,173 → Working Families Organization entities

This channel raises questions about how taxpayer resources may indirectly subsidize political coordination through shared infrastructure and operational systems, creating what appears to be a government-funded foundation that enhances the Soros political coordination network documented in Channels 1 and 2a/2b.

Detailed Government Funding Documentation:

Primary Taxpayer Infrastructure Investment:

- Tides Center (501(c)(3)): $35,365,170 in federal grants (2023 Form 990, Part VIII, Line 1e)

- Make the Road New York (501(c)(3)): $16,124,582 in government grants (52% of total revenue)

- Center for Popular Democracy (501(c)(3)): $545,202 in government grants

Total Network Government Funding: $52,034,954

The Infrastructure-to-Political Connection:

Tides Center Infrastructure Utilization:

- Shared Leadership: CEO Janiece Evans-Page simultaneously serves as Director of Tides Advocacy (501(c)(4))

- Admitted Integration: Tides Advocacy website admits being “an affiliate of Tides Network”

- Professional Acknowledgment: Audited financial statements document “cost sharing agreements” between government-funded entities and political operations

Government-Enabled Political Distribution:

- Tides Center (501(c)(3)) $343,753 → Tides Advocacy (501(c)(4)) → Working Families Organization entities: $430,173 total (same flow as Channel 2b)

- Tides Advocacy (501(c)(4)) →$295,173 to Working Families Organization Inc. (501(c)(4))

- Tides Advocacy (501(c)(4)) →$135,000 to WFP National PAC

The Cash Fungibility Question: Each taxpayer dollar flowing to Tides Center (501(c)(3)) may free up operational capacity that its admitted “affiliate” Tides Advocacy (501(c)(4)) uses for unlimited political activities, potentially creating indirect taxpayer subsidy of political coordination while relationships appear to remain concealed from federal regulators.

Legal Significance: This channel raises questions about potential violations of the prohibition on government funding of political operations. While direct grants to 501(c)(4) political entities are prohibited, the shared infrastructure model may enable taxpayer resources to subsidize political coordination through admitted operational integration that appears to remain hidden from federal oversight.

Where We Are Now: Channel 3 raises questions about how $52+ million in taxpayer infrastructure may subsidize and amplify the $10.14 million Soros pipeline (Channels 1 + 2a + 2b). This creates what appears to be a system where government resources may enhance both elite political donations and charitable tax benefits, while systematic concealment patterns prevent regulatory scrutiny of what may be a unified political machine. The same $430,173 flow documented in Channel 2b raises additional questions about taxpayer-subsidized political coordination.

Channel 4 – The Make the Road Pipeline

U.S. Taxpayers/Elite Donors → $16.1 million government grants → Make the Road New York (501(c)(3)) → $165,000 → Make the Road Action (501(c)(4)) → $45,697.14 → WFP National PAC → supporting political operations

This channel raises questions about how government-funded entities may operate dual-track systems processing both taxpayer resources and political coordination through mathematical precision that suggests systematic coordination rather than independent operations, enhanced by professional audit documentation of “common officers and board members” and shared executive control.

Detailed Cash Flow Documentation:

Government Funding Input:

- Make the Road New York (501(c)(3)) government grants: $16,124,582 (52% of total organizational revenue)

Charitable-to-Political Conversion:

- Make the Road New York (501(c)(3)) → Make the Road Action (501(c)(4)): $165,000 for “Workplace Justice”

- Make the Road New York (501(c)(3)) → NY Communities (501(c)(4)): $93,000 for “Workplace Justice”

The Mathematical Coordination Evidence:

- Make the Road Action (501(c)(4)) → WFP National PAC: Exactly $45,697.14

- WFP National PAC → Make the Road Action (501(c)(4)): Identical $45,697.14 in-kind expenditure for “Phone Bank” services

- Make the Road bidirectional balances: $141,274 outstanding balances due from Make the Road Action to Make the Road New York (Withum audit documentation)

Penny-Perfect Coordination: The identical amounts flowing in opposite directions on the same day approach statistical impossibility for independent operations, suggesting mathematical evidence of coordination between government-funded entities and political operations.

Professional Audit Documentation of Unified Control:

- Unified Executive Control: Theodoro Oshiro serves as Co-Executive Director of Make the Road New York (501(c)(3)) while simultaneously serving as Executive Director of Make the Road Action Inc. (501(c)(4)), receiving $207,989 in combined compensation for controlling both charitable and political operations

- Withum Audit Finding: “The Organization and Make the Road Action have common officers and board members” with shared facilities at 449 Troutman Street

- Cross-Entity Payroll Integration: Cost-sharing agreements totaling $2.4 million shared payroll and fringe benefits between related entities

Legal Significance: This channel raises questions about potential violations of government funding restrictions through dual-track operations where taxpayer-funded 501(c)(3) entities simultaneously operate political coordination arms while mathematical precision in financial flows and professional audit documentation of unified control suggest coordinated operations rather than independent charitable decision-making.

Where We Are Now: Channel 4 provides additional network coordination support that appears to enhance the $10.14 million Soros pipeline (Channels 1 + 2a + 2b) and the $52+ million government infrastructure (Channel 3). The penny-perfect $45,697.14 bidirectional coordination between Make the Road Action and WFP National PAC suggests mathematical precision that eliminates coincidence as an explanation, while the broader $16.1 million government funding and professional audit documentation of unified control may create additional taxpayer subsidy for the coordinated political operations.

The $10.14+ Million Convergence System

The four channels documented above converge at Working Families Organization (501(c)(4)) to create what appears to be a systematic coordination machine that transforms elite donations and taxpayer resources into street-level political warfare. Understanding this convergence raises questions about how sophisticated financial architecture may enable the conversion of charitable tax benefits into manufactured political power.

Total Channel Convergence at Working Families Organization (501(c)(4)):

- Channel 1 – Direct Political: $5.15 million from Open Society Action Fund (501(c)(4))

- Channel 2a – Direct Charitable Conversion: $4.56 million from Tides Foundation (501(c)(3))

- Channel 2b – Indirect Charitable Conversion: $430,173 from Tides Advocacy coordination pipeline

- Total Direct Convergence: $10.14+ million (Channel 1: $5.15M + Channel 2a: $4.56M + Channel 2b: $0.43M = $10.14M)

- Channel 3 – Government Infrastructure Subsidy: Indirect support through $35.4 million taxpayer-funded operational infrastructure

- Channel 4 – Make the Road Coordination: Network coordination through $16.1 million government-funded pipeline

How Working Families Organization Distributes Coordinated Funding:

Political Operations Distribution: Working Families Organization (501(c)(4)) appears to channel the convergent funding into direct political operations through $2.3 million in PAC distributions:

- Working Families Party Building Account (PAC): $2,200,000 for electoral operations supporting candidates like Mamdani

- WFP National PAC: $80,000 for coordinated political spending

- WFP National Independent Expenditure Committee (Super PAC): $13,000 for unlimited independent expenditures

- MoveOn.org Political Action-Super PAC: $10,000 for additional coordination

The Mathematical Evidence of Coordination:

Enhanced Bidirectional Flows: After receiving $10.14+ million through what appears to be systematic coordination, Working Families Organization (501(c)(4)) engages in reverse flows that raise questions about unified operations:

- Back to Tides Advocacy (501(c)(4)): $225,000 for “NY Renews Education Fund”

- Back to Tides Center (501(c)(3)): $100,000 for “Catalyst Project/Maria Fund”

- Tides Advocacy → Tides Foundation (501(c)(3)): $82,000 for “Environmental Advocacy”

- Make the Road bidirectional balances: $141,274 due from Make the Road Action (Withum audit)

- Tides Center ↔ Tides Foundation bidirectional flows: $10,260,073 for “Healthy Individuals and Communities” ($5,634,644 from Tides Center notably reported using its own EIN 94-3213100 rather than Tides Foundation’s correct EIN 51-0198509, plus $4,625,429 from Tides Foundation)

Total Bidirectional Evidence: $11.6+ million ($430,173 incoming + $325,000 outgoing + $82,000 reverse flow + $141,274 Make the Road balances + $10,260,073 circular flows) creating coordination patterns that raise questions about unified operations rather than independent charitable relationships.

The Systematic Concealment Enabling Convergence:

Despite processing $10.14+ million in coordinated funding and engaging in $11.6+ million in bidirectional flows, Working Families Organization (501(c)(4)) systematically denies all related organization relationships on federal tax returns while:

- Reporting zero employees despite $48.8 million in operations

- Acknowledging “$11.04 million in personnel and administrative costs through shared services arrangements”

Legal Significance: This convergence system raises questions about systematic coordination across entities claiming independence while processing both elite donations and taxpayer resources through unified leadership and shared infrastructure. The mathematical impossibility of the bidirectional flows, combined with systematic concealment patterns and professional audit documentation of unified control, raises questions about whether this may operate as one coordinated political machine disguised through legal separation.

Where We Are Now: The convergence system transforms $10.14+ million in direct coordinated funding (elite donations + charitable conversions) enhanced by $52+ million in taxpayer infrastructure into what appears to be coordinated political operations while maintaining systematic concealment from federal oversight. The bidirectional flows and professional audit documentation of unified control raise questions about whether these entities may operate as unified coordination rather than independent organizations deserving separate tax-exempt treatment.

Systematic Concealment: Website Admissions vs. Federal Denials

The most compelling evidence of potential coordination comes from organizations simultaneously maintaining contradictory positions across different disclosure contexts. When entities publicly acknowledge operational relationships while appearing to deny those same relationships on federal tax returns, it creates objective evidence that raises questions about coordinated disclosure practices that may be designed to avoid regulatory oversight.

The Tides Network Contradiction Pattern:

Public Admissions:

- Tides.org website: “Our organization is made up of five Tides entities” with shared “executive leadership, financial management and accounting”

- Tides Advocacy website: Claims to be “an affiliate of Tides Network, a 501(c)(3) charitable organization”

- Professional audits: Document “cost sharing agreements with Tides Foundation and Tides Center”

Federal Tax Return Denials:

- Tides Advocacy (501(c)(4)): Files no Schedule R relationship disclosures for five consecutive years

- Working Families Organization (501(c)(4)): Systematically answers “NO” to all related organization questions despite $11.6+ million in bidirectional flows

The Shared Leadership Evidence: Janiece Evans-Page serves simultaneously as CEO of Tides Foundation (501(c)(3)), CEO of Tides Center (501(c)(3)), and Director of Tides Advocacy (501(c)(4))—raising questions about unified control over both charitable and political operations while this relationship appears to be concealed from federal regulators through systematic Schedule R omissions despite processing $29+ million in transfers between these entities.

The Professional Audit Validation:

Deloitte & Touche 2023 Findings: Independent auditors with full access to internal records confirm operational unity across the Tides network:

- Operational control: “Network is the sole member and appoints board members” requiring consolidated financial statements

- Centralized operations: 290 employees providing services across multiple entities through unified management

- Control deficiencies: Finding 2023-001 documented “significant deficiency” in federal expenditure controls over $16.2 million

Withum 2023 Make the Road Findings: Independent auditors document unified control across the Make the Road network:

- Shared leadership: “The Organization and Make the Road Action have common officers and board members” with Theodoro Oshiro serving as executive director of both entities

- Operational integration: Cost-sharing agreements and shared facilities at 449 Troutman Street

- Financial coordination: $165,000 in transfers with $141,274 in outstanding balances demonstrating operational unity

The EIN Misalignment Coordination:

EIN Reporting Irregularities:

- Think Outside Da Block Misappropriation: Tides Center reports $343,753 grant to “Tides Advocacy” using EIN 81-3812257, which belongs to Think Outside Da Block Inc. (501(c)(3))

- Self-Referential EIN Misuse: Tides Center reports $5,634,644 grant to “Tides Foundation” using its own EIN 94-3213100 instead of Tides Foundation’s correct EIN 51-0198509—demonstrating systematic confusion or deliberate misreporting where organizations use their own identification numbers when reporting grants to different entities

These EIN reporting irregularities provide objective evidence of reporting problems that warrant investigation.

The Sophisticated Actor Standard:

The Working Families Party’s November 2022 documentation of coordination expertise raises questions about whether systematic concealment patterns represent potential oversight or evidence of willful circumvention:

- Documented knowledge: “WFP coordinated a significant grassroots IE table” and multi-state operations

- Regulatory expertise: Understanding of coordination disclosure requirements and compliance frameworks

- 2023 systematic concealment: Same organization then engages in $11.6+ million bidirectional flows while denying relationships

Legal Significance: When organizations demonstrate comprehensive regulatory knowledge then engage in systematic concealment patterns while processing coordinated funding, it raises questions about potential willful circumvention rather than inadvertent violations. The combination of sophisticated actor evidence with mathematical impossibility and objective EIN obfuscation creates grounds that may warrant criminal referral under IRC Section 7206(1) for willful false statements.

Where We Are Now: The systematic concealment patterns suggest that entities acknowledging relationships in every context except federal regulatory filings may be engaging in coordinated disclosure practices designed to avoid oversight of the $10.14+ million coordination system enhanced by $52+ million in taxpayer infrastructure. Combined with mathematical evidence of unified operations, professional audit documentation of shared control, and sophisticated actor knowledge, the framework raises substantial questions about potential circumvention of federal tax law through coordinated concealment.

Case Study: How the Network May Have Manufactured Mamdani’s Campaign

Understanding how the $10.14+ million convergence system may operate in practice requires examining a concrete political outcome. Zohran Mamdani’s rise from unknown candidate to New York mayoral contender provides a case example of how the network appears to transform elite donations and taxpayer resources into manufactured grassroots political power while maintaining what may be systematic concealment from federal oversight.

The Grassroots Illusion:

Mamdani’s campaign presented itself as a grassroots movement powered by small-dollar donations and community organizing. The reality revealed through financial filings shows what appears to be sophisticated coordination between the same network entities that may systematically conceal their relationships from federal regulators while processing over $52 million in taxpayer funds.

Documented Network Support for Mamdani:

The Attack Infrastructure Supporting Mamdani:

- WFP National PAC: $539,616 in documented attack spending against Mamdani’s opponents and $162,186 supporting the Working Families Party endorsed ranked choice voting slate, as of August 31, 2025

- Make the Road Action (501(c)(4)): $45,697.14 in mathematical coordination with WFP National PAC for “Phone Bank” operations enhanced by $550,000 from Open Society Policy Center to Make the Road Action Fund

- Working Families Party PAC: $100,000 to WFP National PAC (2025 NYCFB records) demonstrating continued coordination patterns into current election cycle

- Network Foundation (2023): Working Families Organization (501(c)(4)) received $10.14+ million from coordinated network sources providing operational capacity for political infrastructure

How All Four Channels May Have Enabled the Coordinated Political Infrastructure:

Channel 1 Impact – Direct Elite Funding:

Open Society Action Fund’s $5.15 million to Working Families Organization (501(c)(4)) appears to have enabled the infrastructure that funded WFP National PAC’s $701,802 in coordinated political operations, including attack spending against Mamdani’s opponents to support Working Families Party-endorsed candidates, while maintaining the appearance of grassroots operations.

Channel 2a Impact – Direct Charitable Conversion:

The $4.56 million direct flow from Tides Foundation (501(c)(3)) to Working Families Organization (501(c)(4)) appears to have provided additional operational capacity for coordinated political operations while donors received tax deductions for contributions that ultimately may have supported political coordination across the network’s candidate operations.

Channel 2b Impact – Indirect Charitable Conversion:

The $430,173 flow through Tides Advocacy (501(c)(4)) to Working Families Organization entities appears to demonstrate systematic conversion of tax-deductible charitable donations into political advocacy operations while relationships may have remained systematically concealed from federal regulators.

Channel 3 Impact – Government Infrastructure:

The $35.4 million in taxpayer funding to Tides Center (501(c)(3)) may have subsidized the operational infrastructure that its admitted “affiliate” Tides Advocacy (501(c)(4)) used to distribute $430,173 throughout the network supporting what appears to be coordinated political operations across multiple campaigns.

Channel 4 Impact – Dual-Track Government Operations:

Make the Road New York’s $16.1 million in government grants appears to have enabled dual-track operations where the charitable arm appeared to focus on community organizing while the political arm coordinated with WFP National PAC in penny-perfect $45,697.14 exchanges demonstrating mathematical coordination precision that eliminates coincidence as an explanation. Professional auditors documented unified executive control with Theodoro Oshiro serving as Co-Executive Director of both charitable and political operations.

The Mathematical Precision Raising Questions About Coordination:

Penny-Perfect Evidence:

- Make the Road Action (501(c)(4)) → WFP National PAC: Exactly $45,697.14

- WFP National PAC → Make the Road Action (501(c)(4)): Identical $45,697.14 in-kind expenditure for “Phone Bank” services on the same day

- Tides Center ↔ Tides Foundation: $5,634,644 in bidirectional flows (notably reported by Tides Center using its own EIN 94-3213100 rather than Tides Foundation’s correct EIN 51-0198509)

- Tides Advocacy → Tides Foundation: $82,000 reverse flow creating additional coordination patterns

Systematic EIN Misreporting: The systematic EIN irregularities include using incorrect identification numbers when reporting grants to different entities, raising questions about systematic reporting confusion or deliberate misrepresentation across multiple organizations.

Coordinated Concealment During Mamdani Support:

- Schedule R omissions: Working Families Organization (501(c)(4)) and Tides Advocacy (501(c)(4)) filed no relationship disclosures despite coordinating $11.6+ million in bidirectional flows

- Website contradictions: Public admission of “affiliate” status while denying relationships to federal regulators

- Sophisticated actor knowledge: Organizations demonstrating regulatory expertise in 2022 then engaging in systematic concealment in 2023

- Professional audit contradictions: Withum documenting “common officers and board members” while entities file contradictory Schedule R denials

The Triple Taxpayer Subsidy That May Amplify Elite Preferences:

Mamdani’s campaign illustrates how the network may create massive political influence while taxpayers subsidize the system through three mechanisms:

- Tax Deduction Savings: George Soros may have saved approximately $2.4 million in taxes on the $8.52 million in charitable contributions that flowed through the conversion system (Channels 2a + 2b combined)

- Infrastructure Subsidy: $52+ million in government grants subsidized the operational infrastructure processing what appears to be coordination

- Matching Fund Multiplication: Coordinated small-dollar fundraising generated 8-to-1 taxpayer matching, amplifying political impact through systematic coordination

Result: Elite donors may have achieved approximately $44+ million in political influence while taxpayers subsidized the system through three separate mechanisms, all while the network maintained the appearance of independent grassroots democracy.

Why This Case Study Matters:

Mamdani represents one political outcome from what appears to be a systematic operation that:

- Processes $10.14+ million in coordinated funding through entities claiming independence

- Utilizes $52+ million in taxpayer resources to subsidize political infrastructure

- May systematically conceal relationships from federal regulators while acknowledging them in other contexts

- Demonstrates $11.6+ million in mathematical coordination precision that eliminates coincidence as an explanation

- Operates under professional audit-documented unified control while filing contradictory federal disclosures

Where We Are Now: The Mamdani case study transforms abstract financial flows into concrete evidence of how systematic concealment may enable the conversion of charitable tax benefits and taxpayer resources into manufactured political power. The network’s sophisticated legal structures appear to maintain plausible deniability through systematic disclosure omissions while processing $10.14+ million in coordinated funding enhanced by $52+ million in taxpayer infrastructure—all disguised as independent grassroots democracy.

This isn’t about opposing any particular candidate or political viewpoint. This is about what appears to be a systematic operation that may be designed to circumvent the legal framework intended to maintain separation between charitable tax benefits and political coordination, while using taxpayer resources to amplify elite political preferences disguised as grassroots democracy.

Why This Matters: Tax System Integrity and Democratic Process

The coordination patterns documented throughout this investigation may represent a fundamental challenge to both the tax-exempt system and democratic processes. When sophisticated actors appear to systematically convert charitable tax benefits into political coordination while utilizing $52+ million in taxpayer resources, it raises questions about the social contract underlying tax-exempt status.

The $8.52+ million charitable-to-political conversion raises questions about systematic circumvention of the legal framework designed to prevent tax-deductible donations from subsidizing political operations. The network’s sophisticated legal structures may enable elite political preferences to appear as grassroots movements while obscuring both the funding sources and taxpayer subsidies, potentially distorting democratic processes through $52+ million in government grants flowing to entities that appear engaged in political coordination.

The Case for Comprehensive IRS Investigation

This investigation reveals $11.6+ million in circular money flows between entities that deny relationships on federal tax returns while processing $10.14+ million in coordinated funding and $52+ million in taxpayer resources. The mathematical precision of these transactions, combined with systematic concealment from federal regulators while publicly acknowledging relationships, raises fundamental questions about whether this network operates as independent charitable organizations or as a coordinated political machine.

IRS Whistleblower Complaint Filed

We’ve filed an Enhanced Sixth Supplemental IRS whistleblower complaint documenting these potential violations with detailed evidence and mathematical proof. The complaint requests immediate investigation while these patterns continue operating daily.

Public Record Disclaimer: All findings in this article are based on publicly available records, including IRS Form 990/990-PF filings, audited financial statements prepared by independent accounting firms, and campaign finance disclosures. This analysis reflects a good-faith review of documentary evidence on matters of public concern.

For updates on this investigation, follow @SamAntar on X

Written by Sam Antar | Forensic Accountant & Fraud Investigator

© 2025 Sam Antar. All rights reserved.