The Investigation

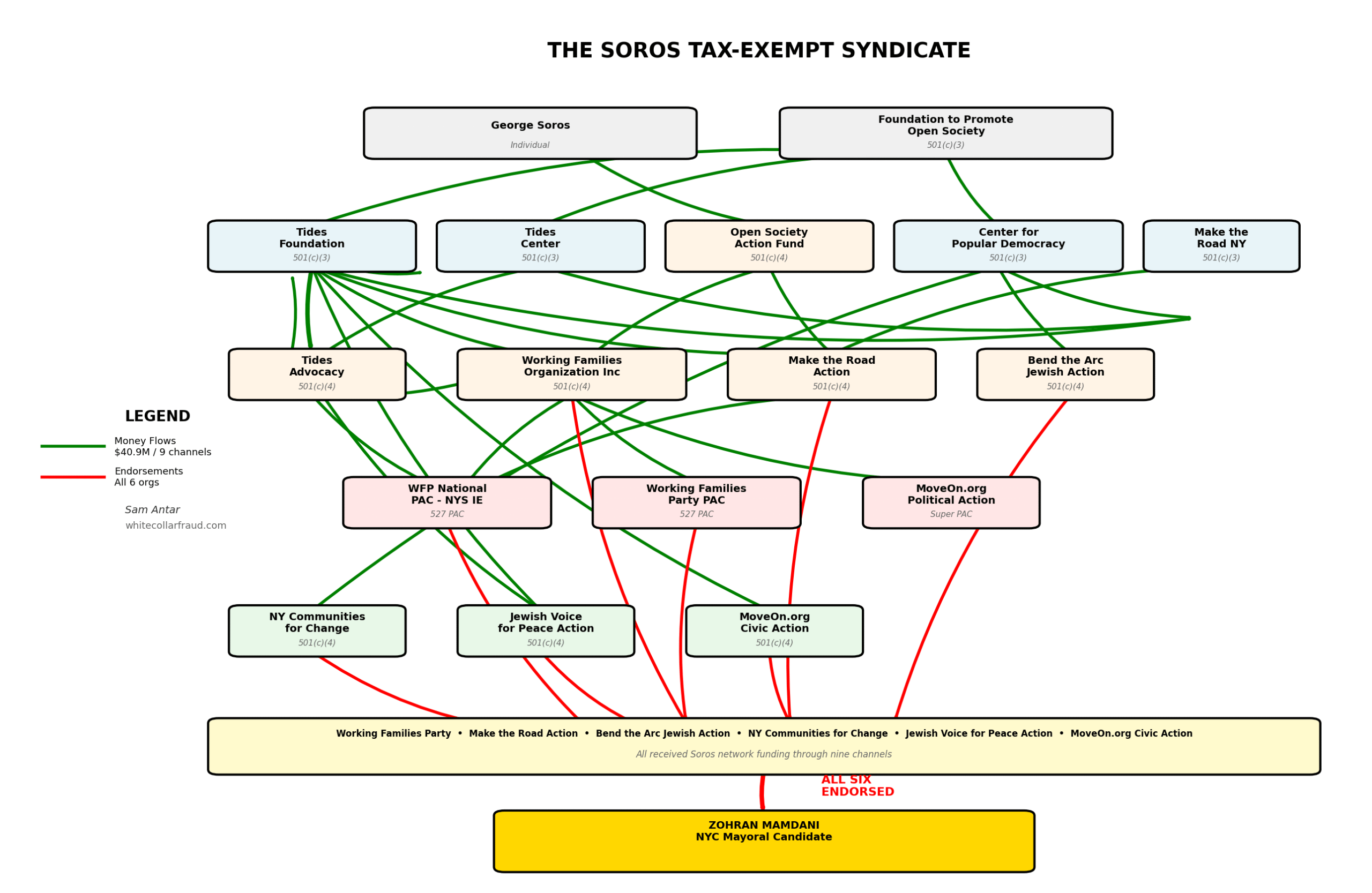

When six organizations receiving $40.9 million from George Soros networks all endorse the same candidate for NYC mayor—Zohran Mamdani—all deploy thousands of volunteers in ground operations presented as independent grassroots mobilization, all conceal their coordination on federal tax forms while admitting it publicly, it proves systematic coordination designed to manipulate an election while hiding the truth from voters.

The most damning evidence comes from the organizations’ own admissions. Working Families Party’s November 9, 2022 memo openly admits “coordinating” Independent Expenditures—political activities that by law must be independent and cannot be coordinated. Then there’s Movement Voter Project’s June 25, 2025 report explicitly identifying Make the Road Action and Working Families Party as collaborative “MVP partners” working “in partnership with” each other.

Behind these admissions: $40.9 million flowing through nine distinct channels, all traceable to George Soros networks, all funding organizations that endorsed Mamdani. When you add $52 million in government grants subsidizing the infrastructure these organizations share, American taxpayers bankroll the systematic coordination enabling this election manipulation.

The coordination methods described here resemble those commonly seen in sophisticated criminal enterprises. They involve multiple legitimate-looking entities that hide the true flow and purpose of funds. Advanced operations avoid openly revealing their coordination—they establish plausible separations while keeping control through shared leadership, circular money flows between “unrelated” entities, and selective transparency that hides relationships from federal oversight while acknowledging them in other contexts.

The concealment mechanism: While Mamdani’s campaign must disclose every donor and expenditure, and while PACs must report independent expenditures, the 501(c)(4) organizations working to elect him face no such requirements. They don’t disclose their donors. They don’t report what they spend supporting candidates. They don’t file with the Board of Elections. Voters see professional ground operations with at least 95,500 documented door knocks plus 30,000 phone contacts from the three organizations that publicly reported metrics—but three of six organizations provided no operational data despite deploying “thousands of volunteers” and “extensive operations” over six months. Voters have no way to know who funded these operations, how much was spent, what the actual operational scale was, or that six legally-separate organizations all received money from the same source and coordinated their activities. The systematic non-reporting of operational metrics by half the organizations mirrors the systematic concealment of coordination on federal tax forms. This creates a triple layer of opacity: hidden funding sources, hidden coordination between seemingly independent organizations, and hidden operational scale with most organizations refusing to disclose their actual activity levels.

This investigation documents the complete money trail: nine funding channels traced through public IRS filings, bidirectional flows between entities claiming operational independence, systematic concealment on federal tax forms, penny-perfect circular transactions proving coordination, and the organizations’ own admissions of working “in partnership”—all converging on a single candidate while voters remained completely in the dark.

The tax arbitrage scheme: Direct political contributions receive no tax deduction. But route that same money through 501(c)(3) charities that transfer to 501(c)(4) political organizations, and donors claim charitable deductions for political spending—converting taxable political contributions into tax-deductible charitable donations. The scheme also moves money out of taxable estates, avoiding future estate taxes while building a generational political machine.

Wealthy donors reduce their estate tax burden, claim income tax deductions, fund political operations, and create permanent infrastructure—all while future generations inherit the coordinated network without the tax bill. This parallels how generational wealth traditionally operates: using tax-advantaged structures to build lasting power that transcends individual lifetimes.

When organizations admit “coordinating” Independent Expenditures that must legally be independent, when charitable donations systematically convert to political operations, and when entities conceal coordination on federal tax forms for five consecutive years—this constitutes systematic violation of the Internal Revenue Code, weaponizing tax benefits to subsidize election manipulation while building permanent political infrastructure that outlasts individual donors.

What we document here represents only a fraction of the full picture—and primarily a snapshot of a multi-year scheme. Our investigation focuses on the 2023 tax year because those are the most recent public IRS filings available, but the coordination patterns span multiple electoral cycles (documented from 2022 through 2025). The complete scope of this coordination can only be understood with the investigative and subpoena powers of the federal government. Individual donors, corporate contributions, offshore flows, entities that don’t file public returns, and funding in years before and after 2023 remain completely hidden. This investigation exposes the visible tip of a coordinated political enterprise operating at industrial scale across multiple years.

The scale: $40.9 million in traceable flows from 2023 alone for a single mayoral race—representing only what we can document from one tax year while individual and corporate donors remain completely hidden. Six coordinating organizations deploying 1,200+ volunteers with at least 95,500 verified door knocks plus 30,000 phone contacts from organizations that publicly disclosed metrics—most refused to report their operational scale. When Mamdani’s official campaign knocked 1.6 million doors, the coordinating organizations deployed parallel infrastructure funded by $40.9M, all presented to voters as independent grassroots support. None appearing in campaign finance reports. The same infrastructure operates nationwide across hundreds of races; we’ve documented one visible example.

The proof: Their own admissions, systematic concealment on federal forms, and forensic analysis of public tax filings revealing nine systematic funding channels all originating from George Soros networks.

We have submitted our tenth supplemental whistleblower complaint to the IRS Whistleblower Office documenting this systematic coordination, requesting investigation of potential violations including charitable-to-political conversion (IRC §4955), false disclosure penalties (IRC §6033), false statements on federal forms (IRC §7206), and improper charitable deductions (IRC §170). The systematic patterns documented here—combined with organizations’ own admissions of coordination—provide the IRS with a roadmap for examining whether these entities operated within the boundaries of their tax-exempt status or functioned as a coordinated political enterprise. (Click on image below to view it in a larger size.)

Table of Contents

PART 2: FOLLOWING THE MONEY (CHANNELS 1-7)

PART 3: THE COORDINATION EVIDENCE (CHANNELS 8-9)

PART 4: LEGAL FRAMEWORK AND FINANCIAL RECONCILIATION

PART 1: THE SCANDAL

The Five-Step Systematic Methodology

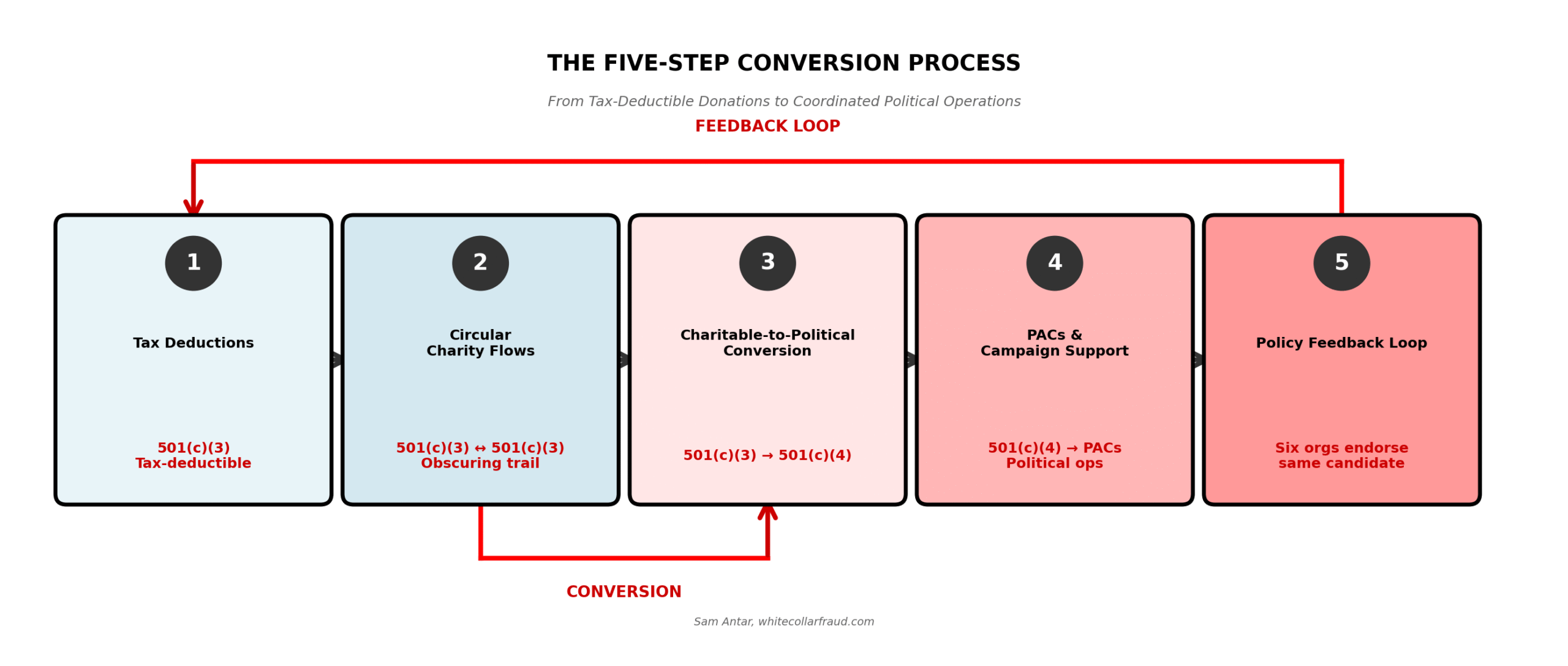

Our comprehensive investigation across nine IRS whistleblower submissions has documented patterns that raise questions about how tax-deductible charitable contributions may relate to political campaign support. The patterns suggest strategic use of tax code distinctions between 501(c)(3) and 501(c)(4) organizations across at least six of the nine documented channels:

STEP 1: Tax-Deductible Charitable Contributions

Wealthy donors make contributions to 501(c)(3) charitable organizations and claim tax deductions under IRC §170, receiving immediate tax benefits averaging 37% of contribution amount for highest-bracket donors. Taxpayer funds through government grants provide additional foundation funding with favorable tax treatment.

- Example: Foundation to Promote Open Society (501(c)(3)) grants $6,435,550 to Tides Foundation in 2023

- Legal Status: Donors receive charitable tax deductions under IRC §170

STEP 2: Pass-Through Foundation Network

Elite funding moves through 501(c)(3) charitable organizations that receive tax-deductible donations while maintaining what appear to be coordinated relationships through shared infrastructure. At this stage, donors have already received their charitable deductions, but money has not yet reached political operations.

- Example: Tides Foundation 501(c)(3) transfers $4,555,657 to Working Families Organization Inc 501(c)(4) in 2023

STEP 3: The Conversion Question – 501(c)(3) to 501(c)(4) Transfers

Money systematically transfers to 501(c)(4) organizations that can engage in unlimited political activity. This raises significant questions: If donors had contributed directly to 501(c)(4) organizations, they would receive NO tax deduction. The 501(c)(3) to 501(c)(4) transfer structure raises questions about whether donors are effectively claiming tax benefits for what becomes political activity funding through what appears to be a form of tax arbitrage that may convert charitable deductions into political power.

- Example: Working Families Organization Inc (501(c)(4)) received funding through multiple channels and redistributed $2 million to Working Families Party PAC. Working Families Party endorsed Zohran Mamdani for NYC Mayor in 2025 general election

- Legal Question: Whether coordination concealed on federal forms while acknowledged publicly constitutes adequate disclosure

STEP 4: PACs and Direct Campaign Support

Funds flow to political committees supporting specific candidates. The charitable tax benefits obtained in Step 1 appear to have systematically converted to direct political campaign support, while voters remain unaware of the funding pipeline. The patterns suggest possible coordination through what may be concealment from federal tax authorities, with entities appearing to deny relationships on Schedule R while admitting coordination elsewhere in the same filings.

- Example: Foundation to Promote Open Society (501(c)(3)) grants $2,085,000 to Tides Center (501(c)(3)), which transfers $343,753 to Tides Advocacy (501(c)(4)), which distributes $430,173 to Working Families Organization entities ($295,173 to Working Families Organization Inc (501(c)(4)) and $135,000 to WFP National PAC (527))

- Political Outcome: Working Families Party endorsed Zohran Mamdani for NYC Mayor in the 2025 general election. WFP National PAC – NYS IE Committee spent money promoting Mamdani and opposing Cuomo in the race

STEP 5: Policy Feedback Loop

Elected officials support policies benefiting the funding network, potentially completing the cycle and ensuring continued resource flows.

- Example: At least six documented organizations all endorse same candidate, deploy 95,500+ verified doors knocked plus 30,000 phone contacts (with most refusing to disclose full operational metrics)

- Disclosure Gap: None of this coordination or funding appears in campaign finance reports

The Tax Arbitrage Question

To understand the potential significance, consider a $1 million contribution:

- Direct to 501(c)(4): Donor pays $1M, receives $0 tax benefit, $1M reaches political operations

- Through 501(c)(3) to 501(c)(4) conversion: Donor pays $1M, receives $370K tax deduction (37% bracket), $1M still reaches political operations through transfer

- Net difference: Same political impact, $370K lower cost to donor, $370K cost potentially shifted to taxpayers

When this appears to operate systematically across $13M+ in a single channel and $40.9M+ across nine channels, the patterns raise questions about tens of millions in potential tax benefit conversions.

This five-step methodology appears across multiple channels with remarkable consistency—raising questions about sophisticated coordination designed to convert tax-deductible charitable donations into political operations while potentially avoiding campaign finance disclosure requirements. Here’s what that coordination produced:

The Convergence: Six Organizations, Nine Channels

Nine funding channels converged on six organizations that all endorsed Zohran Mamdani for NYC mayor in the 2025 general election.

| Organization | Funded Through Channels | Amount | Endorsed |

|---|---|---|---|

| Working Families Party (political party)* | 1-5 (via WFO Hub) | $10,185,830 | Mamdani 2025 |

| Make the Road Action (501(c)(4)) | 4 | $16,277,082 | Mamdani 2025 |

| Bend the Arc Jewish Action (501(c)(4)) | 6 | $13,000,000+ | Mamdani 2025** |

| NY Communities for Change (501(c)(4)) | 7 | $474,500 | Mamdani 2025 |

| Jewish Voice for Peace Action (501(c)(4)) | 8 | $176,000 | Mamdani 2025 |

| MoveOn.org Civic Action (501(c)(4)) | 9 | $204,000 | Mamdani 2025 |

*Working Families Organization Inc (501(c)(4)) received $10,185,830 through Channels 1-5, then systematically redistributed $4.3 million to multiple PACs sharing the same address (77 Sands Street, Brooklyn, NY 11201).

**First-ever mayoral endorsement by organization; professional political infrastructure deployed within 72 hours.

Total Direct Flows (Channels 1-9): $40,867,412 | Government Funding (Channel 3): $52,034,954

Statistical improbability: When six organizations all receiving systematic funding from the same network all endorse the same candidate in the same race, the patterns raise serious questions about coordination.

The convergence pattern raises an obvious question: How does coordination of this scale actually function? The Working Families network provides the clearest example:

Inside the Central Hub: The Working Families Network

The Working Families network serves as the central coordination hub, receiving $10.19 million through five separate channels (Channels 1, 2a, 2b, and 5). Understanding this network’s structure reveals how the broader coordination may operate:

- Working Families Party (Political Party): Official party claiming grassroots authenticity

- Working Families Organization Inc (501(c)(4)): Political advocacy operations serving as central coordination hub. Receives $10.19 million through five channels (Channels 1, 2a, 2b portion, and 5). Functions as systematic PAC redistribution infrastructure

- WFP National PAC (527): Electoral committee for direct candidate support, engaging in 2025 same-day coordinated transfers totaling $100,000

- Working Families Party PAC: Recipient of December 2024 $2 million redistribution validating systematic political coordination

- WFP National Independent Expenditure Committee (Super PAC): Unlimited independent expenditures

All entities share the same address: 77 Sands Street, Brooklyn, NY 11201

How Working Families Organization Redistributes to PACs

This network structure demonstrates how the $10.19 million convergence at Working Families Organization Inc (501(c)(4)) operates as systematic PAC redistribution infrastructure. Here’s the complete breakdown:

Working Families Organization Inc (501(c)(4)) Systematic PAC Redistribution (2023-2024):

2023 Distributions (from Form 990, Schedule I):

- WF Party Building Account (PAC): $2,200,000 (Line 79)

- WFP National PAC: $80,000 (Line 81)

- WFP National Independent Expenditure Committee (PAC): $13,000 (Line 80)

- MoveOn.org Political Action-Super PAC: $10,000 (Line 44)

- 2023 Subtotal: $2,303,000

2024 Distribution (from FEC filing C00606962):

- Working Families Party PAC (Committee ID C00606962): $2,000,000 (December 9, 2024)

Total 2023-2024: $4,303,000

All entities claim independence on federal forms despite this systematic redistribution pattern—distributing millions to multiple legally separate PAC entities all sharing the same address.

The December 2024 Deployment

On December 9, 2024—during the mayoral campaign—Working Families Organization (501(c)(4)) transferred $2,000,000 to Working Families Party PAC (527), validating that the systematic convergence of $10.19 million through five channels directly enabled political operations rather than independent charitable activities.

Source: FEC filing C00606962, December 9, 2024

Final Deployment: WFP National PAC – NYS IE Committee Spending (2025)

This systematic redistribution infrastructure—including the December 2024 $2 million transfer—enabled WFP National PAC – NYS IE Committee to deploy substantial independent expenditures during the 2025 mayoral race:

- Total spending: $711,792

- Supporting Zohran Mamdani: $65,955

- Opposing Andrew Cuomo: $539,616

- Supporting other WFP-endorsed candidates: $106,221

Source: NYC Campaign Finance Board Independent Expenditure Profile

Working Families Party formally endorsed Mamdani for NYC Mayor.

PART 2: FOLLOWING THE MONEY (CHANNELS 1-7)

The following seven channels document systematic flows from George Soros networks to political organizations. The patterns raise questions about whether tax-deductible charitable contributions are being systematically converted into political operations.

The Working Families Hub: Five Funding Sources, One Destination

Before examining each channel individually, it’s essential to understand that five separate funding channels (Channels 1, 2a, 2b, 5, and portions of Channel 3) all converge at Working Families Organization Inc (501(c)(4)). This convergence pattern raises questions about whether the hub operates as a central coordination point.

| Channel | Flow | Amount |

|---|---|---|

| Channel 1 (Track 1) | OSAF (501(c)(4)) → WFO (501(c)(4)) | $5,150,000 |

| Channel 2a | Tides Foundation (501(c)(3)) → WFO (501(c)(4)) | $4,555,657 |

| Channel 2b (Flow 1) | Tides Advocacy (501(c)(4)) → WFO (501(c)(4)) | $295,173 |

| Channel 2b (Flow 2) | Tides Advocacy (501(c)(4)) → WFP National PAC (527) | $135,000 |

| Channel 5 | CPD (501(c)(4)) → WFO (501(c)(4)) | $50,000 |

| Total Convergence at WF Network | $10,185,830 | |

*Note: Channel 2b’s total is $430,173, but $295,173 went to Working Families Organization Inc while $135,000 went directly to WFP National PAC (527). The total Working Families network convergence is $10,185,830 when including both WFO and WFP National PAC.

The Common Political Outcome

After receiving funds from these five channels, the Working Families network engaged in systematic political activity that raises questions about coordination:

- Endorsement: Working Families Party endorsed Zohran Mamdani for NYC Mayor in the 2025 general election (source)

- December 9, 2024 Redistribution: Working Families Organization Inc transferred $2,000,000 to Working Families Party PAC (527) (FEC filing C00606962)

- Total PAC Distributions (2023-2024): Working Families Organization Inc redistributed $4,303,000 to multiple political committees

- Coordinated Operations: Penny-perfect $45,697.14 circular transaction with Make the Road Action on June 11, 2025, raising questions about coordination between entities

The Coordination Question

The convergence pattern raises significant questions: Why do five separate funding channels—using different legal structures and flowing through different intermediaries—all lead to the same political organization, which then systematically redistributes millions to PACs supporting the same candidate?

When combined with Working Families Party’s November 2022 admission of “coordinating” Independent Expenditures (which by law must be independent), the financial patterns suggest systematic coordination rather than independent charitable activity.

The Individual Channels: How The Money Flowed

Now that we understand where five channels converged and what resulted, let’s examine each channel’s specific mechanics:

Channel 1: Direct Political Pipeline – $5,700,000 (Two Tracks)

Complete Flow: George Soros → Open Society Action Fund Inc (501(c)(4)) → $5,700,000 → Two separate political organizations

Channel 1 demonstrates Open Society Action Fund deploying direct political funding to multiple organizations in the coordinated network, not just one recipient. The two tracks fund separate organizations that subsequently engage in documented coordinated operations (penny-perfect $45,697.14 circular transaction on June 11, 2025).

Financial Documentation:

Track 1: Open Society Action Fund → Working Families Organization Inc

- Open Society Action Fund → Working Families Organization Inc: $4,150,000

- Source: 2023 Open Society Action Fund Form 990, Schedule I, Line 228

- Open Society Action Fund → Working Families Organization Inc: $1,000,000

- Source: 2023 Open Society Action Fund Form 990, Schedule I, Line 229

- Track 1 Total: $5,150,000

Track 2: Open Society Action Fund → Make the Road Action

- Open Society Action Fund (501(c)(4)) → Make the Road Action Fund Inc (501(c)(4)): $550,000

- Source: 2023 Open Society Action Fund Form 990, Schedule I, Line 99

- Recipient: Make the Road Action Fund Inc, 449 Troutman Street Suite C, Brooklyn, NY 11237

- Track 2 Total: $550,000

Channel 1 Total: $5,700,000 (Track 1: $5,150,000 + Track 2: $550,000)

Political outcomes for Track 1 documented in convergence section above. Track 2 outcome below.

Track 2 Political Outcome:

Make the Road Action endorsed Zohran Mamdani for NYC Mayor and deployed 6,000 door knocks in the primary per Movement Voter Project report, with operations continuing into the general election including 2,000 doors knocked on Staten Island on the first day of early voting alone (October 25, 2025).

The Coordination Nexus Between Track 1 and Track 2 Recipients:

Make the Road Action (Track 2 recipient) and Working Families Organization (Track 1 recipient) engaged in penny-perfect coordinated transactions demonstrating they operate as a coordinated network despite being legally separate entities:

June 11, 2025 Circular Transaction:

- Make the Road Action → WFP National PAC: Exactly $45,697.14

- WFP National PAC → Make the Road Action: Identical $45,697.14 in-kind expenditure for “Phone Bank” services

- Same day, identical amounts, opposite directions

- Source: NYC Campaign Finance Board Independent Expenditure profile

This mathematical precision eliminates coincidence and proves organizations funded by the same source (Open Society Action Fund) coordinate their political operations. The penny-perfect circular transaction provides mathematical evidence that Track 1 and Track 2 recipients operate as a unified coordinated network, not independent entities.

Channel 2a: Direct Charitable-to-Political Conversion – $4,555,657

Complete Flow: George Soros → Foundation to Promote Open Society (501(c)(3)) → $6.4 million → Tides Foundation (501(c)(3)) → $4.56 million → Working Families Organization (501(c)(4)) → $2,303,000 → Systematic Multi-PAC Redistribution Network

This channel demonstrates the tax arbitrage question: donors receive charitable deductions for contributions to Foundation to Promote Open Society (501(c)(3)), yet funds flow to a political organization.

Financial Documentation:

Foundation Input to Tides Foundation (501(c)(3)):

- Foundation to Promote Open Society Input Total: $6,435,550

- Source: 2023 Foundation to Promote Open Society Form 990-PF, Part XIV

Conversion Output to Working Families Organization Inc (501(c)(4)):

- Tides Foundation Inc (501(c)(3)) → Working Families Organization Inc (501(c)(4)): $4,555,657

- Source: 2023 Tides Foundation Form 990, Schedule I, Line 2272

Channel 2a Total: $4,555,657

Political outcome documented in convergence section above.

IRC §4955 Implication: Tax-deductible donations to Foundation to Promote Open Society (501(c)(3)) and Tides Foundation Inc (501(c)(3)) systematically converted to political operations through Working Families Organization Inc (501(c)(4)).

Channel 2b: Indirect Charitable Conversion – $430,173

Complete Flow: George Soros → Foundation to Promote Open Society (501(c)(3)) → $2.1M → Tides Center (501(c)(3)) → $343,753 → Tides Advocacy (501(c)(4)) → $430,173 → Working Families Entities

Financial Documentation:

Foundation to Promote Open Society (501(c)(3)) Input to Tides Center (501(c)(3)):

- Foundation to Promote Open Society Input Total: $2,085,000

- Source: 2023 Foundation to Promote Open Society Form 990-PF, Part XIV

Traceable Flows to Working Families Network from Tides Advocacy:

- Tides Advocacy (501(c)(4)) → Working Families Organization Inc (501(c)(4)): $295,173

- Source: 2023 Tides Advocacy Form 990, Schedule I, Line 97

- Tides Advocacy (501(c)(4)) → WFP National PAC (527): $135,000

- Source: 2023 Tides Advocacy Form 990, Schedule I, Line 98

- Total to Working Families Network: $430,173

The Industrial-Scale Context:

Channel 2b represents only the traceable portion of Tides Advocacy’s systematic conversion infrastructure:

Systematic Tides Network Charitable-to-Political Conversion Infrastructure:

- Tides Foundation (501(c)(3)) → Tides Advocacy (501(c)(4)): $29,312,169

- Source: 2023 Tides Foundation Form 990, Schedule I, Line 2041

- Tides Center (501(c)(3)) → Tides Advocacy (501(c)(4)): $343,753

- Source: 2023 Tides Center Form 990, Schedule I, Line 340

- Total Tides Advocacy (501(c)(4)) Annual Conversion: $29,655,922

The $29.7 million demonstrates the industrial scale of systematic conversion operations. The $430,173 documented here represents only the traceable flows to Working Families entities—we can only document what reached the six Mamdani endorsers to avoid overstating the case.

Circular Flows Between Tides Charities:

- Tides Foundation (501(c)(3)) → Tides Center (501(c)(3)): $4,625,429

- Source: 2023 Tides Foundation Form 990, Schedule I, Line 2042

- Tides Center (501(c)(3)) → Tides Foundation (501(c)(3)): $5,634,644

- Source: 2023 Tides Center Form 990, Schedule I, Line 341

Total Circular Charity Flows: $10,260,073

Channel 2b Total: $430,173 (traceable portion of $29.7M Tides Advocacy systematic conversion)

Political outcome documented in convergence section above.

Schedule R Violation: Tides Advocacy (501(c)(4)) systematically filed zero Schedule R relationship disclosures for five consecutive years (2019-2023) while processing $29.7+ million in annual conversions from related Tides charitable entities. This raises questions about willful concealment of systematic coordination on an industrial scale.

Channel 3: Government Infrastructure – $35,365,170

How Taxpayer Funds May Enable Private Political Operations

Channel 3 documents $35.4 million in taxpayer-funded government grants to 501(c)(3) charitable organizations whose 501(c)(4) political affiliates received Soros network funds through other channels and endorsed Mamdani.

The Cash Fungibility Question:

The principle is simple: every taxpayer dollar granted to a 501(c)(3) charity frees up that organization’s resources for other purposes. When the charity shares infrastructure, leadership, and operations with a 501(c)(4) political affiliate, government funding may indirectly enable political activity.

Key Examples:

- Tides Center (501(c)(3)): $35,365,170 in government grants

- Political affiliate: Tides Advocacy (501(c)(4))

- Political outcome: Processed $29.7M conversion, funded multiple Mamdani endorsers

- Source: 2023 Tides Center Form 990, Part VIII, Line 1e

Channel 3 Total: $35,365,170

Important Note: Channel 3 is documented separately and NOT included in the $40.9M total to avoid double-counting. However, it raises questions about how American taxpayers may subsidize infrastructure that enables systematic political coordination.

Channel 4: Make the Road Network – $16,277,082

Complete Flow: Multiple tracks through Make the Road network, including Foundation to Promote Open Society funding via Tides Network, government contracts enabling infrastructure, and documented bidirectional flows demonstrating coordination.

Note: Make the Road Action (501(c)(4)) also received $550,000 in direct political funding from Open Society Action Fund (documented in Channel 1, Track 2). Channel 4’s $16,277,082 specifically represents the four tracks documented in Make the Road’s and Tides’ 2023 Form 990s.

Financial Documentation (Four Tracks Totaling $16,277,082):

Track 1: Government Infrastructure

- U.S. Government → Make the Road NY (501(c)(3)): $16,124,582

- Source: 2023 Make the Road NY Form 990, Part VIII, Line 1e

- Government funding creates operational infrastructure that enables documented charitable-to-political conversions

Track 2: Tides Center Pipeline

- Tides Center (501(c)(3)) → Make the Road NY (501(c)(3)): $37,500

- Source: 2023 Tides Center Form 990, Schedule I, Line 202

Track 3: Tides Foundation to Action

- Tides Foundation (501(c)(3)) → Make the Road Action (501(c)(4)): $75,000

- Source: 2023 Tides Foundation Form 990, Schedule I, Line 1205

- Direct charitable-to-political transfer from Tides Foundation to Make the Road’s political arm

Track 4: Tides Foundation to NY

- Tides Foundation (501(c)(3)) → Make the Road NY (501(c)(3)): $40,000

- Source: 2023 Tides Foundation Form 990, Schedule I, Line 1206

Channel 4 Four-Track Total: $16,277,082

Systematic Charitable-to-Political Conversion Within Network:

- Make the Road NY (501(c)(3)) → Make the Road Action (501(c)(4)): $165,000

- Source: 2023 Make the Road NY Form 990, Schedule I, Line 3

- This documented $165,000 internal conversion from 501(c)(3) charity to 501(c)(4) political arm raises questions under IRC §4955 about how government infrastructure subsidies enable systematic charitable-to-political conversions

The Penny-Perfect Coordination:

On June 11, 2025, Make the Road Action and WFP National PAC engaged in same-day circular transactions:

- Make the Road Action → WFP National PAC: Exactly $45,697.14

- WFP National PAC → Make the Road Action: Identical $45,697.14 in-kind expenditure for “Phone Bank” services

- Same day, identical amounts, opposite directions

- Source: NYC Campaign Finance Board Independent Expenditure profile

This mathematical precision eliminates coincidence and raises serious questions about coordination between entities claiming to operate independently.

Political Outcome:

Make the Road Action endorsed Mamdani and deployed 6,000 door knocks in the primary per Movement Voter Project’s June 25, 2025 report, with operations continuing into the general election including 2,000 doors knocked on Staten Island on the first day of early voting alone (October 25, 2025). Movement Voter Project explicitly documents Make the Road Action working “in partnership with Working Families Party”—the same two organizations that received funding through Channel 1 (Track 1 and Track 2) and engaged in the penny-perfect $45,697.14 circular transaction on June 11, 2025. The mathematical precision of the circular transaction combined with their own admission of working “in partnership” eliminates any possibility of coincidental independent operations.

Channel 5: Center for Popular Democracy Distribution – $50,000

Complete Flow: Center for Popular Democracy (501(c)(3)) → Working Families Organization Inc (501(c)(4)): $50,000

Financial Documentation:

- Center for Popular Democracy (501(c)(3)) → Working Families Organization Inc (501(c)(4)): $50,000

- Source: 2023 Center for Popular Democracy Form 990, Schedule I, Line 32

The Leverage Question:

- Center for Popular Democracy received $545,202 in government grants in 2023

- Yet distributed $1,411,940 to network entities

- Leverage ratio: 259%

- Source: 2023 Center for Popular Democracy Form 990

This raises questions about how government funding may enable political coordination infrastructure beyond what taxpayers directly funded.

Political outcome documented in convergence section above.

Channel 5 Total: $50,000

Channel 6: Bend the Arc Multi-Year Pattern – $13,000,000

Complete Flow: Foundation to Promote Open Society (501(c)(3)) → Bend the Arc: A Jewish Partnership for Justice (501(c)(3)) ↔ Bend the Arc Jewish Action Inc (501(c)(4)) [Multi-year bidirectional flows 2021-2023]

The Multi-Year Pattern:

Foundation Grants (2018-2024):

- Cumulative Foundation to Promote Open Society grants to Bend the Arc charity: $1,533,500

- Source: Multiple years Foundation to Promote Open Society Form 990-PF filings

Bidirectional Flows (Charity ↔ Political):

- 2021: Bend the Arc (501(c)(3)) ↔ Bend the Arc Jewish Action (501(c)(4)): $4,033,698

- 2022: Bend the Arc (501(c)(3)) ↔ Bend the Arc Jewish Action (501(c)(4)): $3,636,274

- 2023: Bend the Arc (501(c)(3)) ↔ Bend the Arc Jewish Action (501(c)(4)): $3,809,977

- Total Multi-Year Bidirectional Flows: $11,479,949

- Sources: 2021-2023 Form 990 filings for both organizations

Channel 6 Total: $13,000,000+ (Foundation grants + bidirectional flows)

The Political Outcome:

In September 2025, Bend the Arc Jewish Action endorsed Mamdani—its first-ever mayoral endorsement. Within 72 hours, professional political infrastructure deployed supporting the endorsement, raising questions about whether multi-year funding patterns enable rapid political mobilization.

The Coordination Question: Why would an organization make its first-ever mayoral endorsement for a candidate who receives systematic support from five other organizations all funded by the same network?

Channel 7: NY Communities for Change – $474,500

Complete Flow: Center for Popular Democracy (501(c)(4)) → NY Communities for Change (501(c)(4)): $474,500

Financial Documentation:

- Center for Popular Democracy (501(c)(4)) → NY Communities for Change (501(c)(4)): $474,500

- Source: 2023 Center for Popular Democracy Form 990, Schedule I, Line 3

The Political Outcome:

NY Communities for Change (501(c)(4)) endorsed Mamdani at the #1 rank position “from the very beginning” and deployed 7,500 doors knocked with 30,000 phone contacts per Inside Climate News. Backed by 20,000+ members, NYCC conducted documented door-knocking operations integrating tenant rights advocacy with campaign mobilization.

In September 2025, NY Communities for Change (501(c)(4)) launched a new independent expenditure committee, Livable Future PAC, planning to raise and spend approximately $50,000 for continued canvassing operations in the general election—demonstrating the coordination network’s sustained deployment beyond the primary.

The Distribution Hub Pattern:

Center for Popular Democracy distributed to two Mamdani endorsers:

- Working Families Organization Inc: $50,000 (Channel 5)

- NY Communities for Change: $474,500 (Channel 7)

- Total CPD distributions to endorsers: $524,500

This pattern raises questions about whether CPD functions as a coordination hub distributing funds to organizations that all support the same candidate.

Channel 7 Total: $474,500

Channels 1-7 Summary

| Channel | Amount | Type |

|---|---|---|

| Channel 1 (Two Tracks) | $5,700,000 | Direct Political |

| Channel 2a | $4,555,657 | Charitable Conversion |

| Channel 2b | $430,173 | Charitable Conversion |

| Channel 3 | $35,365,170 | Government (Not in $40.9M total) |

| Channel 4 (Four Tracks) | $16,277,082 | Mixed |

| Channel 5 | $50,000 | Distribution Hub |

| Channel 6 | $13,000,000 | Multi-Year Bidirectional |

| Channel 7 | $474,500 | Distribution Hub |

| Channels 1-7 Total | $40,487,412 |

Note: Channel 3 ($35.4M in government funding) is documented separately to show infrastructure enablement but is NOT included in the $40.9M total to avoid overstating Soros network flows.

PART 3: THE COORDINATION EVIDENCE (CHANNELS 8-9)

Channel 8: Jewish Voice for Peace Action – $176,000

NEW EVIDENCE – Tenth Supplemental Submission

Two-Track Tides Network Flow → Jewish Voice for Peace Network

Channel 8 documents systematic funding through the Tides network to both the charitable and political arms of Jewish Voice for Peace, demonstrating the same conversion methodology documented across Channels 1-7.

Complete Flow:

Tides Foundation (501(c)(3)) and Tides Center (501(c)(3)) → Jewish Voice for Peace (501(c)(3)) → Jewish Voice for Peace Action (501(c)(4)), demonstrating systematic charitable-to-political conversion through the Tides network.

The Two Tracks:

Track 1 – Tides Foundation (501(c)(3)) → Jewish Voice for Peace (501(c)(3)):

- Tides Foundation (501(c)(3)) → A Jewish Voice for Peace Inc (501(c)(3)): $76,000

- Source: 2023 Tides Foundation Form 990, Schedule I, Line 16

Track 2 – Charitable Conversion: Tides Center (501(c)(3)) → Tides Advocacy (501(c)(4)) → Jewish Voice for Peace Action (Political):

- Tides Center (501(c)(3)) → Tides Advocacy (501(c)(4)): $343,753 (part of $29.7M total conversion documented in Channel 2b)

- Source: 2023 Tides Center Form 990, Schedule I, Line 340

- Tides Advocacy (501(c)(4)) → Jewish Voice for Peace Action (501(c)(4)): $100,000

- Source: 2023 Tides Advocacy Form 990, Schedule I, Line 41

Channel 8 Total: $176,000 (charitable + political tracks)

The Network Integration:

A Jewish Voice for Peace Inc (501(c)(3), EIN: 90-0189474) operates Jewish Voice for Peace Action (501(c)(4)), EIN: 82-3172699) as affiliated political arm. Organizations share infrastructure, leadership, and operational capacity.

Evidence of integration:

- Shared website infrastructure (jvp.org houses both organizations)

- Common leadership structure

- Operational integration similar to other channels

Charitable-to-Political Transfers:

Jewish Voice for Peace Action 2023 Form 990, Schedule R Part V documents transactions with A Jewish Voice for Peace Inc:

- Transaction Type L: $0 (legal fees)

- Transaction Type N: $0 (occupancy)

- Transaction Type O: $194,000 (reimbursement)

- Transaction Type P: $0 (personnel)

- Transaction Type R (PACs): $0 (cost allocations to JVP Action PAC and JVPA IE PAC)

The $194,000 reimbursement demonstrates systematic resource sharing between the charitable and political arms, similar to the bidirectional flows documented in Channel 6 (Bend the Arc).

Political Outcome:

Jewish Voice for Peace Action (501(c)(4)) endorsed Zohran Mamdani for NYC mayor with early strategic timing and explicit public statements. This political activity was funded through systematic conversion of tax-deductible charitable donations.

Sources:

- New York Times, “Many Jewish Voters Back Mamdani and Many Agree With Him on Gaza,” August 4, 2025

- The Guardian, “What should Jewish New Yorkers make of Zohran Mamdani? | Beth Miller and JoAnn Mort,” July 16, 2025

- Fundraising page: “New year, new mayor: Join JVP Action in support of Zohran Mamdani”

Ground Operations and Network Coordination:

JVP Action deployed the single largest door-knocking operation in the race:

- 80,000 doors knocked (largest of all organizations)

- Hundreds of thousands of calls

- Professional field infrastructure activated

- Source: Public statements by Political Director Beth Miller; The Guardian, July 2025

Beth Miller, Political Director of JVP Action (The Guardian, July 2025): Jewish New Yorkers supporting Mamdani “in droves”

Cross-Channel Coordination Evidence:

Jewish Voice for Peace Action is one of six organizations receiving Soros network funding that endorsed Mamdani and deployed coordinated ground operations. The 80,000 doors knocked by JVP Action represents the largest single ground operation, deployed in coordination with:

- Working Families Party (501(c)(4)) (Channels 1-5): Coordinated PAC network operations

- Make the Road Action (501(c)(4)) (Channels 1 & 4): 6,000 doors in primary, 2,000+ additional in general election, working “in partnership with WFP”

- Bend the Arc Jewish Action (Channel 6) (501(c)(4)): Endorsed with infrastructure mobilization

- NY Communities for Change (Channel 7) (501(c)(4)): 7,500 doors knocked, 30,000 phone contacts

- MoveOn.org Civic Action (Channel 9): Volunteer coordination operations

All six organizations received funding through interconnected Soros network channels, endorsed the same candidate, and deployed ground operations during the same campaign period. While not explicitly named in the Movement Voter Project June 25, 2025 report identifying collaborative “MVP partners,” JVP Action’s 80,000-door operation—by far the largest—demonstrates systematic deployment of professional field infrastructure consistent with coordinated network operations rather than isolated independent activity.

Key Finding: The scale and timing of JVP Action’s ground operations (80,000 doors) alongside five other Soros-funded organizations endorsing and mobilizing for the same candidate during the same period raises questions about systematic coordination across the network, not coincidental parallel activity.

Channel 9: MoveOn.org Civic Action – $204,000

NEW EVIDENCE – Tenth Supplemental Submission

Two-Track Funding: Tides Foundation Direct + Charitable Conversion

Complete Flow: MoveOn Education Fund (501(c)(3)) → Tides Foundation (501(c)(3)) → MoveOn.org Civic Action (501(c)(4)), plus MoveOn Education Fund (501(c)(3)) → MoveOn.org Civic Action (501(c)(4)) direct, plus Working Families Organization Inc (501(c)(4)) → MoveOn.org Political Action (Super PAC).

The Circular Flow: MoveOn Education Fund (501(c)(3)) grants $50,000 to Tides Foundation (501(c)(3)), which then distributes $150,000 to MoveOn.org Civic Action (501(c)(4))—demonstrating systematic charitable-to-political conversion through intermediary foundations.

Track 0: The Circular Flow (MoveOn → Tides → MoveOn)

- MoveOn Education Fund (501(c)(3)) → Tides Foundation (501(c)(3)): $50,000

- Documentation: MoveOn Education Fund 2023 Form 990, Schedule I, Line 2

- Pattern: MoveOn Education Fund grants to Tides Foundation, which then distributes $150K back to MoveOn.org Civic Action—a circular flow demonstrating coordinated conversion infrastructure

Track 1: Tides Foundation Direct Funding

- Tides Foundation → MoveOn.org Civic Action: $150,000

- Amount: $150,000 (2023)

- Documentation: 2023 Tides Foundation Form 990, Schedule I, Line 1308

Track 2: Charitable-to-Political Conversion

- MoveOn Education Fund → MoveOn.org Civic Action: $54,000

- Amount: $54,000 (2023)

- Documentation: MoveOn Education Fund 2023 Form 990, Schedule I, Line 1

Channel 9 Total: $204,000

Track 3: Cross-Network PAC Funding

- Working Families Organization Inc (501(c)(4)) → MoveOn.org Political Action (Super PAC): $10,000

- Source: 2023 Working Families Organization Inc Form 990, Schedule I, Line 44

- This demonstrates systematic network integration: Working Families Organization Inc (receiving $10.19M from Channels 1-5) redistributes funds to MoveOn.org Political Action, connecting Channel 9 to the broader coordination network

The Network Structure:

- MoveOn Education Fund (501(c)(3), EIN: 87-0632134): Charitable entity

- MoveOn.org Civic Action (501(c)(4), EIN: 06-1553389): Political arm

- Organizations share infrastructure, branding, and operations

- Presented to public as unified “MoveOn” organization

Political Outcome:

MoveOn.org Civic Action officially endorsed Zohran Mamdani for NYC Mayor at the #1 rank position—their highest endorsement level.

The MoveOn Ground Operation:

MoveOn’s Upper West Side Action Group deployed massive coordinated volunteer operations:

- 8,154 members mobilized

- 13,713 volunteer shifts completed

- 379,454 letters sent

- Professional field infrastructure coordinated with other network entities

- Source: Swing Left website, “Upper West Side Action Group: MoveOn/Indivisible/Swing Left,” accessed October 21, 2025

“Upper West Side Action Group: MoveOn/Indivisible/Swing Left” demonstrates coordinated volunteer operations supporting Mamdani with 8,154 group members deploying 13,713 volunteer shifts.

Network Coordination:

MoveOn.org Civic Action is one of six organizations receiving Soros network funding that endorsed Mamdani and deployed coordinated operations. The massive volunteer deployment (8,154 members, 13,713 shifts) demonstrates professional coordination infrastructure, not independent grassroots activity.

Cross-Channel Integration:

MoveOn operated alongside:

- Working Families Party (501(c)(4)) (Channels 1-5, $10.19M)

- Make the Road Action (501(c)(4)) (Channels 1 & 4, $16.8M)

- Bend the Arc Jewish Action (501(c)(4)) (Channel 6, $13M)

- NY Communities for Change (501(c)(4)) (Channel 7, $475K)

- Jewish Voice for Peace Action (501(c)(4)) (Channel 8, $176K)

All funded through interconnected Soros network channels, all endorsing the same candidate, all deploying coordinated operations during the same campaign period.

Key Finding: Channel 9 demonstrates circular flow tactics: MoveOn Education Fund (501(c)(3)) grants $50K to Tides Foundation, which returns $150K to MoveOn.org Civic Action (501(c)(4)). Additionally, MoveOn Education Fund directly grants $54K to MoveOn.org Civic Action. Total: $204,000 in charitable-to-political conversion. The broader MoveOn network is integrated with the coordination hub through Working Families Organization Inc’s $10,000 transfer to MoveOn.org Political Action (Super PAC). MoveOn coordinated through ‘Upper West Side Action Group’ partnership with 8,154 members deploying 13,713 volunteer shifts, completing six-organization convergence on Mamdani endorsement.

The Six-Organization Convergence

Channels 8-9 bring the total to six organizations—all funded by Soros networks, all endorsing Mamdani, all deploying coordinated ground operations:

- Working Families Party (Channels 1, 2a, 2b, 5): $10,185,830 – Endorsed Mamdani

- Make the Road Action (Channels 1, 4): $16,827,082 – Endorsed Mamdani

- Bend the Arc Jewish Action (Channel 6): $13,000,000 – Endorsed Mamdani

- NY Communities for Change (Channel 7): $474,500 – Endorsed Mamdani

- Jewish Voice for Peace Action (Channel 8): $176,000 – Endorsed Mamdani

- MoveOn.org Civic Action (Channel 9): $204,000 – Endorsed Mamdani

Total Ground Operations:

- Jewish Voice for Peace Action: 80,000 doors knocked per organization’s statement

- NY Communities for Change: 7,500 doors knocked, 30,000 phone contacts backed by 20,000+ members with documented canvassing operations

- Make the Road Action: 6,000 doors in primary per MVP report, 2,000+ in general election

- Working Families Party: 1,000 volunteers, 100+ canvassing events per MVP report

- Bend the Arc Jewish Action: Rapid 72-hour infrastructure deployment following endorsement

- MoveOn.org Civic Action: Member mobilization campaigns

- Combined: 95,500+ verified doors knocked plus 30,000 phone contacts from organizations that publicly reported metrics, with three organizations providing no operational data despite extensive documented activities

The Pattern

When six organizations all receiving systematic funding from the same network all endorse the same candidate in the same race, this pattern raises serious questions about whether independent decision-making is occurring.

The Complete Nine-Channel Summary: $40,867,412

Final Financial Reconciliation

Channels 1-7 (Documented in Part 2): $40,487,412

- Channel 1 (Two Tracks): $5,700,000 – Direct Political → WFP + Make the Road Action

- Channel 2a: $4,555,657 – Charitable Conversion → WFP

- Channel 2b: $430,173 – Charitable Conversion → WFP

- Channel 4 (Four Tracks): $16,277,082 – Multi-track Network → Make the Road Action

- Channel 5: $50,000 – Hub Distribution → WFP

- Channel 6: $13,000,000 – Bidirectional Flows → Bend the Arc Jewish Action

- Channel 7: $474,500 – Hub Distribution → NY Communities for Change

Channels 8-9 (NEW – This Submission): $380,000

- Channel 8: $176,000 – Charitable Conversion → Jewish Voice for Peace Action

- Channel 9: $204,000 – Charitable Conversion → MoveOn.org Civic Action

NINE-CHANNEL TOTAL: $40,867,412

Channel 3 (Government Infrastructure – Separate Documentation): $52,034,954

- Tides Center: $35,365,170

- Make the Road NY: $16,124,582

- Center for Popular Democracy: $545,202

- NOT included in $40.9M total to avoid double-counting

- Documents taxpayer funding enabling political infrastructure

Organization Key:

- WFP = Working Families Party

- MRTA = Make the Road Action

- BTAJA = Bend the Arc Jewish Action

- NYCC = New York Communities for Change

- JVPA = Jewish Voice for Peace Action

- MoveOn = MoveOn.org Civic Action

The Working Families Convergence Hub: $10,185,830

Five separate channels converged at Working Families Organization Inc (501(c)(4)) and WFP National PAC:

- Channel 1 Track 1: $5,150,000 – Open Society Action Fund (501(c)(4)) → Working Families Organization (501(c)(4))

- Channel 2a: $4,555,657 – Tides Foundation (501(c)(3)) → Working Families Organization (501(c)(4))

- Channel 2b: $430,173 – Tides Advocacy (501(c)(4)) → WF entities, including $295,173 to Working Families Organization (501(c)(4)) + $135,000 to WFP National PAC

- Channel 5: $50,000 – Center for Popular Democracy (501(c)(3)) → Working Families Organization (501(c)(4))

Working Families Convergence Total: $10,185,830

This convergence demonstrates Working Families Organization Inc operating as a central coordination hub receiving systematic flows from multiple sources, then functioning as systematic PAC redistribution infrastructure (documented $4.303M in PAC distributions 2023-2024, including $2M to Working Families Party PAC in December 2024).

The Make the Road Hub: $16,827,082

Multiple tracks converged at Make the Road Action (501(c)(4)):

- Channel 1 Track 2: $550,000 (OSAF → MRTA)

- Channel 4 (four tracks): $16,277,082 (multiple sources → MRTA)

Make the Road Total: $16,827,082

Six Charitable Conversion Channels: $35,166,912

Six channels documented systematic charitable-to-political conversions, raising significant questions under IRC §4955 (political expenditure taxes), IRC §170 (improper charitable deductions), and IRC §501(c)(3) operational test compliance:

- Channel 2a: $4,555,657

- Channel 2b: $430,173

- Channel 4: $16,277,082

- Channel 5/7 combined: $524,500

- Channel 6: $13,000,000

- Channel 8: $176,000

- Channel 9: $204,000

Total charitable-to-political conversion: $35,166,912

This systematic pattern across six separate channels raises questions about whether tax-deductible charitable donations are being systematically converted into political operations while maintaining the appearance of independent charitable activity.

PART 4: LEGAL FRAMEWORK AND FINANCIAL RECONCILIATION

Understanding the Legal Framework

The Charitable Deduction Question

Federal tax law provides charitable deductions under IRC §170 to encourage charitable giving. These deductions reduce donors’ taxable income, providing significant tax benefits.

The trade-off: In exchange for tax benefits, charitable organizations must refrain from political campaign intervention. This is the foundation of IRC §501(c)(3) tax-exempt status.

Here’s how it works with a simple example:

If a donor contributes $1 million directly to a political organization:

- No tax deduction

- Donor pays full income tax on that $1 million

- At 37% federal rate: $370,000 in taxes owed

But if that same donor contributes $1 million to a 501(c)(3) charity, which then transfers it to a 501(c)(4) political organization:

- Donor claims charitable deduction under IRC §170

- Donor avoids $370,000 in income tax

- Money still reaches political operations

- Estate tax also reduced

Same political outcome—but with tax benefits that shouldn’t apply to political spending.

The scale documented here: Six channels routing $35.2 million through this structure, combined with $52 million in taxpayer subsidies, raises questions about systematic conversion operations designed to maximize tax benefits while funding political activities.

Substance Over Form

Federal tax law examines how organizations actually operate (substance) rather than how their legal structures appear on paper (form). When organizations claim independence on federal forms but demonstrate coordinated behavior—penny-perfect circular transactions, systematic endorsement convergence, shared infrastructure, and public admissions of coordination—tax authorities can look past legal structures to examine operational reality. Tax law looks at what organizations do, not just what their formation documents say.

The Documentary Evidence

The investigation evolved from pattern analysis to direct proof. Movement Voter Project’s June 25, 2025 report explicitly identifies “several local MVP partner organizations” working “in partnership with” each other. Working Families Party’s November 9, 2022 memo admits “coordinating” Independent Expenditures that must legally be independent. When sophisticated actors with demonstrated regulatory knowledge openly acknowledge coordination while filing federal forms claiming independence, this transforms circumstantial patterns into documentary evidence.

Complete Financial Reconciliation

How the $40.9 Million Adds Up

Method 1: By Channel

- Channel 1: $5,700,000 (Direct political, two tracks)

- Channel 2a: $4,555,657 (Charitable conversion)

- Channel 2b: $430,173 (Charitable conversion)

- Channel 4: $16,277,082 (Multi-track network)

- Channel 5: $50,000 (Hub distribution)

- Channel 6: $13,000,000 (Bidirectional flows)

- Channel 7: $474,500 (Hub distribution)

- Channel 8: $176,000 (Charitable conversion)

- Channel 9: $204,000 (Charitable conversion)

Nine-Channel Total: $40,867,412

Method 2: By Conversion Type

Six Charitable Conversion Channels:

- Channel 2a: $4,555,657

- Channel 2b: $430,173

- Channel 4: $16,277,082

- Channel 5/7 combined: $524,500

- Channel 6: $13,000,000

- Channel 8: $176,000

- Channel 9: $204,000

Charitable Conversion Subtotal: $35,167,412

One Direct Political Channel (Two Tracks):

-

- Channel 1 Track 1: $5,150,000 (OSAF → WFO)

- Channel 1 Track 2: $550,000 (OSAF → MRTA)

Direct Political Subtotal: $5,700,000

Combined Total: $40,867,412

Method 3: By Primary Recipient Hub

Working Families Network Convergence:

- Channel 1 Track 1: $5,150,000

- Channel 2a: $4,555,657

- Channel 2b (WFO portion): $295,173

- Channel 5: $50,000

- Channel 2b (WFP PAC portion): $135,000

Working Families Convergence: $10,185,830 (Working Families Organization Inc: $10,050,830 + WFP National PAC: $135,000)

Make the Road Network:

- Channel 1 Track 2: $550,000

- Channel 4 (four tracks): $16,277,082

Make the Road Total: $16,827,082

Other Endorsing Organizations:

- Channel 6 (Bend the Arc): $13,000,000

- Channel 7 (NYCC): $474,500

- Channel 8 (JVP Action): $176,000

- Channel 9 (MoveOn): $204,000

Other Organizations Total: $13,854,500

All Methods Reconcile to: $40,867,412

Part 4 Conclusion

The systematic patterns documented across nine channels raise questions the IRS should examine: whether charities systematically converting $35.2 million in tax-deductible donations to political operations remain qualified for tax-exempt status (IRC §501(c)(3)), whether these conversions trigger political expenditure taxes (IRC §4955), whether five consecutive years of zero relationship disclosures while processing $29.7M annually constitute adequate transparency (IRC §6033), whether systematic concealment on federal forms while openly admitting coordination raises questions about statement accuracy (IRC §7206), and whether donors properly claimed tax benefits for what functioned as political contributions (IRC §170). These are questions for the IRS to investigate and determine, based on the systematic patterns documented in public filings.

METHODOLOGY NOTE

This investigation is based exclusively on publicly available documents—IRS Form 990 filings, FEC reports, foundation grant databases, organizational websites, and public endorsement pages. Every factual claim is supported by primary source documentation linked directly in the text above.

If any organization believes we have made a factual error in our analysis of these public records, we invite them to contact us with corrections. We will promptly review any documentation provided and make appropriate corrections.

All source documents remain publicly accessible and independently verifiable.

Revision Note (October 28, 2025): Following review of additional primary source documentation, door-knocking totals have been revised from 256,000+ to 95,500+ verified contacts based on newly obtained source materials. This correction revealed systematic operational concealment: three of six organizations refused to disclose operational metrics despite documented deployment of “thousands of volunteers” and professional infrastructure. The capability-reporting gap—exemplified by NY Communities for Change’s 20,000 members reporting only 7,500 doors over six months before launching a $50,000 IE committee—parallels the systematic concealment of coordination on federal tax forms documented in our IRS whistleblower submissions. New evidence also documents continued coordination through October 2025 general election operations. All financial flows ($40.9M across nine channels), coordination evidence, and legal analysis remain unchanged and fully supported. The operational concealment pattern strengthens evidence of systematic, multi-dimensional evasion of oversight mechanisms.

For daily updates, follow @SamAntar on X (formerly Twitter)

Written by Sam Antar | Forensic Accountant & Fraud Investigator

© 2025 Sam Antar. All rights reserved.