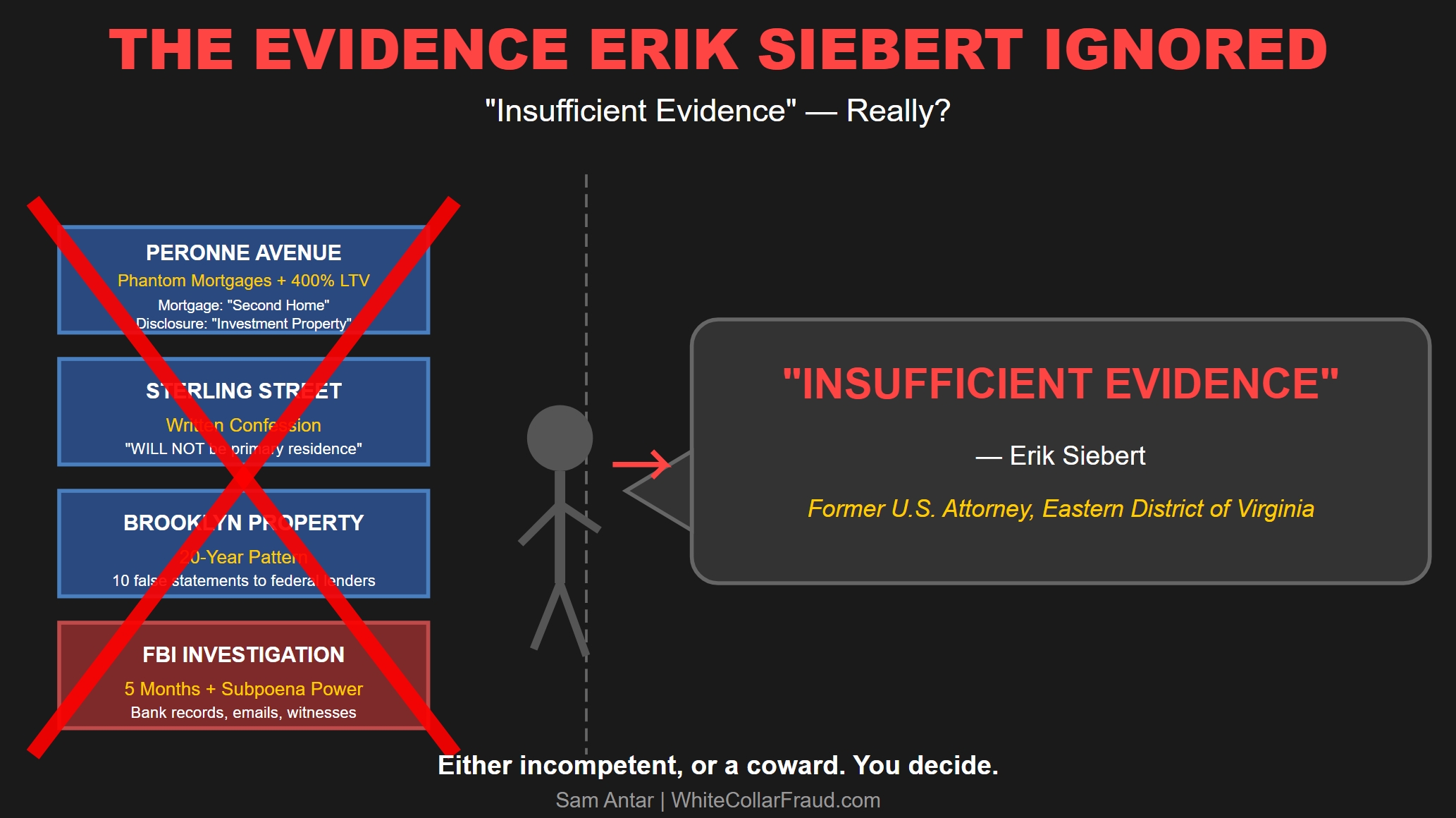

Four amicus briefs filed in the past week all make the same claim: Career prosecutors found insufficient evidence, and Erik Siebert declined to prosecute Letitia James for mortgage fraud.

That claim is provably false.

Between February and June 2025, I published independent forensic investigations documenting 40 years of systematic financial fraud in verifiable public records: phantom mortgages that don’t exist in property records, real mortgages never disclosed, undisclosed properties, contradictory sworn statements, and mathematical impossibilities that no legitimate lender would permit. My first investigations were published in February 2025—weeks before any alleged political involvement.

Gateway Pundit’s Joel Gilbert independently investigated the same public records, publishing his own findings documenting the fraud.

Based on our published findings, the FBI then conducted a five-month investigation with subpoena power—accessing bank records, emails, witness interviews, phone records, and internal lender documents that went far beyond what any private citizen could obtain.

Erik Siebert, the former U.S. Attorney for the Eastern District of Virginia, had access to all of it: the 40 years of fraud documented in public records, our independent investigations, and everything the FBI uncovered.

He chose not to act.

The constitutional arguments about vindictive prosecution are for Judge Jamar K. Walker to decide. But those arguments rest on two false premises that, if disproven, undermine the entire vindictive prosecution claim: (1) that there was insufficient evidence, and (2) that the investigation originated from political pressure rather than independent forensic analysis of public records.

If Judge Walker accepts these false premises and dismisses the case, he risks creating a dangerous precedent: any defendant with political connections can claim vindictive prosecution simply by alleging their prosecution followed political pressure—even when overwhelming documentary evidence exists and was discovered through independent investigation.

That’s not protecting constitutional rights. That’s providing a “get out of jail free” card to politically connected defendants who committed well-documented crimes. The factual question—whether there was sufficient evidence—is answerable by examining what Siebert actually had when he made his decision.

Here’s what he had access to, and chose to walk away from.

WHAT FOUR AMICUS BRIEFS ALL CLAIM ABOUT SIEBERT

In the past week, four separate amicus briefs have been filed supporting Letitia James’s motion to dismiss the federal indictment:

- Letitia James’s Motion to Dismiss (November 7, 2025)

- Bipartisan Former Federal Judges and Former U.S. Attorneys (November 7, 2025)

- Former Senior Officials of the Department of Justice (November 13, 2025)

- Senate Democratic Leader Chuck Schumer and House Democratic Leader Hakeem Jeffries (November 14, 2025)

All four briefs make sophisticated constitutional arguments about vindictive prosecution, political motivation, and the chilling effect on free speech.

But buried in those constitutional arguments is one critical factual claim that appears in all four briefs:

Career prosecutors found insufficient evidence and Erik Siebert declined to prosecute.

Here’s what they specifically claim:

From James’s Motion:

- “career prosecutors…declined to indict AG James for mortgage fraud”

- “there was no probable cause”

- “insufficient evidence to bring charges”

- “absence of evidence”

- “found evidence that would appear to undercut some of the allegations”

- “concluded that any financial benefit…would have amounted to approximately $800”

From Former DOJ Officials Brief:

- “no career prosecutor from the U.S. Attorney’s Office…signed the indictment”

- “Evidence Appears to Undercut Claims Against Letitia James” (ABC News)

From Former Judges/U.S. Attorneys Brief:

- “prosecutors…believe they have not gathered enough evidence”

- “did not believe there was a viable criminal case”

From Schumer/Jeffries Brief:

- “experienced prosecutors…believed there was insufficient evidence”

The constitutional arguments are for Judge Jamar K. Walker to decide. That’s a legal question about process.

But the factual premises underlying those constitutional arguments—that there wasn’t enough evidence and that this investigation was politically motivated rather than evidence-driven—are questions about substance. And they’re answerable by looking at what Erik Siebert actually had access to when he made his decision.

So let’s answer it.

THE REAL QUESTION

The four amicus briefs focus on prosecutorial motivation, arguing that Lindsey Halligan was installed to do Trump’s bidding rather than follow the evidence.

That’s a serious allegation about process. But it raises an even more serious question about substance:

If there wasn’t enough evidence to proceed—as all four amicus briefs claim—then what exactly was Erik Siebert looking at when he declined to prosecute?

The answer is simple: 40 years of systematic financial fraud documented in public records, mortgage documents, property filings, and sworn financial disclosure statements.

Let’s be honest about what happened here. The problem was never lack of evidence. The problem was a prosecutor who chose not to act on it.

Here’s what Erik Siebert had access to—and chose to walk away from.

THE PERONNE AVENUE IMPOSSIBILITY: PHANTOM MORTGAGES AND HIDDEN DEBT

In her 2023 Financial Disclosure Statement to New York State, Letitia James reported the following for 3121 Peronne Avenue, Norfolk, Virginia:

- Property value: $100,000-$150,000

- Freedom Mortgage: $150,000-$250,000

- National Mortgage: $100,000-$150,000

- Total disclosed debt: $250,000-$400,000

Simple math: That’s a loan-to-value ratio of 167% to 400%.

Standard lending practices typically limit total financing to 80-90% of property value for investment properties. No legitimate lender provides financing exceeding 250% of a property’s value. This isn’t a technical violation—it’s a mathematical impossibility that should have triggered immediate scrutiny.

In February 2025, I commissioned an independent title search on the Peronne Avenue property. The results were unequivocal:

- Freedom Mortgage: Does not exist in property records

- National Mortgage: Does not exist in property records

- OVM Financial mortgage ($109,600): Exists, recorded August 17, 2020—but was never disclosed on any financial disclosure statement

The phantom mortgages (Freedom Mortgage and National Mortgage) first appeared on her 2023 Financial Disclosure Statement and continued on her 2024 Financial Disclosure Statement. Meanwhile, the real OVM Financial mortgage ($109,600) that was recorded on August 17, 2020, was never disclosed on any financial disclosure statement from 2020 through 2024.

This wasn’t a one-time reporting error. This was systematic concealment under penalty of perjury, filed electronically with a state agency.

Erik Siebert had access to these same public records. The New York State Ethics Commission financial disclosures are publicly available. Norfolk County property records are publicly available. Title searches can be ordered by anyone.

He chose not to pursue it.

The Second Home vs. Investment Property Contradiction

But there’s another problem with Peronne Avenue that Siebert apparently found unworthy of prosecution.

The OVM Financial mortgage was structured as a “second home” loan. That means James signed documents under penalty of perjury swearing she would occupy the property for personal use.

Yet on her financial disclosures to New York State, she consistently classified the same property as “Investment.”

The mortgage contract says second home. The state disclosures say investment property. Both cannot be true.

And here’s where it gets worse: James’s tax returns reported “zero personal use days” for the Peronne property on Schedule E forms—directly contradicting her sworn statement to the lender that she would use it as a second home.

A second home with zero personal use days? That’s not a mistake. That’s perjury in writing.

Erik Siebert looked at contradictory sworn statements about the same property to different government entities and decided there was nothing worth prosecuting.

THE STERLING STREET CONFESSION: FRAUD IN WRITING

If Peronne Avenue was mathematical impossibility, Sterling Street was written confession.

On August 30, 2023, Letitia James purchased property at 604 Sterling Street, Norfolk, Virginia for $240,000 with a $219,780 mortgage (91.6% loan-to-value).

Here’s what Erik Siebert had access to—and here’s the timeline that proves intent. Remarkably, these emails were provided by Abbe Lowell himself in his response to Bill Pulte’s FHFA criminal referral:

August 2, 2023: James sent an email to her mortgage broker stating explicitly: “This property WILL NOT be my primary residence. I WILL NEVER BE A VIRGINIA RESIDENT.”

August 3, 2023: The very next day, her broker confirmed the loan was locked as a “primary residence product.”

August 4-17, 2023: Multiple submission attempts. The application kept getting bounced from the underwriting system.

August 17, 2023: Just 15 days after writing “WILL NOT be my primary residence,” James signed a sworn declaration—witnessed by two of her own government employees—stating the Sterling Street property would be her “principal residence.”

August 30, 2023: Purchase completed.

This is not ambiguity. This is written proof of intent to defraud:

- She wrote down that the property would NOT be her primary residence

- The loan was rejected

- She signed a sworn declaration 15 days later saying it WOULD be her primary residence

- The loan was approved

- Her sworn statement was filed along with the deed and mortgage in the property records.

- She never disclosed the property on her 2023 or 2024 financial disclosure statements

- She never disclosed the $219,780 mortgage on her 2023 or 2024 financial disclosure statements

The financial benefit? Over $100,000 in interest savings by obtaining primary residence rates instead of investment property rates.

Every single one of these facts was available in public records when Erik Siebert was reviewing the case. The emails exist. The sworn declarations exist. The property records exist. The financial disclosure statements—showing the property was never disclosed—exist.

Erik Siebert looked at written confession of mortgage fraud and decided not to prosecute.

THE BROOKLYN PATTERN: SYSTEMATIC MANIPULATION

If Erik Siebert thought Peronne and Sterling were isolated incidents, the Brooklyn property at 296 Lafayette Avenue should have disabused him of that notion.

This property reveals sophisticated knowledge of financial classifications and systematic manipulation spanning years.

The Citibank HELOC That Appeared, Disappeared, and Transformed

In August 2019, James recorded a Citibank home equity line of credit for $100,000. This is documented in NYC ACRIS property records (Document ID 2019082900029001) and is not in dispute.

Here’s what James disclosed on her financial disclosure statements:

- 2019 Financial Disclosure: NOT DISCLOSED

- 2020 Financial Disclosure: NOT DISCLOSED

- 2021 Financial Disclosure: NOT DISCLOSED

- 2022 Financial Disclosure: Disclosed—but misclassified as a traditional mortgage instead of HELOC

- 2023 Financial Disclosure: VANISHED—no record of satisfaction exists in property records

- 2024 Financial Disclosure: NOT DISCLOSED

A $100,000 debt instrument recorded in August 2019 wasn’t disclosed for three consecutive years. When it finally appeared, it was misclassified. Then it vanished with no corresponding satisfaction document in public records.

The Citizens Bank Mortgage That Changed Identity

In July 2021, James recorded a Citizens Bank mortgage (ACRIS Document ID 2021070901370001).

Her financial disclosures:

- 2021 Financial Disclosure (year of recording): NOT DISCLOSED

- 2022 Financial Disclosure: Disclosed as mortgage

- 2023 Financial Disclosure: Reclassified as HELOC—with no modification document in property records

- 2024 Financial Disclosure: Classified as HELOC

A mortgage that wasn’t disclosed in the year it was recorded, appeared the next year, then transformed into a HELOC the following year—with no corresponding modification in public records.

The First Savings Bank Phantom

James has reported a First Savings Bank loan on her financial disclosures since at least 2020. It wasn’t identified as a home equity loan until 2023.

Despite exhaustive searches of ACRIS property records, there is no trace of this loan in official filings.

This “phantom mortgage” appears in financial disclosures but cannot be verified through public records—the exact same pattern as the Freedom Mortgage and National Mortgage on the Virginia property.

The loan’s absence from official records is particularly concerning given James’s legal background and her position as the state’s chief law enforcement officer.

All of this was available to Erik Siebert. ACRIS is a public database. Financial disclosure statements are public documents. Title searches are available to anyone.

He looked at systematic manipulation of financial disclosures across multiple properties and multiple years and decided there was insufficient evidence to proceed.

THE 40-YEAR PATTERN SIEBERT CHOSE TO IGNORE

If Erik Siebert thought this was recent conduct, he had access to evidence stretching back four decades:

1983: Queens property mortgage documents list James’s father as “husband” rather than “father.” Relationship status on federally-insured mortgage documents affects loan terms, legal rights, inheritance, and insurance coverage.

2001-2021: Brooklyn property (296 Lafayette Avenue). Certificate of Occupancy: Legal 5-unit building. Physical evidence: 6 electric meters, 5 doorbells. Every mortgage document over 20 years: Consistently reported as 1-4 units to different federal lenders.

The Complete Timeline of False Statements:

| Date | Lender | Units Reported | Actual Units |

|---|---|---|---|

| March 30, 2001 | Chase | “One or Two Family” | 5 units |

| August 29, 2003 | MERS | “4 Family Dwelling” | 5 units |

| July 1, 2005 | MERS | “4 Family” | 5 units |

| October 26, 2006 | American General | “1–3 Family” | 5 units |

| May 25, 2007 | American General | “1–2 Family Residence” | 5 units |

| August 23, 2011 | US Bank | “4 Fam.” (handwritten) | 5 units |

| January 26, 2015 | Municipal Credit Union | “4 Family” | 5 units |

| October 26, 2017 | Wells Fargo | “4 Family” | 5 units |

| August 23, 2019 | Citibank | “4 Family” | 5 units |

| June 21, 2021 | Citizens Bank | “1 or 2 Family Residence” | 5 units |

Ten false statements across 20 years to different federal lenders. Each false statement enabled James to obtain residential loan terms, avoid commercial property requirements, and qualify for federal programs.

2011: Federal HAMP fraud. James obtained federal mortgage modification assistance—a program explicitly excluding buildings with 5 or more units. The handwritten modifications on the HAMP agreement show “4 fam” hastily written in one corner with a contradictory note stating “…not more than 6 residential units…”

This isn’t mortgage fraud. This is defrauding a federal relief program intended for struggling homeowners.

2020-2024: The financial disclosure violations documented above across Peronne Avenue, Sterling Street, and Brooklyn properties.

This pattern began during the Reagan administration. It continued through five presidencies: Reagan, Bush, Clinton, Bush, Obama, and into the current administration. It predates Trump’s entry into politics by 33 years. It predates Letitia James becoming Attorney General by 37 years.

Erik Siebert had access to all of this evidence. Every mortgage document is in property records. Every Certificate of Occupancy is in city records. Every financial disclosure statement is public. Every HAMP document is in federal files.

He looked at 40 years of systematic fraud and decided not to prosecute.

MY INVESTIGATION TIMELINE: INDEPENDENT DISCOVERY FROM PUBLIC RECORDS

Here’s what matters for the vindictive prosecution argument Abbe Lowell is making:

I discovered and documented this evidence through independent forensic analysis of publicly available records. No one from Trump’s team, the DOJ, the FHFA, or any campaign directed my investigation.

The timeline is dispositive:

February 8, 2025: I published “Beyond Campaign Spending: Letitia James’ Puzzling Property Portfolio Raises New Questions” documenting the mathematical impossibilities in her 2023 financial disclosure statement.

February 13, 2025: I published “Discrepancies in AG Letitia James’ Financial Disclosures” revealing the results of an independent title search I commissioned showing phantom mortgages and hidden debt.

March 3, 2025: I published “Exposing a Decade of Letitia James’ Financial Misreporting” covering Brooklyn and Peronne Avenue properties.

March 18, 2025: Gateway Pundit’s Joel Gilbert published “Big Development: Is Letitia James Guilty of Mortgage Fraud?” investigating the Brooklyn property, documenting the 4 vs 5 units issue on the HAMP loan. I publish “Exposed: Letitia James’ Handwritten Mortgage Modifications Raise Fraud Questions” the same day. We were working independently, both following public records.

March 21, 2025: I publish “Building Permits Raise Serious Questions” – Trump shares it same day

April 1, 2025: I published “EXCLUSIVE: NY Attorney General Letitia James Declares Virginia Home Her ‘Principal Residence'” documenting the Sterling Street property and the August 2 vs. August 17 written contradictions.

April 10, 2025: Trump shares the Sterling Street investigation.

April 14, 2025: The Federal Housing Finance Agency issued a criminal referral to the Department of Justice explicitly citing my publicly available investigations as part of the factual basis.

April 29, 2025: Gateway Pundit’s Joel Gilbert and Jim Hoft published “BIG NEWS: My Visit to Letitia James’s Apartment Building CONFIRMS Mortgage Fraud Allegations (VIDEO)” documenting our joint visit to the Brooklyn property, where we confirmed the physical evidence of 6 electric meters contradicting the 4-unit classification on mortgage documents.

May 17, 2025: I published “Exclusive: Letitia James’ 2024 Financial Disclosure: Missing Properties & Phantom Mortgages” documenting that James’s 2024 financial disclosure—filed while under federal investigation—continued the same pattern of phantom mortgages and undisclosed properties.

May 20, 2025: I published “Deflect and Deny: Letitia James Dodges DOJ Probe with More Deception” analyzing James’s public defense strategy where she dismissed the federal investigation as “retribution” while the documentary evidence continued to contradict her claims.

June 5, 2025: I published “CHECKMATE: Letitia James’s Own Documents Prove She Just Lied to America” analyzing James’s Pod Save America interview where she made false statements about her own legal documents that were easily disproven by public records. Those lies, made while under federal investigation, potentially add obstruction charges to the already overwhelming evidence of systematic fraud.

September 19, 2025: Erik Siebert resigned as U.S. Attorney for the Eastern District of Virginia, hours after President Trump publicly stated “I want him out.” According to multiple news reports, Siebert’s office had concluded there was insufficient evidence to charge Letitia James for mortgage fraud—despite having access to eight months of publicly available investigations (February through June 2025) documenting phantom mortgages, undisclosed properties, contradictory sworn statements, and 40 years of systematic fraud.

November 12, 2025: Federal prosecutors subpoenaed the New York State Commission on Ethics seeking James’s financial disclosure statements for the last five years, due December 5.

A critical point: The current federal indictment only charges James with two counts of bank fraud on the Peronne Avenue mortgage for lying about how she’d use the property. The Sterling Street undisclosed property and mortgage, the Brooklyn 40-year pattern, the HAMP fraud, the five years of phantom mortgages on financial disclosures—none of that is in the current indictment.

Why? Because prosecutors are building superseding charges. You don’t subpoena five years of state financial records to try a case about one loan—you do it when you’re building NEW charges for wire fraud, false statements, and possibly RICO.

In my most recent article, “Federal Subpoena Targets NY Attorney General Letitia James’s Financial Disclosures: Evidence of Superseding Indictments,” I analyzed the strategic significance of this subpoena. The December 5 deadline gives prosecutors exactly enough time to return to the grand jury with NEW charges before the January 26 trial. Here’s what superseding charges could include:

Wire Fraud (18 U.S.C. § 1343): Five years of false financial disclosures filed electronically under penalty of perjury. Each electronic filing is potential wire fraud. Five years = five potential counts at twenty years maximum per count.

The Financial Disclosure Pattern (2020-2024):

- James disclosed two phantom mortgages on Peronne Avenue (Freedom Mortgage: $150,000-$250,000; National Mortgage: $100,000-$150,000) that don’t exist in property records

- She concealed the real $109,600 OVM Financial mortgage that does exist

- She never disclosed the Sterling Street property or its $219,780 mortgage purchased in August 2023

- Brooklyn property shows missing mortgages, shifting classifications, and phantom loans across multiple years

False Statements (18 U.S.C. § 1001): Five years of false statements to a government agency (NY State Commission on Ethics). Five potential counts at five years per count.

RICO (18 U.S.C. § 1961-1968): Pattern of criminal activity conducted through an enterprise. Five years of electronic fraud = pattern. AG’s office = enterprise.

Brooklyn Pattern Evidence (Not Currently Charged):

- 20+ years of false mortgage statements (2001-2021) misrepresenting 5-unit building as 4 units to federal lenders

- 2011 Federal HAMP fraud: mortgage modification obtained through false unit count

- Shifting mortgage classifications with no corresponding changes in public records

Queens Property (Not Currently Charged): 1983 mortgage listing father as “husband”

The amicus briefs claim there was “insufficient evidence” for the current indictment. But they’re ignoring three critical facts:

- The current indictment is just the first charge—two counts on one property

- The November 12 subpoena proves prosecutors are building comprehensive charges covering the entire pattern I documented

- Even if Judge Walker dismisses on vindictive prosecution grounds, it doesn’t bar superseding charges—different conduct, different statutes, no double jeopardy

As I wrote in my Federal Subpoena article: “Judge Walker’s ruling determines the forum. Not whether accountability happens.”

This sequence proves the investigation followed evidence discovered through independent forensic analysis. The FHFA did not direct my investigations—the FHFA followed my published findings.

Erik Siebert had access to all of this evidence—eight months of independent investigations from February through June 2025, the FHFA criminal referral citing that evidence, and the same public records prosecutors are now subpoenaing to build superseding charges.

He concluded there was “insufficient evidence” and chose to resign rather than prosecute.

What Siebert Had That I Didn’t

A critical point: Everything documented in this article came from public records. Title searches. Financial disclosure statements. Property records. Mortgage documents. Certificate of Occupancy filings. All available to anyone with internet access and a few hundred dollars for title searches.

I don’t know what the hardworking FBI agents discovered during their five-month investigation. I don’t have access to:

- Subpoenaed bank records

- Email communications

- Witness interviews

- Phone records

- Internal lender documents

- IRS records

- Title company files

- Insurance policies

If public records alone prove systematic fraud spanning 40 years across multiple properties and multiple states, what additional evidence did federal investigators with subpoena power uncover?

Erik Siebert saw everything I saw—plus everything the FBI found. And he decided there was insufficient evidence to prosecute.

WHY DID SIEBERT WALK AWAY FROM 40 YEARS OF DOCUMENTED FRAUD?

This deserves emphasis: I am a registered Democrat. I don’t support Donald Trump. I didn’t vote for him. I don’t particularly like him.

In fact, Eric Trump blocked me on Twitter years ago and still has me blocked to this day. And so did Preet Bharara, this post on October 18, 2020, proves it. The idea that I’m working with the Trump administration to fabricate evidence against Letitia James is so absurd that Eric Trump won’t even see this article when it’s published—because he blocked me.

I’m a forensic accountant. I follow documents, not political agendas. When I analyzed James’s financial disclosures in February 2025, I wasn’t thinking about Trump—I was looking at mathematical impossibilities that violate basic underwriting principles. When I ordered the title search that proved Freedom Mortgage and National Mortgage don’t exist, I wasn’t advancing a political agenda—I was verifying claims against public records.

The fraud existed for 40 years before Trump entered politics. It will continue to exist regardless of who’s president. Documents don’t have political affiliations.

But none of this actually matters. My political affiliation doesn’t change what’s in the property records. Joel Gilbert’s reporting doesn’t alter what’s on the financial disclosure statements. Our personal opinions about Trump don’t make phantom mortgages appear or mathematical impossibilities become possible. The documents exist independent of who discovered them or why.

Erik Siebert had access to all of this—evidence discovered by a registered Democrat, working independently, analyzing public records. He had access to our published investigations. He had access to the same public records we analyzed. He had access to the FHFA criminal referral that cited our work. He had access to the financial disclosure statements that prosecutors are now subpoenaing to build superseding charges.

He chose not to act.

So why did Siebert walk away?

Was it because:

- He didn’t understand basic underwriting principles and thought 400% LTV was normal?

- He didn’t know how to order a title search to verify whether mortgages existed?

- He thought phantom mortgages appearing on financial disclosures while real mortgages were hidden was just an innocent clerical error?

- He believed writing “WILL NOT be my primary residence” then signing a sworn declaration 15 days later saying it would be was an honest mistake?

- He thought 20 years of false unit counts to federal lenders was just confusion about how to count buildings?

- He concluded that obtaining HAMP assistance for an ineligible property was merely an administrative oversight?

Or was it because he made a judgment call that prosecuting the sitting New York Attorney General—regardless of how overwhelming the evidence—would be too politically sensitive?

And here’s the irony that should shame every experienced prosecutor who signed those amicus briefs:

They attack Lindsey Halligan’s lack of prosecutorial experience. They question her qualifications. They suggest she doesn’t understand what constitutes sufficient evidence.

But Erik Siebert—with all his prosecutorial experience, all his institutional knowledge, all his career prosecutor credentials—looked at 40 years of documentary evidence and got it wrong. The “inexperienced” prosecutor saw what the “experienced” prosecutor missed. Or more accurately: had the courage to act on what the experienced prosecutor chose to ignore.

Experience without courage is just credentialed cowardice.

That’s the question the vindictive prosecution hearing should actually address.

Because if Erik Siebert declined to prosecute because the evidence was weak, then Lindsey Halligan should be commended for having the courage to bring a strong case based on evidence discovered through independent forensic analysis.

But if Erik Siebert declined to prosecute because the target was too politically powerful—despite documentary evidence spanning 40 years across multiple properties in multiple states—then the problem isn’t Lindsey Halligan’s alleged bias.

The problem is Erik Siebert’s refusal to act on overwhelming evidence.

And that’s a failure of prosecutorial courage, not a vindication of James’s innocence.

CONCLUSION: DOCUMENTS DON’T LIE

I’ve spent decades as a forensic accountant working with federal prosecutors, the FBI, the SEC, and class-action firms. My methodology has always been the same: follow the documents, not the narratives.

Public records don’t have political affiliations. Title searches don’t care who’s president. Mathematics doesn’t change based on who’s being investigated.

The evidence against Letitia James is:

- Systematic (spanning 40 years)

- Multi-jurisdictional (New York and Virginia)

- Multi-victim (federal lenders, state agencies, federal programs)

- Documented (every claim verifiable in public records)

- Quantifiable (specific dollar amounts, specific dates, specific contradictions)

Four amicus briefs—filed by James’s own lawyers, former federal judges and U.S. Attorneys, former senior officials of the Department of Justice, and the Democratic leaders of Congress—can argue about Lindsey Halligan’s motivations. They can question the appointments process. They can claim vindictive prosecution.

What they cannot do is make the documents disappear.

The phantom mortgages still don’t exist in property records.

The undisclosed properties still aren’t on the financial disclosure statements.

The mathematical impossibilities are still mathematically impossible.

The contradictory sworn statements still contradict each other.

And the 40-year pattern still predates any alleged political motivation by decades.

Erik Siebert had access to all of this evidence—documented by a registered Democrat who doesn’t support Trump, working independently from public records, months before any alleged political involvement. He had access to investigations cited in a federal criminal referral. He had access to the same financial disclosures that prosecutors are now subpoenaing to build superseding charges.

He chose not to act.

So when four amicus briefs filed by some of the most distinguished legal minds in America all claim there was “insufficient evidence,” they’re not just wrong about the facts.

They’re asking Judge Jamar K. Walker to accept that Erik Siebert looked at 40 years of systematic financial fraud—phantom mortgages, hidden debt, undisclosed properties, contradictory sworn statements, and mathematical impossibilities—all documented in public records by independent investigators months before any alleged political pressure, and correctly concluded there was nothing worth prosecuting.

That’s not a legal argument.

That’s asking the court to deny reality.

Follow @SamAntar on X for updates on this investigation

Written by Sam Antar | Forensic Accountant & Fraud Investigator

© 2025 Sam Antar. All rights reserved.